Harrison Barnes' Legal Career Advice Podcast - Episode 15

Listen to The BCG Attorney Search 2020 State of the American Lateral Law Firm Market Report Podcast

2019 was another strong year for the lateral attorney hiring market. This report highlights some of the legal market forces that had an impact on law firm hiring, the practice areas we saw the most interviewing and placement activity, and the outlook for the 2020 lateral market.

This report will discuss:

- Law Firm Mergers: 2019 was a record year for law firm merger activity. Many large firms are adopting mergers as a growth strategy but are increasingly opting to absorb smaller regional firms in niche practice areas rather than seeking out other large firms to merge with.

- Diversity Demands from Corporate Clients: Law firms are facing more demands than ever from their top corporate clients to make a real commitment to diversifying their hiring and staffing. General counsel are threatening to spend their legal budget elsewhere if the firm can’t comply with diversity requirements.

- Parental Leave Policies: In what appears to be the latest tactic in the war to attract top talent, several major law firms overhauled their parental leave policies to allow new parents more time off. Most importantly, these new leave policies are gender-neutral.

- Busiest Practice Areas in 2019: The top five busiest practice areas in 2019 were 1) litigation, 2) corporate, 3) labor and employment, 4) intellectual property, and 5) real estate. This report discusses the reasons these practice areas dominate, and the outlook for attorneys in these practice areas in 2020.

- Niche Practice Areas to Watch: Finally, we discuss some niche practice that are gaining steam as we head into 2020, including 1) data privacy, 2) cannabis law, and 3) bankruptcy.

This annual report from BCG Attorney Search summarizes our recruitment, placement and job search of hundreds of attorneys each year in firms throughout the country. I watch our candidates go through every stage of the job search process—from submitting applications and going to interviews, to accepting offers. By closely observing this process and the trends that reveal themselves, we get a profound understanding of the legal market and what is in demand in markets and practice areas across the nation.[i]

I. Introduction

Every year, BCG Attorney Search compiles extensive data on the lateral attorney hiring market through our work with the hundreds of attorneys we help to find positions in law firms. We gather information on the practice areas and locations of the candidates who are getting the most traction with law firms (in the form of interviews and placements). We also have access to extensive data on law firm job postings, which allows us to objectively assess which practice areas and locations are the most in-demand, from a firm hiring perspective. In addition to analyzing this data, we explore larger legal market trends that influence the lateral hiring market.

In this year’s report, we discuss the following topics:

- Law Firm Merger Activity. What are the trends in the law firm merger market, and what effect do these mergers have on lateral attorney hiring within law firms?

- Law Firm Culture Shifts in 2019. How are law firms responding to cultural paradigm shifts related to diversity and parental leave, and how does this impact the lateral market

- Busiest Practice Areas for Lateral Hiring in 2019. Which legal practice areas were busiest in 2019, and what is the outlook for these practice areas in 2020?

- Niche Practice Areas to Watch in 2020. What are the hottest niche practice areas we expect law firms to be looking to hire for in 2020?

II. Law Firm Mergers in 2019

For the third straight year, the legal market saw a record-breaking number of law firm mergers. In 2019, there were a whopping 115 law firm mergers, topping last year’s record of 106, according to data compiled by Altman Weil. The overwhelming majority of these mergers (88%) involved the acquisition of smaller firms (2-20 attorneys).

The Benefit of Small Firm Acquisitions

There are a lot of reasons law firms could be focusing more on the serial acquisition of smaller firms to grow their national platform. The acquisition of a specialized regional boutique can provide a larger firm with easy access to a competitive practice or geographic market. That seemed to be the strategy employed by several of the bigger firms that targeted small firms for acquisition in 2019.

For example:

- Atlanta-based labor and employment firm Fisher Phillips was able to open a new office in Detroit and almost double their attorney contingent Washington D.C. with the acquisition of specialized employment boutiques in those markets.

- Carlton Fields picked up a sophisticated DC boutique specializing in government contracting, adding new expertise and depth to the firm’s construction practice.

- Philadelphia-based Cozen O’Conner was able to continue its expansion in the West Coast market by adding 13 new attorneys to its ranks from an established Silicon Valley boutique.

These smaller mergers allow for more sustained growth than undertaking a mega-merger, which can come with numerous complications related to compensation, potential client conflicts, and firm leadership responsibilities. This strategy can also be more effective than poaching a group of lateral partners from a competing firm as the partner group may not be able to successfully bring all their clients with them to the new firm. Picking up a whole firm can be a safer bet.

Big Law Firm Mergers Pick Up in Q4 of 2019 with Midwest Focus

It was starting to seem that 2019 would be a rather tame year for high-stakes, market-shaking mergers. Through the first three quarters of the year, the biggest merger on the books was the combination of two Northwest major players: Pepper Foster and Garvey Schubert, forming the new firm Foster Garvey with a total headcount of 180 attorneys. By contrast, by the end of the first quarter of 2018, it looked like there would be no end to the trend of mega-mergers after a spate of large firm combinations including Hunton & Williams’ acquisition of Andrews Kurth (creating a 1000 attorney firm) and Foley & Lardner’s combination with Gardere Wynne Sewell (creating a 1100 attorney firm).

But with the fourth quarter of 2019 came a sudden burst of acquisitions of firms with over 100 attorneys. Not surprisingly three of the six acquisitions of 100+ attorney firms in Q4 of 2019 were made by the global behemoth Dentons. Dentons has been a runaway train of acquisition and has grown from 6,400 attorneys in 2015 to almost 10,000 attorneys today.

Leaving Dentons aside, what’s most notable about the other big mergers in 2019 is their geography. While 2018 seemed to be a frenzied grab for market share in Texas, in 2019 big firms seemed to be jockeying for position in the Midwest, and specifically Minneapolis. The most notable merger of the year was the combination of Minneapolis-based powerhouse Faegre Baker Daniels and Philadelphia-based Drinker Biddle & Reath, creating a 1300 attorney firm called Faegre Drinker.

So what is driving these Midwest mergers? These mergers are likely driven by the same market forces that drive all law firm mergers. These mid-market firms are facing pressures from their clients to scale up. Their upper middle market clients are looking at the depth of specialization and breadth of the services offered by the largest national firms and demanding that these smaller market firms keep up if they want to keep their business.

The Midwest is also a less saturated market and has been less picked over than markets like New York, Los Angeles, Chicago, and even Texas. There are a lot of attractive features about acquiring firms in the Midwest: low cost, strong talent pool, and a good supply of upper-middle market corporations.

It should be noted that these firms are not just facing pressure from clients to grow. The partners in these firms are also looking for the best platform to sell their services and are threatening to take their books of business to bigger firms that will better allow them to attract bigger clients.

Effect of Law Firm Merger Activity on the Lateral Hiring Market

As a recruiting company, we are particularly interested in tracking what these law firm mergers might mean for the lateral hiring market.

1. Small Firm Acquisitions Could Lead to More Associate Opportunities

Many of these smaller firms that are targeted for acquisition are very partner heavy. When these firms get acquired by a larger firm, this can often open up opportunities for associates because these partners have a lot of work that needs to be serviced. The economies of scale that are gained when these smaller firms join a larger platform mean that these partners will have more resources at their disposal for hiring associates. There are a built-in budget and infrastructure for recruiting and training the associates, and the smaller firm partners will not so directly have to bear the cost of the salaries of the newly hired associates.

In addition, when these smaller, niche practices join a larger platform with a more well-rounded practice, this opens opportunities to take on more diverse work from the client. For example, the small firm partner may have a large corporate client that he is servicing for one particular kind of work. That client likely needs legal support in more areas, such as a real estate, tax, intellectual property, etc., that the small firm may not have the depth of expertise to service. Joining forces with the larger firm gives that client immediate access to one firm that can handle its legal needs. This means more work that trickles down throughout all the different practice areas in the firm—and more associates are needed to take on this work.

2. Effect of Big Firm Mergers on Lateral Market

The impact of the larger firm mergers on the lateral associate market is a little harder to parse. While for the most part, the attorneys within the acquired firm are not at risk of getting laid off, big law firm mergers can leave associates out in the cold.

It can be difficult for an associate to find their bearings in the new firm. The merged firm can become almost unrecognizable. Some of the concerns the attorneys from the acquired firm may have are:

- Uncertainty about the future organizational direction

- Feelings of loss of previous organizational culture

- Uncertainty about personal job security

- Perceptions of lack of leadership credibility

- Feelings of confusion due to a lack of communication

- Perceptions of increased job stress and workload

Many attorneys end up so frustrated or unhappy with the new firm dynamics that they end up looking for opportunities elsewhere. If that happens in a particular region, like Minneapolis, it could mean there will be glut of attorneys looking to lateral to another firm, which increases competition in that market, making it harder for that associate to find a new job.

So, before an associate decides to jump ship from the new firm, they should consider the potential upsides to staying. For example:

- More opportunities with a bigger firm

- Different types of work with new clients

- Enhanced learning and career development

III. Law Firm Culture Shifts in 2019

General Counsel Get Serious About Diversity

In 2019, General Counsel of major corporations had a strong message for law firm management: “Improve diversity or lose our business.” In the wake of a major law firm’s announcement of the newly promoted partner class, which included a photo lineup of 11 white men and one white woman, the Chief Legal Officer of car-sharing company Turo penned an open letter that took law firms to task for this lack of diversity.

“We applaud those firms” the letter reads, “that have worked hard to hire, retain, and promote to partnership this year outstanding and highly accomplished lawyers who are diverse in race, color, age, gender, gender orientation, sexual orientation, national origin, religion, and without regard to disabilities.” “At the same time,” the letter continued, “we are disappointed to see that many law firms continue to promote partner classes that in no way reflect the demographic composition of entering associate classes. Partnership classes remain largely male and largely white.”

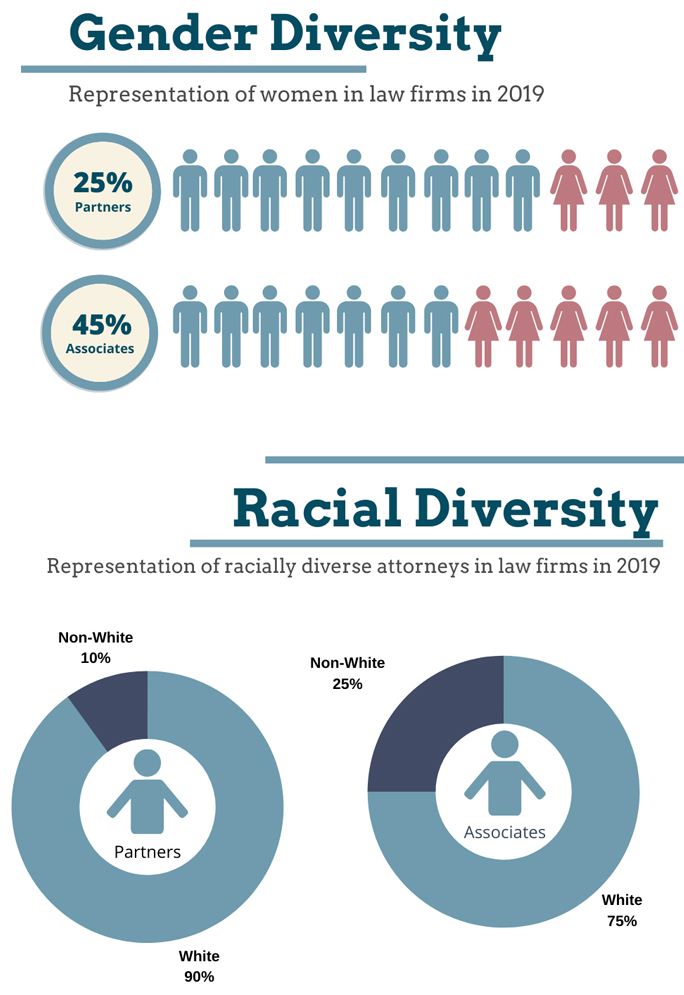

The truth behind the letter’s sentiment is apparent if you look at the numbers. According to data compiled by NALP, in 2019 only 25% of law firm partners are women compared to 45% of associates. Non-white partners account for 10% of all law firm partners compared to 25% of associates.

By the end of 2019, more than 200 General Counsel had signed the letter. Their goal was to provide a real-money incentive for law firm management to foster ethnic and gender diversity in their firms. The message: If you don’t make some changes, we will spend our legal budget elsewhere. Among the signatories to the letter are top legal officers of several large corporations, including Mozilla, Booz Allen Hamilton, Google Fiber, S&P Global Ratings, Lyft, and Heineken USA.

This is not the first time there has been a client-driven demand that law firms improve diversity. But the effect of the publicity surrounding this letter and the sheer volume of general counsel that are signing on to this message seems have caused a marked shift in how seriously law firms are taking the directive.

At BCG Attorney Search, we saw firsthand that law firms were taking action to hire more diverse attorneys. Multiple firms solicited our help specifically to hire more women and diverse attorneys. Some of the firms even explicitly referenced requirements from their clients that their matters be staffed with a more diverse team. They were desperately seeking our help because these law firms simply did not have enough female or minority attorneys to comply with their clients’ demands. Firms Adopt More Generous and Gender-Neutral Parental Leave Policies

Every year, the war among the biggest law firms for top talent seems to escalate. In last year’s State of the Market Report, we explained how the associate salary increases, led by Milbank, Tweed, Hadley & McCloy, set off a domino effect across peer firms that clamored to match the raises. We observed that the two motivations behind the salary increase 1) improving associate retention and 2) attracting top talent.

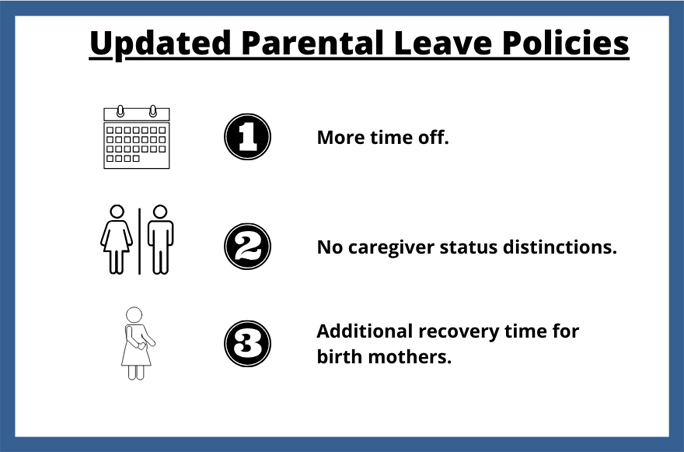

In 2019, in a continued effort to attract the best candidates, big law firms turned their focus from compensation to benefits. By the end of 2018, a handful of firms, including White & Case, Fenwick and West, and Susman Godfrey had announced new gender-neutral and more generous parental leave policies. Throughout 2019, several other major firms followed suit, including Paul Hastings, Munger Tolles, Sidley Austin, and Barnes & Thornburg.

Some of the perks common to these policies are:

- More time off. New policies have extended total available leave to between 12-22 weeks. Susman Godfrey even offers “unlimited” parental leave.

- No caregiver status distinctions. The policies have removed the primary and secondary caregiver designations, allowing mothers and fathers alike to take the full parental leave offered.

- Additional recovery time for birth mothers. In addition to the paid leave, the new policies provide mothers 6-8 weeks of fully paid time off to recover from childbirth.

While these more generous parental leave policies are a step in the right direction, it remains to be seen if there will be a shift in law firm culture that will embolden attorneys to take full advantage of the leave offered. There is still a fear of retribution, especially for new dads.

When attorneys take parental leave, there can be many subtle—or not so subtle—consequences when they try to come back to work. Candidates we work with have reported being negatively affected by taking too much leave. For example, they have trouble sourcing work after an extended absence, especially if they don’t have a supportive mentor to go to bat for them and help them reintegrate into the firm workforce. The attorney (generally female) ends up on what’s charmingly referred to as the “mommy track.” They are passed over for partner and their career prospects become limited.

It is not too difficult to understand why law firms seem to be merely paying lip service to the concept of expanding their parental leave policies. At the end of the day, law firms are businesses. When someone goes on leave, they become a cost center. The firm pays them a full salary for weeks and weeks while being unable to bill clients for their time.

But, while it may be understandable why these firms are having trouble “walking the walk” when it comes to parental leave, ultimately they are marginalizing a lot of talented attorneys who end up just leaving the firm—or the workforce—altogether. In our experience as recruiters, we have seen more than one attorney simply walk away from their firm if they were not able to get adequate parental leave.

Moving toward gender-neutral policies, however, could signal an important tipping point. If men begin to take parental leave as often as women, this could go a long way to creating an environment that truly embraces the philosophy underlying the policy.

IV. Analysis of the Top Five Practice Areas of 2019

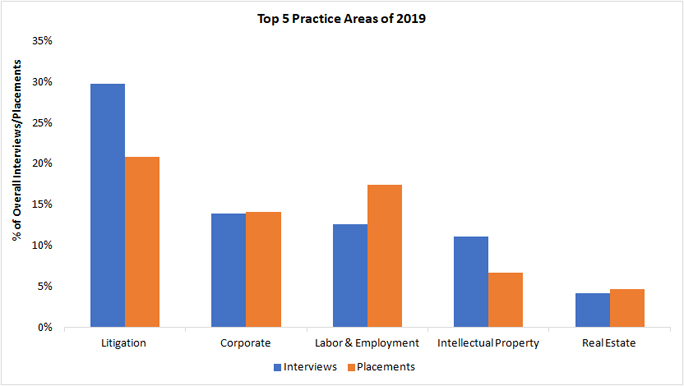

The hottest practice areas of 2019, as a percentage of the total interviews and placements of our candidates, were 1) Litigation; 2) Corporate; 3) Labor and Employment; 4) Intellectual Property, and 5) Real Estate.

Litigation

1. Steady Demand for Litigators in 2019, But Tough Competition for Top Jobs

It should come as no surprise that the hottest practice area for both interviews and placements in 2019 was litigation. Litigation is the “bread and butter” of most firms. Litigators account for approximately 40% of all attorneys practicing in law firms.

Litigation openings accounted for almost 50% of all attorney jobs that came onto the market, according to job posting data monitored by BCG Attorney Search. There were also more openings for litigators in 2019 compared to 2018—approximately 35% more. As discussed in more detail below, this demand is largely driven by smaller firms—including many firms that do not typically use recruiters.

Despite the increased demand, with our own candidates, we saw a slight decrease in overall litigation interviews and placements in 2019. Litigation jobs accounted for 30% of our total interviews and 20% of placements, down about 13% and 40%, respectively, from 2018.

| 2018 | 2019 | % of Growth | 2018 Rank | 2019 Rank | |

|---|---|---|---|---|---|

| Placements | 34.25% | 20.81% | -39.25% | 1 | 1 |

| Interviews | 35.00% | 30.34% | -13.32% | 1 | 1 |

This data indicates that the lateral market is highly competitive—especially at the top firms. Indeed, litigation openings at the largest law firms accounted for only 14% of all the litigation openings BCG Attorney Search worked to fill this year. Considering the oversupply of litigators, landing a position with these firms is becoming more and more difficult. They are looking for only the absolute cream of the crop when it comes to lateral hiring. Even the litigators we worked with this year who came from top firms found it difficult to transition to another big firm.

More and more, these top firms are imposing strict guidelines on recruiters for the kinds of candidates they will even accept applications firm. For example, firms may impose requirements that the attorney comes from a top 20 law school, have a minimum GPA, be in the top 10-15% of the class, have been on law review, have completed a federal—or even better, an circuit—clerkship, etc.

With such stiff competition among litigators for the relatively small number of opportunities at the top tier firms, many of our candidates ended up finding opportunities with small to mid-sized firms. And there was an abundance of opportunities at such firms.

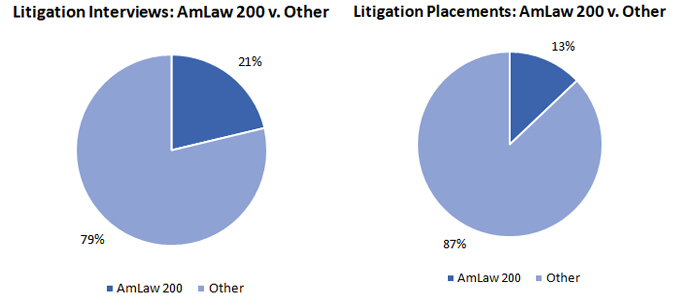

Here’s a snapshot of the interviews and placements of our litigation candidates at AmLaw firms versus all other firms.

2. Litigation Outlook in 2020

In the summer of 2019, there were countless predictions that a recession was imminent. Almost every financial news outlet was warning that the economy was in trouble. But as the year came to a close, on the strength of the stock market rally, continued job growth, and the Federal Reserve cutting interest rates, much of that chorus had faded away by the end of the year.

Nevertheless, the specter of an economic slowdown is still looming. That could be good news for litigators. Typically, when the economy is good, litigation tends to slow down. But when the bottom falls out, companies start to resort to the courts to recoup their financial losses. This means more demand for litigators.

Corporate

1. Corporate Work Still in Demand in 2019

Demand for corporate attorneys in 2019 remained strong. We saw an uptick in the overall interviews of our corporate candidates, but a small decrease in the percentage of candidates we actually placed in corporate positions this year.

Corporate openings accounted for approximately 12% of all the attorney jobs BCG worked on this year. That roughly tracks the percentage of our total interviews and placements we made in that practice area this year.

| 2018 | 2019 | % of Growth | 2018 Rank | 2019 Rank | |

|---|---|---|---|---|---|

| Placements | 15.75% | 14.09% | -10.53% | 2 | 3 |

| Interviews | 12.80% | 13.85% | 8.14% | 2 | 2 |

The combination of the longest bull market in history and low-interest rates have allowed companies to build up ample cash reserves to allow them to pursue M&A as a growth strategy. And while overall deal volume in 2019 was down from 2018, there was still a lot of deal activity throughout the year.

The continued strength of the deal market means law firms are still looking to hire qualified M&A candidates. In fact, 42% of the corporate positions we saw come onto the market in 2019 were at firms looking for candidates with experience in M&A. So, it was not too surprising that most of the corporate interviewing and hiring activity was for candidates with an M&A background.

Corporate attorneys with very niche experience were also highly sought after in 2019. Any candidates with fund formation or Investment Company Act experience could expect to be invited to interview at several firms and entertain multiple offers.

As far as supply and demand for corporate attorneys, it is really the opposite side of the coin from litigation. Whereas in litigation, the supply of attorneys far outpaces demand, there are not nearly as many qualified corporate attorneys on the market. With such a strong economy in recent years, there has been a lot of work to go around for transactional lawyers. However, corporate law took a nosedive during and immediately after the recession. Most attorneys just coming out of law school between 2009 to 2013 (or later) were largely corralled into firms’ litigation or other practice groups. Today, the need for strong corporate mid or senior level transactional attorneys is very high, and the depleted ranks of qualified attorneys is becoming evident.

2. Corporate Work Still Largely Driven by Large Firms

Unlike litigation, corporate deal work is still largely done by the top firms. The work is specialized, requires skills only learned in large law firms, and takes time to learn. Companies pursuing these deals are looking for the resources and expertise of the biggest law firms.

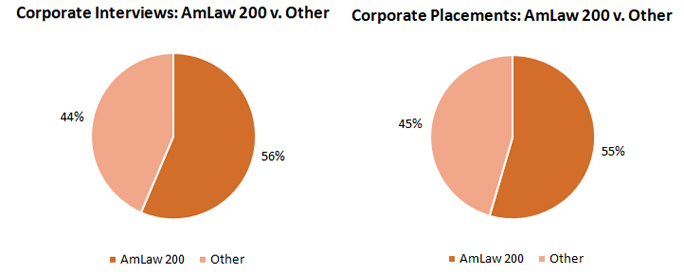

While less than a quarter of the interviews and placements of our litigation candidates this year were in AmLaw 200 firms, the big firms drove over half of our corporate interviews and placements. AmLaw litigation positions accounted for only 14% of the total openings, but AmLaw corporate positions were 50% of all the corporate job searches we recruited for.

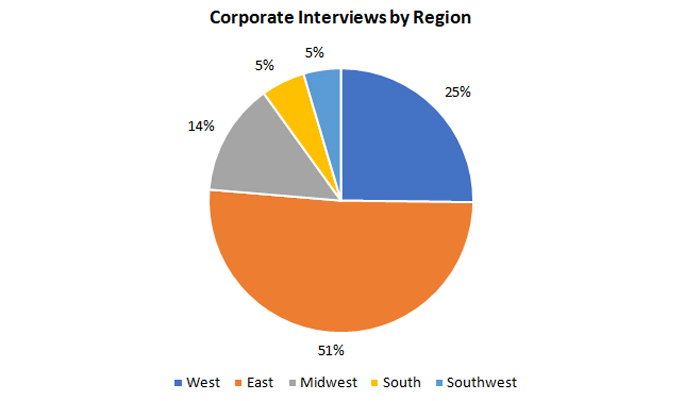

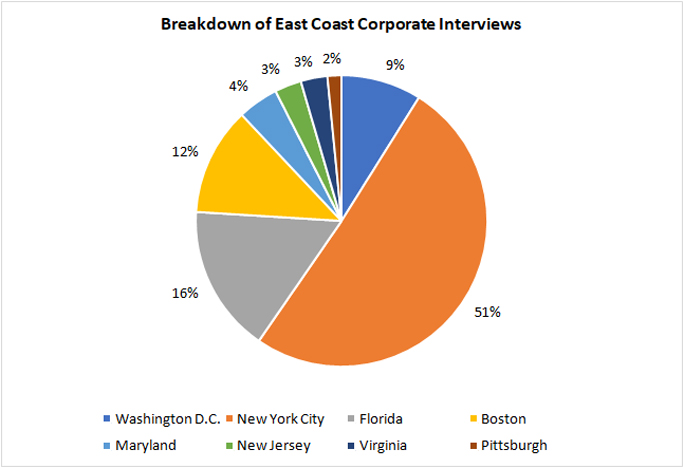

3. Corporate Interviews by Region

The demand for corporate work is still overwhelmingly on the East Coast. Over 50% of our corporate interviews were in the east in 2019. This is not surprising, as the biggest market for corporate attorneys is, and always been, New York City. However, we saw a bit more activity in some other East Coast markets in 2019 as well, including Florida and Boston.

There was also a fair amount of corporate interviewing and hiring activity on the West Coast.

4. Outlook for Corporate in 2020

Just as the potential economic turndown bodes well for litigation, it bodes just as poorly for corporate. In times of recession, transactional attorneys take the biggest hit.

If we can take any lessons from the Great Recession, it’s that a bad economy can be devastating to corporate attorneys and, in particular, younger transactional attorneys. There was an unprecedented wave of layoffs after the last recession.

But the lessons of the Great Recession were so hard learned that many firms have taken care not to put themselves back in that kind of situation. The backlash from the massive layoffs was very vocal. Except for the biggest law firms, most of the top firms have not returned to the practice just before the recession of hiring enormous first-year classes. All firms reduced class size after the recession, and all but a few of the biggest firms have returned to pre-recession levels of hiring.

Hopefully, that means firms have exercised a little more caution in who they are hiring. That said, if another recession is on the horizon, we can expect to see corporate hiring take a hit. But, with market indicators still generally favorable as 2020 gets started, we should expect a relatively steady flow of corporate opportunities, at least for the immediate future.

Labor and Employment – Counseling and Litigation

1. Labor and Employment Attorneys Very Marketable in 2019

For the past few years, we’ve seen labor and employment becoming one of the busiest practice areas for our candidates. This year, labor and employment was our third busiest practice area after litigation and corporate.

Over the past few years, several major law firms have been moving away from having significant employment practice groups. This is in part because labor and employment is such a competitive space that the market keeps the billing rates for these attorneys relatively low compared to other practice areas. Instead, the top law firms are increasingly seeking to fill their labor and employment roles with staff attorneys—which allows the firms more latitude for keeping overall costs down.

But law firms that specialize in labor and employment have been busy and growing quickly over the past few years. The majority of our labor and employment candidates in 2019 were at these specialized firms.

There were more also simply more opportunities on the market in 2019 for labor and employment attorneys than in 2018—approximately 31% more. This led to a significant increase in overall interviews and placements of our labor and employment candidates in 2019.

| 2018 | 2019 | % of Growth | 2018 Rank | 2019 Rank | |

|---|---|---|---|---|---|

| Placements | 8.90% | 17.45% | 95.97% | 3 | 2 |

| Interviews | 9.23% | 12.58% | 36.24% | 3 | 3 |

The need for experienced labor and employment attorneys is likely spurred by increased litigation, new laws and regulations, and the #MeToo era.

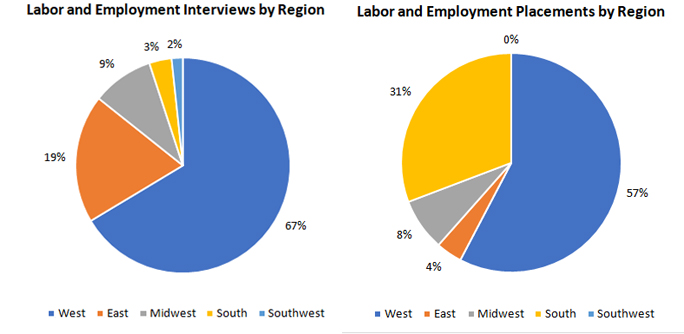

2. Regional Observations of Labor and Employment Market in 2019

The overwhelming majority of interviewing and placement activity for labor and employment attorneys has generally been on the West Coast—and primarily California. This year was no exception, with a whopping 67% of total L&E interviews and 57% of L&E placements occurring on the West Coast. From a recruiting perspective

The chart above also reflects a huge wave of labor and employment placements we made in the South. We facilitated the move a large group of employment partners and associates from a large, general practice firm to a specialized L&E firm’s Atlanta office. This is totally in keeping with the observation above—namely, that there has been a progressive shift of the labor and employment practice toward these specialized employment firms. Employment partners with business are seeing the value in the platform provided by these firms which is particularly tailored to the work.

3. Outlook for Labor & Employment in 2020

The need for labor and employment attorneys does not seem to be abating any time soon. Demand for this work is more insulated from economic changes than areas like litigation and corporate.

We’ve seen the need for experienced attorneys in this practice area steadily increase over the last few years of a strong job market and economy. When the overall market is healthy, and companies are being started and growing, there is a need for labor and employment counseling. Businesses must ensure that employment policies, training programs, and everyday practices are in compliance.

But if an economic slowdown is on the horizon, businesses downsize, and the job market declines. When that happens, there is inevitably a dramatic increase in employment lawsuits. Moreover, litigation rises in an economic downturn as regulators step up enforcement and organizations file more lawsuits to collect money owed.

Whatever the 2020 market has in store, we should expect to see a steady demand for labor and employment attorneys.

Intellectual Property

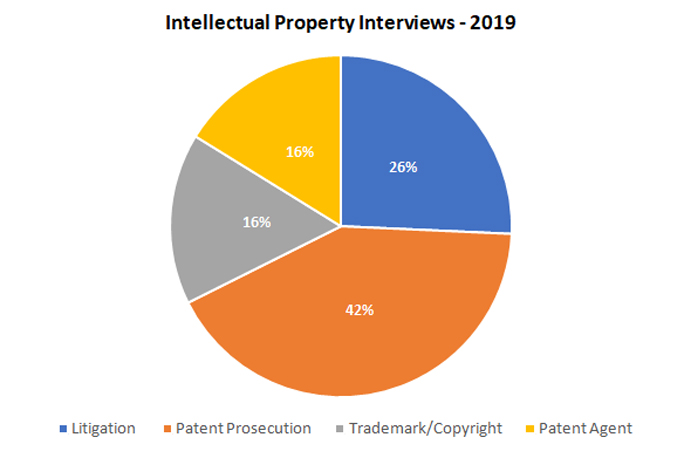

Intellectual property has consistently been one of the hottest niche practice areas. Overall, intellectual property accounted for 11% of our total interviews and 7% of total placements. This broad categorization includes patent prosecution, IP litigation, trademark and copyright, and patent agents.

Here’s how the interviews of our candidates in these various intellectual property subcategories broke out:

Let’s discuss each of these subcategories in turn.

1. Patent Prosecution:

While the bulk of the interviewing and hiring activity in the IP space was for patent prosecution positions, overall in 2019 we had fewer candidates getting interviews or offers in this practice area compared to 2018.

| 2018 | 2019 | % of Growth | 2018 Rank | 2019 Rank | |

|---|---|---|---|---|---|

| Placements | 5.48% | 2.68% | -51.01% | 4 | 8 |

| Interviews | 6.97% | 4.65% | -33.26% | 4 | 4 |

In 2018, we noted that patent prosecution interviews and placements dipped for the first time in several years. We observed that many large law firms are having issues maintaining their patent prosecution practices and staying busy. Because a lot of patent prosecution work is now being done for flat fees, this is making it more difficult for large law firms to be competitive and many are doing less and less patent work. This is creating more work for smaller law firms, and this is where a lot of the work is going.

That trend seemed to continue into 2019. We worked with many senior patent prosecution attorneys this year who were being pushed out of their firms. While we were able to place many of them, several attorneys had to settle for staff attorney positions, which came with a significant pay cut.

2. Intellectual Property – Litigation

Patent litigation has slowed considerably in recent years. Five years ago it was among the hottest practice areas we were working in. While there is work out there, the overall market enthusiasm for this practice area has ebbed.

| 2018 | 2019 | % of Growth | 2018 Rank | 2019 Rank | |

|---|---|---|---|---|---|

| Placements | 4.79% | 2.01% | -58.01% | 6 | 10 |

| Interviews | 2.26% | 2.85% | 26.02% | 10 | 8 |

A great deal of the slowdown has come as a result of the Supreme Court’s ruling in Alice Corp. v. CLS Bank International (2014), which held “that certain business methods, previously thought to be patentable, are not.” This has slowed the work of patent trolls significantly, led to layoffs, reduced work, and created tremendous competition for the few jobs that there are.

We have encountered a lot of sad stories about intellectual property litigators losing their jobs—both partners and associates. The market is poor, there is an oversupply of attorneys, and there is not enough work. While there are certain firms that have managed to stay busy, this has become the exception and not the rule.

Intellectual property litigators with Ph.D.s in electrical engineering who are graduates of top law schools and coming from top firms with one to six years of experience are marketable. Other than that, there are few opportunities for attorneys without business. Even some attorneys with good-sized books of business have had some difficulties finding work. Many law firms that hired intellectual property litigation partners when the market was good seem to have gotten burned when it slowed down and had turned more cautious.

3. Patent Agents

| 2018 | 2019 | % of Growth | 2018 Rank | 2019 Rank | |

|---|---|---|---|---|---|

| Placements | 2.05% | 0.67% | -67.34% | 10 | 21 |

| Interviews | 2.53% | 1.80% | -28.86% | 9 | 12 |

In 2018, we saw a spike in the number of patent agents and technical specialists interviewing and getting hired. We attributed that increase to the competitive cost pressures that have caused patent prosecution to become more and more commoditized.

We noted that some law firms have been attempting to keep costs down by going the patent agent route—hiring very qualified patent agents that they can bill out at a lower rate than unqualified first-year associates and deliver a better overall product. These top firms won’t pay for just any patent agents, and the bottomless pool of candidates with science backgrounds looking to break into the patent agent game will still have a hard time finding a position with these firms. But highly credentialed, experienced patent agents will give these firms a competitive advantage that will help keep the patent prosecution costs low, quality high, and, importantly, keep the whole scope of the patent work with the firm.

In 2019, BCG Attorney Search had fewer candidates interviewing or getting hired through us. But this could largely be a reflection of the fact that firms are less and less inclined to use recruiters (and pay fees) for patent agents. Based on the data BCG tracks, the number of patent agent opportunities coming onto the market remained basically the same in 2019 compared to 2018.

We expect to continue to see patent agents, especially those with PhDs and substantive experience, to be able to find opportunities inside law firms in the coming year.

4. Trademark/Copyright

| 2018 | 2019 | % of Growth | 2018 Rank | 2019 Rank | |

|---|---|---|---|---|---|

| Placements | 2.05% | 1.34% | -34.68% | 9 | 13 |

| Interviews | 1.83% | 1.80% | -1.76% | 11 | 13 |

We saw very little activity in trademark and copyright hiring in 2019. One reason for this is likely that many large law firms have started hiring staff attorneys to do this work. This trend is attributable to a couple of different factors.

First, firms may be hesitant to hire full associates to do this sort of work since they have been through many periods of boom and bust where trademark attorneys are let go when the economy slows down. Because this work is so strongly tied to new businesses starting, it tends to get busy when the economy is “buzzing”. The moment things slow down many law firms let their trademark attorneys go.

Second, trademark and copyright are perceived to be “light” forms of intellectual property-related work that does not require a ton of training to learn or advanced scientific degrees. This means that much of the routine work is not complex and there is a perception that the attorneys do not need to be as highly qualified either. As a result, the bar for entry is not as high for trademark and copyright attorneys, and this leads to more competition than in the more scientifically stringent requirements of patent work.

Real Estate

1. Real Estate Rebounds in 2019

Ever since the economy pulled out of the lowest lows of the 2008 recession, real estate has been a relatively in-demand practice area across the country. Skylines in cities across the nation have been littered with the silhouettes of cranes putting up new residential and commercial developments. But after reaching almost a fever pitch between 2014 and 2016, real estate work significantly slowed down starting at the end of 2016 and into 2018.

Then, starting in the second half of 2018, we actually began to see a rebound in the real estate hiring market—at least for experienced transactional real estate attorneys. It was starting to look like the real estate attorney lateral market was in an upswing. That prediction was proved correct in 2019. In fact, in 2019 we saw a modest increase in total real estate openings in the market –10%--and a significant uptick in the number of real estate candidates getting traction in their lateral job searches.

| 2018 | 2019 | % of Growth | 2018 Rank | 2019 Rank | |

|---|---|---|---|---|---|

| Placements | 3.42% | 4.70% | 37.18% | 7 | 6 |

| Interviews | 2.87% | 4.12% | 43.42% | 6 | 5 |

Many large firms have been looking for attorneys with experience in commercial real estate—specifically leasing, sales, and dispositions. The firms looking to fill mid-to-senior level real estate openings in this practice area were quite persistent in reaching out to us for qualified candidates, more so than for any other openings they had. Any candidates who had the proper substantive expertise in real estate were quickly brought in for interviews and were ultimately hired. It should be noted, however, that the need in this practice area is for sophisticated and well-credentialed attorneys, usually with previous large firm experience, and most of the hiring was happening at AmLaw 100 firms.

2. Outlook for Real Estate in 2020

Again, the prospects for real estate attorneys in 2020 will largely depend on what happens with the economy. During the last recession, investment dried up, transactions were stalled or canceled, and as a result, the real estate sector was hit particularly hard, with many attorneys, and sometimes entire practice groups, getting pushed out the door at law firms due to a lack of work.

It’s hard to imagine another economic downturn as devastating as what was we experienced in 2009. And as we’ve already discussed, the market still appears to be humming along. Unless something unpredictably dire occurs, real estate attorney demand should, at least, hold steady in 2020.

V. Niche Practice Areas to Watch in 2020

Data Privacy

Almost every AmLaw 100 firm has a privacy group, and we saw steady demand for qualified attorneys in this practice area. In fact, we saw a 34% increase in data privacy jobs in 2019 over 2018. With the CCPA just becoming effective as of January 1, 2020, and New York currently considering similarly sweeping privacy legislation, there are no signs of demand dwindling in this practice area. Qualified and experienced data privacy attorneys will likely find themselves in high demand for years to come.

This is one area where the demand for experienced attorneys far outpaces the supply, and this is definitely not a practice area attorneys can break into without the experience. Reports from the field have taught us that the law firms are specifically looking for attorneys with CCPA knowledge and actual GDPR experience. Consequently, many of the top firms seeking experienced privacy attorneys held the positions open for months at a time.

Last year we saw several candidates getting data privacy interviews, but they were unable to secure offers. This seemed to indicate that the firms were interested in talking with candidates with some data privacy experience but were not willing to pull the trigger if the candidate didn’t have the kind of high-level data privacy experience they wanted.

Maybe the firms realized they were looking for a unicorn. This year the need to fill positions, and the lack of super qualified candidates, seemed to lead firms to finally start lower their expectations a little. Candidates with even limited experience with data privacy became very hot commodities. They were interviewing in multiple markets with the most prestigious law firms and ultimately received multiple offers.

This is shift is readily apparent from our own data. While the number of data privacy interviews remained largely flat, the number of data privacy placements jumped considerably.

| 2018 | 2019 | % of Growth | 2018 Rank | 2019 Rank | |

|---|---|---|---|---|---|

| Placements | 0.00% | 1.34% | 100.00% | 27 | 17 |

| Interviews | 0.70% | 0.74% | 6.18% | 23 | 21 |

So, while the need in this practice area will still be for qualified privacy practitioners, the high level of demand may mean that firms may be more willing to hire candidates with a less extensive privacy background than they have in recent years.

It should also be noted that a subset of data privacy work will likely become more popular in 2020: data breach litigation. In 2019 alone, there were multiple highly publicized, large-scale data breaches reported. Millions of customers had their personal information compromised by these breaches.

For example:

- First American – 885 million accounts breached

- Facebook – 600 million accounts breached

- Capital One 360 – 100 million accounts breached

- American Medical Collection Agency – 25 million accounts breached

The CCPA provides a private right of action for data breaches of certain categories of personal information. This will inevitably lead to increased class action filings, which bring with them a steady stream of work for litigators with a data privacy background.

Cannabis Law

However, with the wave of recreational cannabis legalization sweeping across the country since Colorado first legalized it in 2012, several firms in the AmLaw 200 are seeing the huge potential in the industry. There are currently 12 jurisdictions in the United States (11 states and the District of Columbia) that have legalized recreational marijuana, and several other states will have legalization initiatives on the ballot in 2020. According to BDS Analytics, a cannabis market analytics company, the global cannabis market could exceed $40 billion by 2024, so the money grab is officially on.

2019 marked a rather dramatic sea-change in the acceptance of Cannabis Law as a more mainstream practice area. For the first time, Chambers USA added Cannabis Law to their practice area rankings. Several attorneys from the AmLaw 200 were among the ranked attorneys, including attorneys from Duane Morris, Saul Ewing, Husch Blackwell, Fox Rothschild, Akerman, and Buchanan Ingersoll & Rooney. Other big-name firms that have a foothold in the cannabis legal game are Goodwin Procter, Dorsey & Whitney, and Seyfarth Shaw, just to name a few.

Two major Big Law players also entered the cannabis law space in earnest in 2019. In June of 2019, Sheppard Mullin announced the launch of a 70-attorney Cannabis Industry Team. In July, Mannat, Phelps & Phillips formalized their practice with the creation of a cannabis and CBD practice. Common to the announcement by both firms was the fact that they already had a robust roster of cannabis industry clients. So, these announcements seemed to indicate that the work is just coming out of the shadows. This is not these firms’ first forays into the space. Rather, these firms are looking to grow their practices.

Cannabis law is varied and encompasses several different practice areas. The issues cannabis businesses face relate to regulatory compliance, capital raising, banking and finance, accounting control and anti-money laundering compliance, among other areas. These firms also advise established financial institutions that do business with cannabis industry clients.

As a recruiting company, we have been closely watching this space over the past few years. We had not seen a significant number of opportunities advertised for attorneys with cannabis experience. What openings we did see were largely at smaller firms that specialized in cannabis law, and those firms were not looking for our recruiting help. And honestly, if we saw candidates with cannabis law backgrounds, we were not likely to work with them.

But in 2019, we saw a 25% increase in the number of job openings specifically seeking attorneys with cannabis law experience—and for the first time, some of these openings were at big-name firms. We also had many more attorney candidates with great credentials and top firm experience come to us seeking to get into the space. We think this trend will continue in 2020 as the practice continues to gain legitimacy and the legal cannabis market continues to grow.

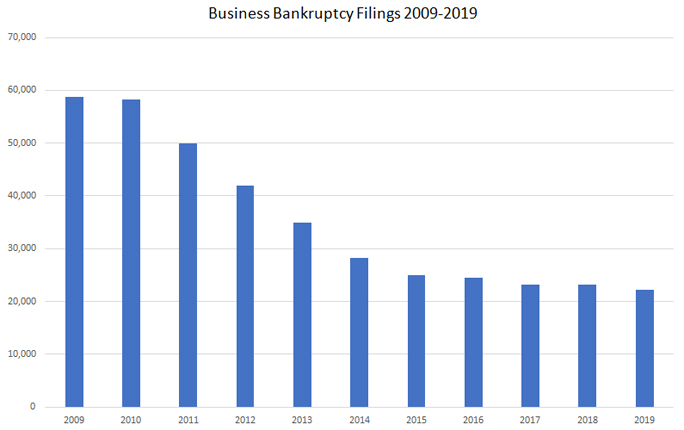

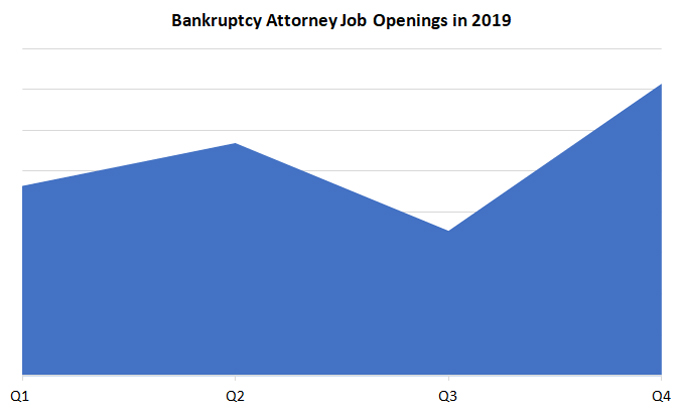

Bankruptcy

The demand for bankruptcy attorneys is counter-cyclical to the strength of the economy. After the Great Recession, there was a virtual firestorm of corporations filing for bankruptcy—and a corresponding need for legal counsel to manage the workload of restructuring or dissolving thousands of insolvent corporations. However, since 2010 there has been a steady decrease in activity on the federal bankruptcy docket.

As the bankruptcy filings dried up, so did the demand for bankruptcy attorneys—especially at the bigger firms that handle the highly complex restructuring work that is needed when businesses, rather than consumers, file for bankruptcy. We have seen very little activity in this practice area for the last several years.

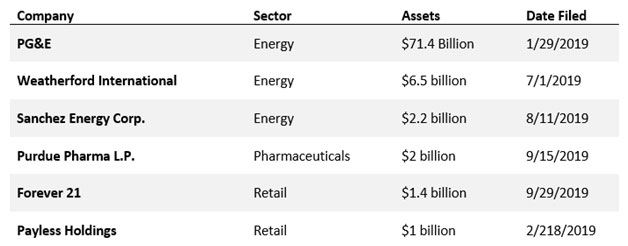

That’s not to say that, over the past few years, the top bankruptcy attorneys in the country haven’t had anything to keep them busy. While the overall volume of filings is down, over the past few years there have been some major corporations that have declared bankruptcy. Many of these high-value bankruptcies are focused in two main industries: 1) retail, and 2) energy.

Some of the big-name companies that filed for bankruptcy in 2019 include:

But a handful of high-value bankruptcies across the market has not been enough to make a significant impact on the lateral market, especially for bankruptcy associates (as opposed to partners). The market has been flat or dying for the past several years.

However, with rumors of another economic slowdown circulating, many are betting that there is another wave of restructuring on the horizon. Unlike 2008, however, there appears to be a slow build toward a potential downturn, which is giving firms an opportunity to start to build their teams up slowly.

Many Big Law firms are looking to add strong restructuring attorneys to their ranks now before the competition for talent gets too fierce. There has already been significant movement at the top as many bankruptcy partners at AmLaw firms have started to shuffle around to find the best platform for their services if, and when, the bankruptcy floodgates open.

Demand for bankruptcy associates has started to pick up as well, especially in the last few months of 2019. But there will be even more competition for experienced bankruptcy attorneys at the more junior and mid-level class years. The slow trickle of bankruptcy work over the last few years means that there have not been many young attorneys joining law firms in the restructuring practice groups. The pool of talent that has sharpened its teeth on this work has all but dried up.

For the past several years, our recruiters have looked at the market and asked: “Is this the year bankruptcy will finally come back?” And year after year, the answer has been a consistent: “No.” In 2020, we might finally be ready to answer that question with a (cautious) “Yes.”

VI. How and Why Law Firms Hire Lateral Attorneys Through Legal Recruiters

To put this data and these trends in context, it is important to review why law firms hire lateral attorneys through recruiters. The role of legal recruiters as agents in the recruiting process for law firms has traditionally been confined to the “high end” law firms in the country. As we noted in 2018, this pattern has appeared to change, as many less prestigious law firms are starting to use recruiters. The trend picked up even more momentum in 2019.

Law firms hire lateral attorneys through recruiters when: (1) they are confident they have profitable ongoing work to give the attorney, (2) there is a shortage of readily available people in the market who complete the work attorneys do, and (3) when the candidate is someone who will impress the law firm’s clients and result in ongoing work being given to the firm.

Law Firms Hire Lateral Attorneys Through Legal Recruiters When They Are Confident They Have Profitable Ongoing Work to Give the Attorney to Do

Law firms hire laterally through legal recruiters when they are succeeding and confident about the future. Law firms that use recruiters are almost always doing work on behalf of stable companies that (within reason) can afford to write an endless series of checks for having their legal work done. This typically means that the attorney will be mainly working for companies that are large enough and have sufficient revenue that legal bills of even hundreds of thousands of dollars a month (or more) do not affect them.

In large cities, these companies may be giant public corporations. In smaller cities, they may be hospitals, local banks, divisions of large national companies, local universities, governments, and other local organizations with healthy revenues and growth. Law firms that service these sorts of institutions are the clients of legal recruiters. In contrast, law firms that do “piecemeal” work that is unpredictable, or who work for individuals (as opposed to companies) tend to rarely, if ever, use legal recruiters.

Law firms that use legal recruiters have “good legal jobs.” A good legal job might pay two or even three times as much in New York City compared to Albany, New York—but the position is still a good one in Albany. A good law firm job typically offers the prospect of stability, a good income, and upward advancement. Law firms with good legal jobs will typically not do a lot of work for individuals and be somewhat “class-conscious” regarding the pedigrees of the attorneys they are hiring. They want to hire people they can “sell” to their clients (and clients expect their law firm’s attorneys to look good on paper).

Law firms that have profitable, ongoing work make a lot of money from their attorneys. They have money to spend on salaries, are unconcerned about temporary slowdowns in the legal market and are also unconcerned about nominal legal recruiter fees that are most often less than even 5% of the revenue that an attorney generates in a year. In fact, because law firms that use legal recruiters have confidence in their hires and the money to support them, we have found that attorneys typically last longer and have better careers with law firms that hire them through legal recruiters than those that do not. A law firm that has confidence in its future and is well managed has no issues with a recruiter’s involvement in a placement and only wants to hire the best people that it can.

Because of how delicate a legal career is and because attorneys want to protect themselves from the risk that a firm without enough work will hire them—only to discard them a short time later—most highly qualified candidates typically want a legal recruiter involved in their placement. Legal recruiters have “good legal jobs,” and law firms that use legal recruiters have profitable work and are confident about their futures.

This discussion would not be complete without us noting that many smaller and midsized law firms used our services this year. This was an indicator that profitable, ongoing legal work has been moving downstream to a greater extent than in the past. This is a good sign for the legal market and seems to imply that there is more profitable work out there.

Law Firms Hire Lateral Attorneys Through Legal Recruiters When There Is a Shortage of People in the Market They Can Hire and Locate Informally

Law firms hire lateral attorneys when there is a shortage of people in the market they have immediate access to. Law firms are typically bombarded with unsolicited resumes from attorneys—even highly qualified ones—when the market is not healthy. Due to this, law firms often do not even need to advertise their positions or use recruiters because the applicants for their positions are right in front of them. Attorneys inside of law firms, recruiting personnel, and others typically have all sorts of “contacts” in the market they can draw from when they are hiring. When a law firm hires this way, they typically recognize and feel comfortable with the person. A proven, known commodity is considered better than one that is not known.

Also, before law firms will go out in the market seeking people—whether it is posting ads on their website, external job boards, or contacting legal recruiters—the law firm will see if there is anyone they already know who they can invite to interview for the job. Many law firm jobs are filled informally like this. This is one reason, for example, that in-house positions with corporations are so difficult for attorneys to find—most of these positions are filled informally because they are in demand from associates with no business at risk of losing their jobs, or attorneys wanting fewer hours, for example. Once an attorney is in-house and in charge of hiring, they will often hire attorneys they are already working with at an outside law firm, or recruit former colleagues they worked with before, or people they knew from law school.

When law firms do not know of attorneys they can bring in to assist them, they contact recruiters, put positions on their websites and start advertising these positions. (Recruiters have access to so few in-house positions, for example, because there is so much demand for them). This indicates that there is a shortage of attorneys in the market and law firms take action and hire this way when they cannot find qualified people through informal channels.

One of the reasons that niche practice areas are so popular for lateral hiring is that there are just not many attorneys with niche skills in the market compared to attorneys in mainstream practice areas. Law firms do not have contacts or resumes, or mainstream attorneys to draw from and hire and therefore need to promote these positions by posting advertisements and contacting legal recruiters.

Law Firms Use Legal Recruiters to Find the Sorts of Candidates Their Clients Will Approve of

Law firms work for clients and, as such, they want to hire attorneys who are acceptable to their clients. This means they look for attorneys who have the pedigrees and background the law firm can “sell” to its clients. In general, large companies and others with lots of legal work are concerned about the pedigree of the attorneys their law firm uses.

For a law firm to hire laterally, the clients of the law firm need to approve of the hire as well. This means that the person hired should have the sorts of qualifications that the client will pay for. If it is a large, prestigious law firm, the prior law firm the attorney worked in, and their law school, as well as other pedigree information, will be important.

VII. State of Additional Individual Practice Areas in 2019

Below we discuss the trends within the various practice areas not already discussed above. In addition to setting out the interview and placement data, we give each practice area an informal health status in terms of what we expect the health of that practice area to be in 2020. The statuses are: 1) Dying, (2) Sick, (3) Stable, (4) Vibrant, or (5) Very Vibrant. Use the images in the key below to quickly identify the health of a practice area.

Insurance Defense

Very VibrantInsurance Defense Placements and Interviews

| 2018 | 2019 | % of Growth | 2018 Rank | 2019 Rank | |

|---|---|---|---|---|---|

| Placements | 0.68% | 6.71% | 879.87% | 23 | 4 |

| Interviews | 4.44% | 3.07% | -31.00% | 5 | 7 |

In 2018, we observed that, for the first time, law firms proactively came to us for help hiring insurance defense litigators. Insurance defense has not historically been a practice area that firms seek recruiter assistance when hiring attorneys. This is largely because insurance companies negotiate rates down dramatically for this kind of work compared to what a firm can charge for more typical commercial litigation work. Furthermore, there is often a high turnover rate in law firms that do this kind of work, so firms typically don’t like to pay recruiters for candidates who may end up leaving after just a year.

In 2018, we noted an incredible 92% increase in total job postings for insurance defense attorneys over 2018. This year, we saw that trend continue with another 60% increase in insurance defense attorney openings over 2018. While many of those job openings were at firms that were still not seeking recruiter assistance to fill the role, we continued to receive a steady number of job orders from insurance defense firms that were seeking our help. With that many more openings in the market, it is not surprising that smaller insurance defense firms, especially in niche, regional markets, were unable to find qualified applicants for their positions.

This year, while the number of candidates interviewing for insurance defense openings remained relatively flat compared to 2018—which was an abnormally high year for insurance defense interviews—we actual placed so many insurance defense attorneys that the practice area was catapulted from our 23rd biggest practice area for placements to our 4th.

This trend shows no sign of slowing down in 2020, as the job openings in insurance defense continued to pour in over the last 3 months of 2019.

Read a Broader Description of the Insurance Defense Here.

Geographic Observations

Insurance Defense Placements

| Region | 2018 | 2019 | % of Growth |

|---|---|---|---|

| East | 0.00% | 4.70% | 100.00% |

| South | 0.00% | 0.67% | 100.00% |

| West | 0.68% | 1.34% | 48.97% |

| Region | 2018 | 2019 | % of Growth |

|---|---|---|---|

| East | 1.13% | 1.90% | 68.03% |

| Midwest | 0.35% | 0.74% | 112.37% |

| South | 0.26% | 0.11% | -59.55% |

| Southwest | 0.26% | 0.32% | 21.35% |

| West | 2.44% | 0.63% | -74.00% |

In 2019, What Are the Prospects for Moving Laterally as an Insurance Defense Attorney?

- The lateral market for attorneys (at the low end) is very healthy.

- At the high end, the practice area is not typically all that healthy for lateral attorneys.

Go Here to Search for Insurance Defense Jobs.

Banking and Finance

Stable| 2018 | 2019 | % of Growth | 2018 Rank | 2019 Rank | |

|---|---|---|---|---|---|

| Placements | 4.79% | 4.70% | -2.01% | 5 | 5 |

| Interviews | 1.57% | 2.85% | 82.03% | 13 | 9 |

Banking and finance practice is generally the domain of only the top firms. It often deals with incredibly complex financial instruments and is a hugely technical area of law. Accordingly, it is a very competitive market with relatively few attorneys qualified to do this work at the highest level. While we did see a rather steady demand from the law firm’s side for these attorneys, we did not see many finance candidates looking to lateral this year.

Read a Broader Description of Banking and Finance Here.

Banking and Finance Placements

| Region | 2018 | 2019 | % of Growth |

|---|---|---|---|

| East | 3.42% | 2.68% | -27.57% |

| Midwest | 0.68% | 0.67% | -2.05% |

| South | 0.00% | 1.34% | 100.00% |

| Southwest | 0.68% | 0.00% | -100.00% |

| East | 3.42% | 2.68% | -27.57% |

| Region | 2018 | 2019 | % of Growth |

|---|---|---|---|

| East | 0.26% | 1.48% | 466.31% |

| Midwest | 0.52% | 0.63% | 21.35% |

| South | 0.26% | 0.21% | -19.10% |

| Southwest | 0.17% | 0.21% | 21.35% |

| West | 0.35% | 0.32% | -8.99% |

In 2020, What Are the Prospects for Moving Laterally as a Finance Attorney?

- This is an active practice area at the junior to the midlevel range for attorneys, but it becomes more difficult for attorneys to lateral into firms as they get more senior.

- Attorneys in this practice area typically can find positions (in a good economy) quite easily, provided they have less than eight years of experience.

- The majority of attorneys who go into this practice area go in-house later in their careers.

- The majority of activity is traditionally in the New York legal market.

Go Here to Search for Banking Finance Jobs.

Tax

VibrantPercentage of Tax Placements and Interviews

| 2018 | 2019 | % of Growth | 2018 Rank | 2019 Rank | |

|---|---|---|---|---|---|

| Placements | 1.37% | 3.36% | 144.97% | 17 | 7 |

| Interviews | 1.83% | 3.59% | 96.48% | 12 | 6 |

Tax has been incredibly slow for the past several years. This has generally been attributable to the fact that there are just too many tax attorneys on the market. Many of the candidates that come to us for help are doing sophisticated tax work at one of the Big Four accounting firms. Unfortunately, these attorneys are simply not marketable to the large firms that have a small handful of tax openings on the market. It’s a very competitive space.

But in 2019, we finally started to see a little more activity in this practice area. There was a 15% increase in tax opportunities coming onto the market compared to 2018—according to job posting data monitored by BCG Attorney Search. A lot of the need is in a supportive capacity for other legal work, such as M&A deals or trusts and estates work. In the grand scheme of things, while there still has not been an overabundance of tax work, tax attorneys found more opportunities on the market in 2019 than they have over the last several years.

Read a Broader Description of the Tax Practice Area Here.

Tax Placements

| Region | 2018 | 2019 | % of Growth |

|---|---|---|---|

| East | 0.00% | 2.01% | 100.00% |

| South | 1.37% | 0.67% | -104.11% |

| West | 0.00% | 0.67% | 100.00% |

| Region | 2018 | 2019 | % of Growth |

|---|---|---|---|

| East | 0.44% | 1.80% | 312.60% |

| Midwest | 0.61% | 0.63% | 4.02% |

| South | 0.26% | 0.11% | -59.55% |

| Southwest | 0.09% | 0.00% | -100.00% |

| West | 0.44% | 1.06% | 142.71% |

In 2020, What Are the Prospects for Moving Laterally as a Tax Attorney?

- This has traditionally been a very difficult area for attorneys to lateral in.

- There are typically numerous applicants for each position in the market.

- There are a high number of tax LL.M.s and attorneys in accounting firms who are hungry for most positions.

- Since tax lawyers typically are in a supporting role for corporate attorneys and tend to be introverted, they often do not generate business, and all but a few get weeded out when they get more senior (this is a very difficult practice area to make partner in).

- Also, because the work is so specialized, the majority of the positions tend to be in major markets (New York City, in particular) and tax attorneys generally cannot move to smaller markets.

Go Here to Search for All Tax Law Jobs.

Insurance Coverage

Vibrant| 2018 | 2019 | % of Growth | 2018 Rank | 2019 Rank | |

|---|---|---|---|---|---|

| Placements | 1.37% | 2.01% | 46.98% | 15 | 11 |

| Interviews | 0.61% | 0.74% | 21.35% | 24 | 22 |

Insurance coverage activity has been picking up over the last couple of years. Last year we observed that the spate of natural disasters that hit the US from wildfires to hurricanes would likely be keeping insurance coverage attorneys busy for a long time. That prediction largely panned out, as we saw even more insurance coverage attorneys interviewing and getting hired in 2019 than in 2018.

The opioid crisis is another big issue that has begun to occupy insurance coverage attorneys. Many firms, particularly in the Midwest, were hiring for positions that would support (almost exclusively) health insurance providers that are fighting with their insureds over whether—and to what extent—opioid-related illness or recovery would be covered.

Read a Broader Description of the Insurance Coverage Practice Area Here.

Insurance Coverage Placements

| Region | 2018 | 2019 | % of Growth |

|---|---|---|---|

| East | 0.68% | 0.00% | -100.00% |

| Midwest | 0.68% | 0.67% | -2.05% |

| West | 0.00% | 1.34% | 100.00% |

Insurance Coverage Interviews

| Region | 2018 | 2019 | % of Growth |

|---|---|---|---|

| East | 0.35% | 0.11% | -69.66% |

| Midwest | 0.09% | 0.21% | 142.71% |

| South | 0.09% | 0.00% | -100.00% |

| Southwest | 0.00% | 0.11% | 100.00% |

| West | 0.09% | 0.32% | 264.06% |

In 2020, What Are the Prospects for Moving Laterally as an Insurance Coverage Attorney?

- This is a healthy practice area for attorneys to lateral in.

- There is a high barrier to entry in this practice area because it takes some time to learn.

- Attorneys who do this work can often lateral as more senior attorneys (with more than ten years of experience) without a lot of business, due to the nature of the work and demand for attorneys with this expertise.

Go Here to Search for Insurance Coverage Jobs.

Construction

VibrantPercentage of Construction Placements and Interviews

| 2018 | 2019 | % of Growth | 2018 Rank | 2019 Rank | |

|---|---|---|---|---|---|

| Placements | 0.68% | 2.01% | 193.96% | 21 | 12 |

| Interviews | 0.70% | 1.16% | 66.86% | 22 | 17 |

In 2019, our Construction law candidates were very marketable, particularly on the east coast.

Read a Broader Description of the Construction Practice Area Here.

Geographic Observations

Construction Placements

| Region | 2018 | 2019 | % of Growth |

|---|---|---|---|

| East | 0.00% | 1.34% | 100.00% |

| Midwest | 0.68% | 0.00% | -100.00% |

| Southwest | 0.00% | 0.67% | 100.00% |

| Region | 2018 | 2019 | % of Growth |

|---|---|---|---|

| East | 0.26% | 0.32% | 21.35% |

| Midwest | 0.26% | 0.21% | -19.10% |

| Southwest | 0.00% | 0.42% | 100.00% |

| West | 0.17% | 0.21% | 21.35% |

This practice area is active wherever there is a construction boom happening.

In 2020, What Are the Prospects for Moving Laterally as a Construction Attorney?

- There is a healthy lateral market for construction attorneys, but this is not one where recruiters tend to be as involved.

- The issue with this practice area is that the salaries and the quality of the attorneys are not as important as they are in many other practice areas, which means that there is a large supply of people willing to do the work and law firms can be quite selective.

- The practice area is popular in areas of the country where there is a lot of construction activity.

- Most of the work that construction attorneys are involved in tends to be residential and not commercial-related work, and this keeps fees low.

Healthcare

StablePercentage of Health Care Placements and Interviews

| 2018 | 2019 | % of Growth | 2018 Rank | 2019 Rank | |

|---|---|---|---|---|---|

| Placements | 1.37% | 1.34% | -2.01% | 13 | 14 |

| Interviews | 1.39% | 1.80% | 28.94% | 14 | 14 |

The demand for healthcare attorneys in 2019 remained relatively flat compared to 2018. This is a very niche practice area with a relatively small number of attorneys with the requisite expertise, which often makes for a small and rather efficient hiring market. The best candidates are known and sought out directly, and recruiters don’t generally need to get involved in such cases.

Geographic Observations

Health Care Placements

| Region | 2018 | 2019 | % of Growth |

|---|---|---|---|

| East | 1.37% | 0.00% | -100.00% |

| West | 0.00% | 1.34% | 100.00% |

| Region | 2018 | 2019 | % of Growth |

|---|---|---|---|

| East | 0.35% | 0.21% | -39.32% |

| Midwest | 0.00% | 0.63% | 100.00% |

| South | 0.09% | 0.32% | 264.06% |

| Southwest | 0.09% | 0.00% | -100.00% |

| West | 0.87% | 0.63% | -27.19% |

In 2020, What Are the Prospects for Moving Laterally as a Healthcare Attorney?

- There are opportunities for healthcare attorneys in most major cities and even many smaller ones.

- This practice area requires a level of training and expertise that relatively few attorneys have.

- Attorneys at all levels find the market quite receptive to them.

- It is not uncommon for attorneys to move from the government to law firms and from in-house to law firms.

- Even senior attorneys with 20 or more years of experience can find a warm reception from law firms if they are geographically flexible enough.

Go Here to Search for Healthcare Jobs.

Trust and Estates

StablePercentage of Trusts and Estates Placements and Interviews

| 2018 | 2019 | % of Growth | 2018 Rank | 2019 Rank | |

|---|---|---|---|---|---|

| Placements | 1.37% | 1.34% | -2.01% | 19 | 15 |

| Interviews | 2.79% | 2.33% | -16.57% | 7 | 11 |

This is traditionally not a practice area where legal recruiters do their best due to the consumer-facing nature of the work trust and estates attorneys do. The work is often cost-sensitive, and this makes it difficult for attorneys in this practice area to bill lots of hours for large clients for an extended period.

While associate placements are not common in trust and estates, there are a great number of partners with large books of business. Most of the activity we had in this practice area was for partners with books of business.

However, as a general matter, due to the aging Baby Boomer population, the demand for trusts and estates attorneys has picked up significantly over the past few years. This work will be in demand for the next several years.

Read a Broader Description of Trust and Estates Here.

Trusts and Estates Placements

?

| Region | 2018 | 2019 | % of Growth |

|---|---|---|---|

| East | 0.68% | 0.00% | -100.00% |

| Midwest | 0.00% | 0.67% | 100.00% |

| West | 0.68% | 0.67% | -2.05% |

| Region | 2018 | 2019 | % of Growth |

|---|---|---|---|

| East | 0.61% | 0.11% | -82.66% |

| Midwest | 0.09% | 0.74% | 749.47% |

| South | 0.00% | 0.11% | 100.00% |

| Southwest | 0.26% | 0.11% | -59.55% |

| West | 1.83% | 1.27% | -30.66% |

Markets in both the East and West Coasts have positions in this practice area.

In 2020, What Are the Prospects for Moving Laterally as a Trusts and Estates Attorney?

- Because this is not a particularly profitable practice area for most law firms, there tends not to be many lateral opportunities in trusts and estates.

- Most of the opportunities for laterals tend to be midlevel to senior trusts and estates attorneys who are taking over and assisting with "legacy practices" of attorneys who are getting senior and ready to retire at law firms around the country.

- One nice thing about this practice area is it is quite conducive to building a book of business since attorneys tend to interact with people like themselves to whom they refer work.

Go Here to Search for Trust and Estates Jobs.

ERISA/Executive Compensation

VibrantPercentage of ERISA/Executive Compensation Placements and Interviews

| 2018 | 2019 | % of Growth | 2018 Rank | 2019 Rank | |

|---|---|---|---|---|---|

| Placements | 0.68% | 1.34% | 95.97% | 22 | 16 |

| Interviews | 0.44% | 1.16% | 166.98% | 27 | 18 |

ERISA/Executive Compensation has been one of the stronger truly “niche” practice areas over the past several years. In 2018, we noted a significant slowdown in hiring for these specialized attorneys. But in 2019, this practice area rebounded. We noted a whopping 50% increase in the total number of ERISA openings come onto the market. While the overall number of openings is still objectively low, this increase in opportunity greatly benefited our candidates with ERISA backgrounds.

Read a Broader Description of This Practice Area Here.

Geographic Observations

ERISA/Executive Compensation Placements

| Region | 2018 | 2019 | % of Growth |

|---|---|---|---|

| East | 0.68% | 0.00% | -100.00% |

| Midwest | 0.00% | 0.67% | 100.00% |

| West | 0.00% | 0.67% | 100.00% |

| Region | 2018 | 2019 | % of Growth |

|---|---|---|---|

| East | 0.09% | 0.42% | 385.41% |

| Midwest | 0.00% | 0.11% | 100.00% |

| South | 0.00% | 0.11% | 100.00% |

| West | 0.35% | 0.53% | 51.69% |

In 2020, What Are the Prospects for Moving Laterally as an ERISA/Executive Compensation Attorney?

The observations about this practice area from 2017 are similar for 2018 as well.

- ERISA/Executive Compensation is a very popular practice area for attorneys to lateral in, and there are typically a fair number of opportunities in most major markets at all points in time.

- This practice area has the added benefit that even lateral attorneys who are more senior (and do not have a book of business) can change firms, or find positions if they are flexible geographically.

- Many law firms have “institutional” clients, and this makes the requirement that an attorney have portable business less important than in other practice areas.

- This practice area has always had a fairly healthy lateral market because the expertise that attorneys have here is so rare.

- There are not a lot of openings in this practice area, and law firms traditionally do not receive a lot of applicants for most positions.

Environmental and Land Use

StablePercentage of Environmental and Land Use Placements and Interviews

| 2018 | 2019 | % of Growth | 2018 Rank | 2019 Rank | |

|---|---|---|---|---|---|

| Placements | 2.05% | 0.67% | -67.34% | 8 | 20 |

| Interviews | 2.70% | 2.54% | -6.05% | 8 | 10 |

Our environmental and land use attorneys were in high demand in 2018, especially on the West Coast. In 2019, we saw a rather dramatic drop off in the number of candidates we were able to place in these positions. This is likely largely attributable to the random fluctuation in the qualified environmental and land use candidates that came to us for help. This is one of the most niche practice areas, and not many attorneys do this work.

But overall, the work in this practice area remained largely stable in 2019. There were roughly the same number of openings in 2019 as there were in 2018. And, when we did have the opportunity to work with qualified environmental or land use attorneys, they were very marketable and could be expected to garner several interviews.

Read a Broader Description of This Practice Area Here.

Geographic Observations

Environmental and Land Use Placements

| Region | 2018 | 2019 | % of Growth |

|---|---|---|---|

| West | 2.05% | 0.67% | -206.16% |

| Region | 2018 | 2019 | % of Growth |

|---|---|---|---|

| East | 0.26% | 0.74% | 183.16% |

In 2020, What Are the Prospects for Moving Laterally as an Environmental and Land Use Attorney?

- Experience counts more than credentials in the land use space, and attorneys with substantive experience will have a relatively easy time finding new employment—even those without stellar credentials.

- Environmental law has typically been a dying practice area and very difficult for attorneys to lateral into, or get into, inside of law firms.

- There was a time when this was a booming practice area in the late 1970s through the 1980s, but the work that drove this boom has largely gone away.

- Very few large law firms do significant work here anymore, and the practice area is a difficult one for attorneys to stay employed in.

- There are some midsized to smaller firms that have ongoing practices doing this that are successful—but not many.

- There are not a lot of opportunities to lateral into major law firms and have not been for some time.

- There are some pockets of success in major law firms, but these tend to be small pockets of attorneys, and these attorneys are often concerned about their futures.

- From a lateral perspective, when there are opportunities, there are often only a few attorneys who are qualified for them.

- This can make getting these jobs less difficult for a qualified candidate than it could be in other practice areas.

- Notwithstanding, there are far more attorneys who would like to practice environmental law than there are attorneys who can find jobs inside of law firms doing the work.

- This is an exceptionally difficult practice area to get into, stay employed in, and lateral in.

Energy and Oil & Gas

SickPercentage of Energy and Oil & Gas Placements and Interviews

| 2018 | 2019 | % of Growth | 2018 Rank | 2019 Rank | |

|---|---|---|---|---|---|

| Placements | 1.37% | 0.67% | -51.01% | 12 | 23 |

| Interviews | 0.52% | 0.53% | 1.13% | 25 | 24 |

Read a Broader Description of This Practice Area Here: Energy and Oil Gas Attorney/

Much of the activity in this practice area this year has been related to renewable energy project finance, rather than oil and gas. We are seeing more large-scale renewable energy projects looking for financing, and firms are looking for qualified attorneys to help them close these deals.

Geographic Observations

Energy and Oil & Gas Placements

| Region | 2018 | 2019 | % of Growth |

|---|---|---|---|

| East | 1.37% | 0.00% | -100.00% |

| West | 0.00% | 0.67% | 100.00% |

| Region | 2018 | 2019 | % of Growth |

|---|---|---|---|

| East | 0.26% | 0.21% | -19.10% |

| Midwest | 0.00% | 0.11% | 100.00% |

| South | 0.09% | 0.11% | 21.35% |

| Southwest | 0.00% | 0.11% | 100.00% |

| West | 0.17% | 0.00% | -100.00% |

In 2020, What Are the Prospects for Moving Laterally as an Energy and Oil & Gas Attorney?