Harrison Barnes' Legal Career Advice Podcast - Episode 46

The 2021 State of the Legal Market: The Top 20 Reasons the 2020 Legal Market Was So Unique and Harrison’s 118 Predictions for the 2021 Legal Market

The 2020 legal market was the most unusual I have seen in my entire career—including the bumps of 2000, 2001, and 2008 through 2011. At no time in history did I see a market fraught both with dangers for the unprepared and opportunity for law firms and attorneys who understand its current rules. And there are rules in all markets. The ability of law firms to understand these rules helps them make more money. The power of candidates to understand these rules keeps them employed and earning as much money as possible.

The Traditional Understanding of What Everyone Wants (Who is Buying What) is what Guides Most Legal Recruiters

Most legal recruiters in the United States are guided by some simple rules about what law firms want. These are the rules I learned early on, and most legal recruiters believe today. It is flat out wrong now. It changed in 2020. I could compare these now antiquated rules to such statements as "the Earth is flat" or "a flying machine is impossible." These rules are just not appropriate anymore in the current economy.

All recruiting firms sell labor to buyers. They find organizations that need a specific type of worker, do the legwork to find those workers, understand if the worker is a good fit for what the clients want, and get paid by the employer if they find that worker. It has always been this way. Law firms and other organizations make lots of money with labor and because of this, are more than happy to pay for labor that can make them money. The cost of recruiter fees is less than 5% of the revenue an attorney will generate in a year for them. It is a good deal.

I will not focus so much on the numbers as exploring the idea of "who is buying" and "who is getting bought." These are among the most important factors in understanding where the legal market is right now and where things are headed.

The Traditional Understanding of Who is Buying Has Always Guided Most Legal Recruiting Firms to Large Law Firms

Traditionally, legal recruiting firms that make permanent placements focus on recruiting and placing attorneys in the largest law firms. Smaller law firms and law firms in niche markets have not used recruiters throughout history because legal recruiters were not interested in them. They did not understand the value proposition. Large law firms in major markets are significant businesses and use legal recruiters to generate hundreds of millions of dollars per year. Recruiters are traditionally concentrated in the largest cities and markets because this is where the buyers are. For example, for years, there was only one legal recruiter in Detroit (one person)—because the market was too small. Recruiters in major cities with lots of firms competed for the same people.

These large law firms traditionally represented significant businesses, paid high salaries (market), would be found on various lists of the largest and most profitable law firms, and practiced in the most profitable areas like litigation, corporate, real estate, and others. These large law firms did not concentrate on representing consumers. Most of their clients were businesses you have heard of.

These large law firms traditionally have sophisticated recruiting departments that demand recruiters send them the best people. Most legal recruiters work for these recruiting departments and are guided by their demands. These law firms set a tone that means most recruiters will not work with smaller law firms and look down on small firms and attorneys from them. They get their fees from law firms that make and have access to enormous sums of money to hire the best attorneys.

I taught myself early on that law firms that used recruiters needed to access "waterfalls of money." This means they represent tons of large clients who think nothing of writing checks for $50,000 to $250,000+ per month to outside attorneys and can afford to do so. Enough clients like this, and the law firm is "flush," and money is no issue. These are large businesses or extraordinarily successful entrepreneurs that can afford to do this.

Because most recruiters believe that the largest and most prestigious law firms are the ones who use legal recruiters, it is not unusual for attorneys in the largest cities like New York to get 10+ calls about each job opening at a major law firm in the market.

This has changed over the past several years. Legal recruiters at BCG Attorney Search who have this mindset are no longer successful. One of our recruiters went from making 30 placements a year fifteen years ago to making only a few now. This no longer works.

Based on the Traditional Understanding of What Buyers Want, Most Legal Recruiting Firms Think Law Firms Only Want:

- Attorneys Matching Their Actual Openings. Most recruiters believe that law firms are only interested in attorneys matching their actual openings. Therefore, if the law firm does not have an opening, and the attorney does not match what the law firm is seeking, the recruiter will not try to get the law firm interested.

- Attorneys Coming from the Best Law Firms. Most recruiters believe only attorneys from the best law firms will get jobs with other large law firms. Most legal recruiters badger only people from the largest law firms and not smaller firms.

- Attorneys from the Best Schools or at the Top of Their Class at Lesser Law Schools. Most legal recruiters believe that the attorneys coming from the best law schools are most marketable. They will look up schools and speak about them as if an attorney from a lesser school is not worth their time.

- Attorneys with 2 to 6 Years of Experience. We typically think attorneys with less than a year of experience require lots of training. Attorneys with over six years of experience are too close to partnership and will often need to be asked to leave when they do not make partner. The sweet spot for most legal recruiters is between one and six years of experience where attorneys typically are profitable, know what they are doing, and are not a threat.

- Attorneys in Economically Appropriate Practice Areas. The most economically appropriate practice area during a good economy is typically anything corporate or "deal" related. This is where most of the attention goes from legal recruiters and others. In average to poor economies, there is more hiring in litigation. During low-interest-rate environments, real estate has typically been busy. When the economy is slow and having significant issues, bankruptcy is often healthy.

- Attorneys in the Right Practice Areas. Specific practice areas have traditionally been believed to be good for recruiters and others. The more "big firm-related" the practice area, the more likely it was to be a source of interest for recruiters: corporate, real estate, intellectual property litigation, finance, and similar practice areas. The more consumer-facing or unprofitable the practice area, the less placeable the attorney is likely to be (personal injury, immigration, insurance defense, trust and estates, and family law, for example).

- Attorneys with as Few Jobs as Possible Who Look Committed. Law firms want to hire people who look like they will stick around. It is expensive financially and a moral drain to hire people who are likely to leave. Law firms want to hire attorneys who look like they are going to be stable.

- For Partnership Roles, Attorneys with at Least a Few Million Dollars in Business (in Most Large Cities). The largest law firms are most interested in partners with substantial business that they believe will go with them. This requirement could exceed several million dollars a year at the most prestigious law firms in the largest cities. Most law firms want their partners to be self-supporting and able to give work to associates. They want these partners taking home around 20 to 35% of their collections and the rest to go to the firm.

- Attorneys Who Are Currently Employed. Law firms have traditionally shied away from unemployed attorneys because of various prejudices. Law firms have always seemed to believe that unemployed attorneys are not committed, were problems at their previous firm, or have other issues that make them not worthwhile.

- Attorneys Who Can Impress Law Firms with Their Qualifications and Not Always Their Individuality and Personality. The belief has always been that attorneys are "commodities" whose qualifications are the most important component when hiring them. The attorney's outside interests, individuality, and personality are unimportant to the law firm.

A review of these various hiring criteria is unimportant because, incredibly, most of this no longer applies in the legal placement market—the market has changed. In 2020, almost everyone was buying everything. Is this a temporary development? I have no idea. I know that I have never seen a market so open to using legal recruiters in my career. Although most law firms have their career sites, most law firms also post their jobs publicly, and a great number of attorneys are applying to these firms regardless of whether they have openings.

Everyone Not Marketable Before is Now Marketable

At the outset, I want to state something so unique I cannot believe I am writing it: The market in 2020 shifted so dramatically that our company went from rejecting almost every single candidate who approached our firm for help because they did not fit our criteria of a "placeable" candidate, to leaving no one. The market in 2020 (from our perspective) was better than it has ever been.

Years ago, we used to be "snobs" and believe only attorneys with the best pedigrees (from the best law schools, working at the best law firms) were worthy of our attention. We rejected so many people that job boards, attorneys, and others often believed we were not a recruiting firm and merely trying to harvest resumes. However, over the past several years, the market has been opening considerably. In 2018 and 2019, we saw attorneys in niche practice areas and locations becoming increasingly employable through us. Then, in 2020, we suddenly were placing clerks of all sorts, law students, first-year attorneys, very senior attorneys, attorneys in consumer practice areas (like worker's compensation, family law, and more) and even had law firms begging us to send them attorneys and hire them. In contrast, many significant law firms slowed down and were not hiring as aggressively as they did in the past.

We have always followed a ranking system for candidates and law firms, ranking each from a 1 to a 5. You can learn more about this ranking system here: https://www.bcgsearch.com/article/900046515/How-to-Easily-Determine-the-Best-Attorneys-and-Law-Firms-The-Five-Prestige-Levels-of-Attorneys-and-Law-Firms/

Essentially, it is like this:

-

Candidates Ranked “5”:

Candidates ranked a “5” typically are from major law firms, went to good law schools and did very well there and are in practice areas that are in demand. These candidates typically are quite suited for practicing law; they are professional and motivated. They generally are not leaving their existing firms due to any problems they are having at those firms. They are often attorneys who are relocating or have reasons for switching firms that make perfect sense. If they are partners, they have large books of business that will generally exceed $3,000,000 and this business will be on behalf of large, national clients. If they are associates, they generally have between 1 and 6 years of experience. -

Candidates Ranked “4”:

Candidates ranked a “4” typically went to top law schools or worked at a “4” or “5” firm. A candidate will generally be ranked a “4” if the attorney has between 1 and 6 years of experience, is at a top law firm and in a marketable practice area. Attorneys from top firms with over $1,000,000 in business are generally “4s” in terms of their marketability but may not necessarily be able to get into “4” or “5” firms. An associate candidate is generally a “4” if he or she is at a “4” or better firm—regardless of his or her law school performance provided the attorney is (1) in a good practice area and (2) does not have too many moves on his or her resume. -

Candidates Ranked “3”:

Candidates ranked a “3” can be quite strong, but they generally are not. They almost always do not have the academic or personal qualifications needed to get a position in a “4” or “5” law firm. Notwithstanding, they are solid attorneys despite not having top-notch qualifications. Attorneys who get positions in “3” law firms may or may not have outstanding academic qualifications. The issue with a “3” attorney compared to a “4” attorney is generally that you can point to one or more things in the attorney’s background that makes that candidate not suitable to working at a law firm ranked a “4” or a “5.” For example, the attorney may (1) have performed poorly in a top law school, (2) have gone to a poor law school, (3) have too many moves on his or her resume, (4) be in an unmarketable practice area, (5) never have been a summer associate in a major law firm, (6) have more than 7 years of experience, or (7) be a partner without enough business to be marketable. -

Candidates Ranked “2”:

Candidates ranked a “2” are generally “average” without any distinguishing characteristics. They are good attorneys capable of doing satisfactory work, but not stellar. Attorneys who could otherwise be “3s” or “4s” are often a “2” because they made some mistakes earlier in their careers, or otherwise. Candidates who are a “2” are rarely marketable by legal recruiters because they do not have any distinguishing skills or talents that make them stick out. Attorneys ranked a “2” comprise the majority of attorneys out there. Because they are doing a significant amount of work for low-paying clients and often individuals, these attorneys rarely learn the skills to fully document transactions or do a great deal of work in litigation. Their work tends to be “spotty” compared to what you see from attorneys in “4” and above firms and often there are typos, missed arguments and things that are not thought of or documented in transactions. This is not necessarily because the attorneys are not capable of this, it is because the attorneys’ firms do not have the time to train these attorneys to do this sort of work. -

Candidates Ranked “1”:

Most “1” candidates have poor training, inconsistent work performance, average to poor law schools and have worked at “1” firms in the past. Law firms that hire them (when they have openings) do not have the highest standard for those that they hire. Any attorney can work in a “1” firm. There is nothing wrong with “1” attorneys, of course, other than the fact that they do not have the qualifications needed to work at a higher ranked law firm. These sorts of attorneys comprise the majority of attorneys practicing at small to solo practice law firms throughout the United States.

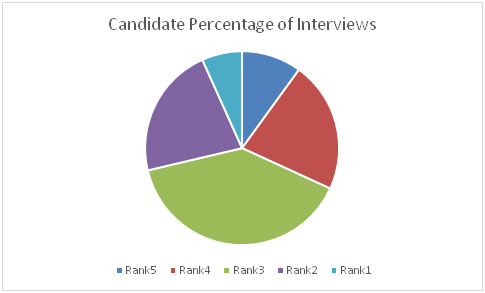

Look at what happened in 2020.

| Candidate Rank | Candidate Percentage of Interviews |

| 5 | 9.91% |

| 4 | 21.7% |

| 3 | 39.2% |

| 2 | 21.8% |

| 1 | 6.68% |

Today, we believe virtually every attorney is marketable. Unable to work with most attorneys, we used to refer people to our sister companies such as LawCrossing.com that were initially set up to help people we could not get jobs for at BCG Attorney Search. There has traditionally been a vast “market inefficiency” that made all but the best candidates marketable through a recruiting firm. Now, practically everyone seems marketable through a recruiting firm—it does not matter where they live, their practice area, or even (in many cases) their seniority.

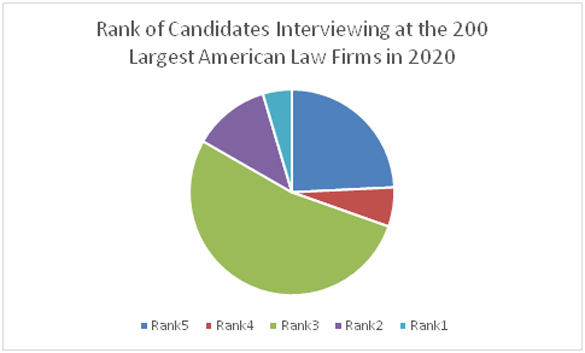

Amazingly, despite less hiring in 2020, larger law firms also were more willing to hire and bring in candidates they traditionally would not. For example, the largest law firms typically interview only 4 and 5 candidates. Look what happened in 2020.

Rank of Candidates Interviewing at the 200 Largest American Law Firms in 2020

| Candidate Rank | Percentage of Interviews |

| 5 | 18% |

| 4 | 4.6% |

| 3 | 39.3% |

| 2 | 9% |

| 1 | 3.4% |

The market has changed. We are becoming better at what we do. We are using data science, getting better at working with candidates, training our recruiters more, and making them more accountable – still, we cannot help but notice a major shift in the market that is driving great demand for more types of attorneys from law firm clients. We cannot work with everyone who approaches us right now, of course, but the odds are that we will have something for them in the future.

This is astonishing news from a legal recruiter and is a sign of an unprecedented sea change. Not only did the market improve in 2020, but it is also better than it has ever been. More types of people are employable than ever before. It is almost as if a social movement has changed the very fabric of the legal market itself. In the week before Christmas, one of our recruiters made four placements. In the week before New Year’s, we kept making placements. The market is ravenous for attorneys if you know where to look.

A review of these various hiring criteria is largely unimportant because, incredibly, most of this no longer applies in the legal placement market—the market has changed fundamentally. In 2020, almost everyone was buying everything. Is this a temporary development? I have no idea. I know that I have never seen a market so open to using legal recruiters in my career. This comes even though most law firms have their career sites, most law firms post their jobs publicly, and many attorneys are applying to these firms regardless of whether they have openings.

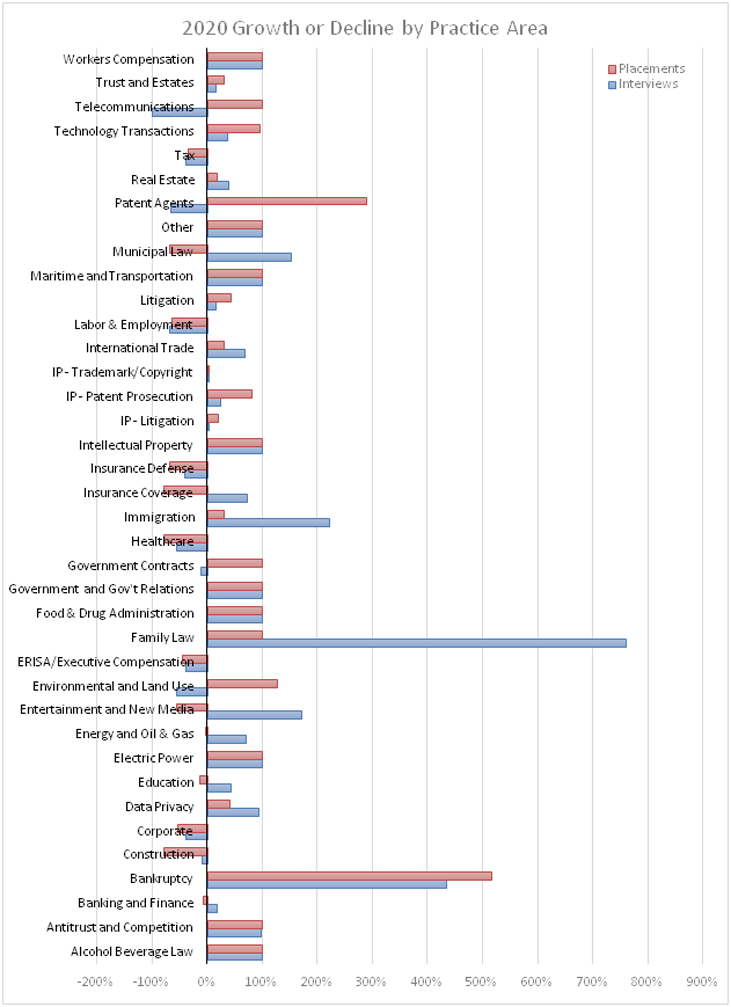

2020 Hiring and Interview Statistics for BCG Attorney Search

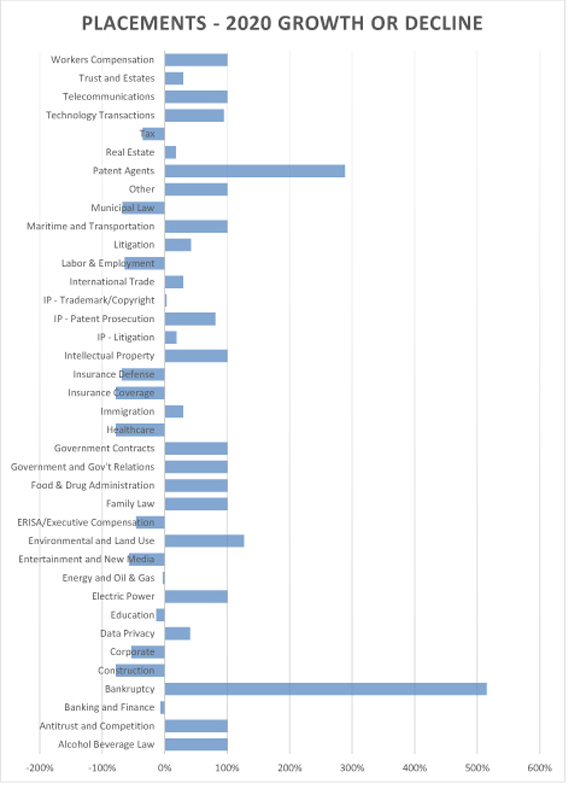

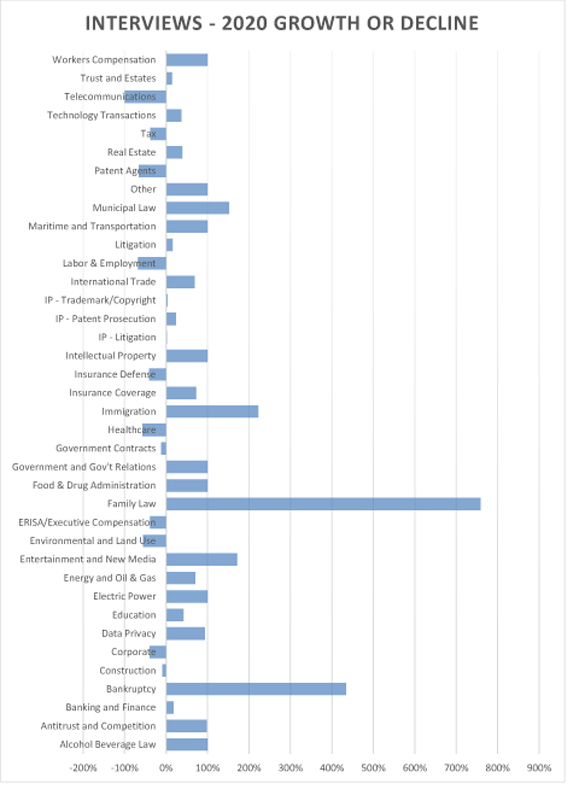

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Alcohol Beverage Law | 0.00% | 0.00% | 100.00% | 27 | 34 |

| Interviews | Alcohol Beverage Law | 0.00% | 0.02% | 100.00% | 38 | 37 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Antitrust and Competition | 0.00% | 1.01% | 100.00% | 28 | 19 |

| Interviews | Antitrust and Competition | 0.42% | 0.84% | 97.82% | 24 | 24 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Banking and Finance | 4.70% | 4.38% | -6.84% | 5 | 6 |

| Interviews | Banking and Finance | 2.85% | 3.36% | 17.66% | 8 | 7 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

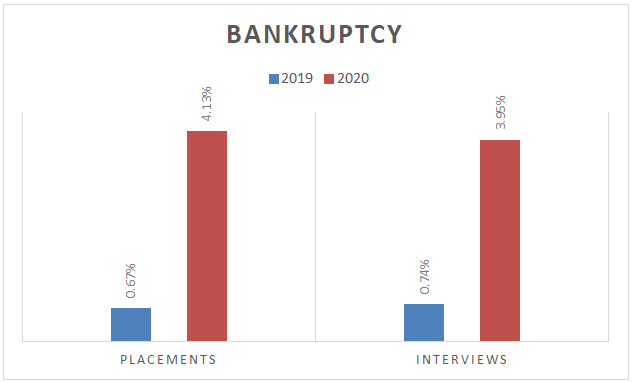

| Placements | Banking and Finance | 4.70% | 4.38% | -6.84% | 5 | 6 |

| Interviews | Banking and Finance | 2.85% | 3.36% | 17.66% | 8 | 7 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

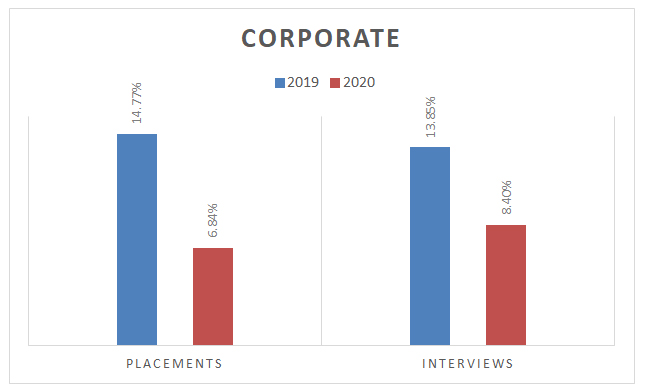

| Placements | Corporate | 14.77% | 6.84% | -53.67% | 3 | 2 |

| Interviews | Corporate | 13.85% | 8.40% | -39.35% | 2 | 2 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Data Privacy | 1.34% | 1.88% | 40.36% | 12 | 14 |

| Interviews | Data Privacy | 0.74% | 1.43% | 93.42% | 18 | 14 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Education | 0.67% | 0.58% | -13.62% | 19 | 26 |

| Interviews | Education | 0.63% | 0.90% | 42.13% | 21 | 21 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Electric Power | 0.00% | 0.00% | 100.00% | 29 | 35 |

| Interviews | Electric Power | 0.00% | 0.06% | 100.00% | 37 | 36 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Energy and Oil & Gas | 0.67% | 0.65% | -2.83% | 20 | 24 |

| Interviews | Energy and Oil & Gas | 0.53% | 0.90% | 69.98% | 22 | 22 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Entertainment and New Media | 0.67% | 0.29% | -56.81% | 21 | 32 |

| Interviews | Entertainment and New Media | 0.42% | 1.15% | 171.08% | 23 | 16 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Environmental and Land Use | 0.67% | 1.52% | 126.74% | 22 | 16 |

| Interviews | Environmental and Land Use | 2.54% | 1.13% | -55.55% | 10 | 17 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | ERISA/Executive Compensation | 1.34% | 0.72% | -46.01% | 13 | 23 |

| Interviews | ERISA/Executive Compensation | 1.16% | 0.71% | -38.72% | 16 | 26 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

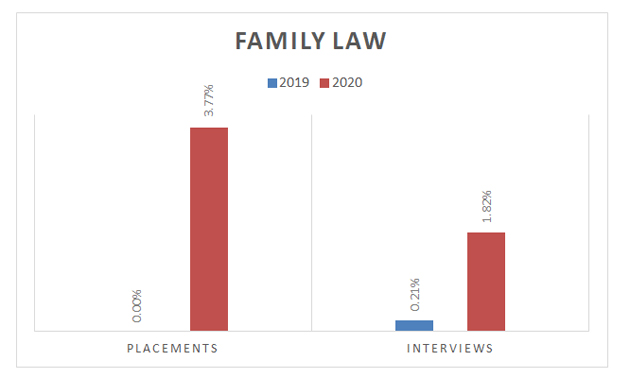

| Placements | Family Law | 0.00% | 3.77% | 100.00% | 30 | 8 |

| Interviews | Family Law | 0.21% | 1.82% | 758.67% | 25 | 13 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Food & Drug Administration | 0.00% | 2.17% | 100.00% | 31 | 12 |

| Interviews | Food & Drug Administration | 0.00% | 0.86% | 100.00% | 32 | 23 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Government and Government Relations | 0.00% | 0.14% | 100.00% | 32 | 33 |

| Interviews | Government and Government Relations | 0.00% | 0.61% | 100.00% | 33 | 29 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Government Contracts | 0.00% | 0.00% | 100.00% | 33 | 36 |

| Interviews | Government Contracts | 0.21% | 0.19% | -12.08% | 29 | 34 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Healthcare | 1.34% | 0.29% | -78.41% | 14 | 31 |

| Interviews | Healthcare | 1.80% | 0.77% | -56.90% | 13 | 25 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

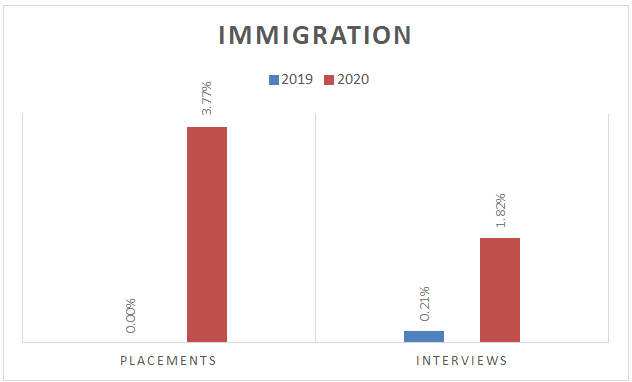

| Placements | Immigration | 0.67% | 0.87% | 29.57% | 23 | 20 |

| Interviews | Immigration | 0.21% | 0.68% | 222.37% | 26 | 27 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Insurance Coverage | 2.01% | 0.43% | -78.41% | 10 | 28 |

| Interviews | Insurance Coverage | 0.74% | 1.28% | 72.91% | 19 | 15 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Insurance Defense | 6.71% | 2.13% | -68.26% | 4 | 13 |

| Interviews | Insurance Defense | 3.70% | 2.17% | -41.39% | 6 | 11 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Intellectual Property | 0.00% | 0.87% | 100.00% | 34 | 22 |

| Interviews | Intellectual Property | 0.00% | 1.01% | 100.00% | 31 | 20 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Intellectual Property - Litigation | 2.01% | 2.39% | 18.77% | 11 | 10 |

| Interviews | Intellectual Property - Litigation | 2.85% | 2.90% | 1.49% | 9 | 8 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Intellectual Property - Patent Prosecution | 2.68% | 4.86% | 80.85% | 8 | 5 |

| Interviews | Intellectual Property - Patent Prosecution | 4.65% | 5.76% | 23.88% | 4 | 3 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | International Trade | 0.67% | 0.87% | 29.57% | 24 | 21 |

| Interviews | International Trade | 0.21% | 0.36% | 68.51% | 28 | 32 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | IP- Trademark/Copyright | 1.34% | 1.38% | 2.57% | 15 | 17 |

| Interviews | IP- Trademark/Copyright | 1.80% | 1.86% | 3.43% | 12 | 12 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

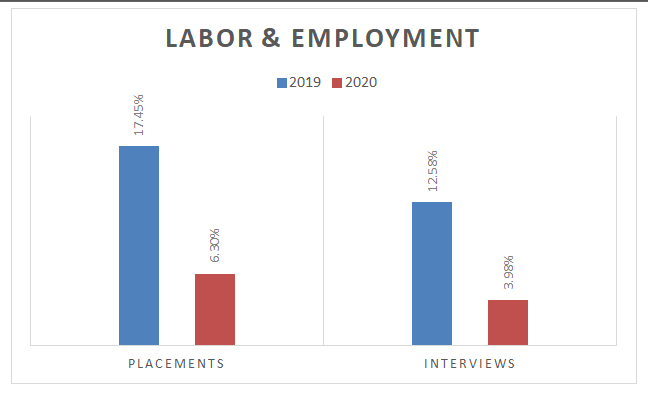

| Placements | Labor & Employment | 17.45% | 6.30% | -63.87% | 2 | 3 |

| Interviews | Labor & Employment | 12.58% | 3.98% | -68.35% | 3 | 5 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

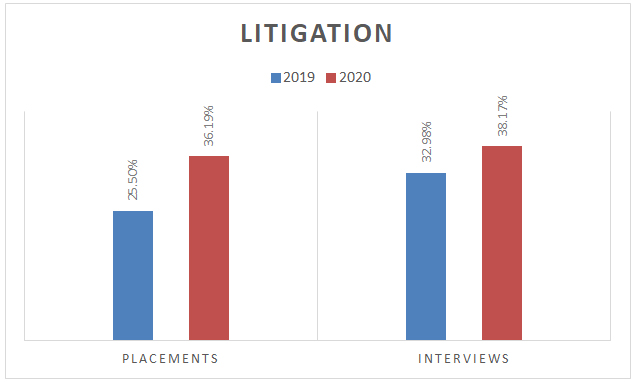

| Placements | Litigation | 25.50% | 36.19% | 41.90% | 1 | 1 |

| Interviews | Litigation | 32.98% | 38.17% | 15.74% | 1 | 1 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Maritime and Transportation | 0.00% | 0.43% | 100.00% | 35 | 30 |

| Interviews | Maritime and Transportation | 0.00% | 0.14% | 100.00% | 36 | 35 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Municipal Law | 1.34% | 0.43% | -67.61% | 16 | 29 |

| Interviews | Municipal Law | 0.21% | 0.53% | 152.03% | 27 | 30 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Other | 0.00% | 0.65% | 100.00% | 36 | 25 |

| Interviews | Other | 0.00% | 0.28% | 100.00% | 35 | 33 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Patent Agents | 0.67% | 2.61% | 288.70% | 25 | 9 |

| Interviews | Patent Agents | 1.80% | 0.62% | -65.52% | 14 | 28 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

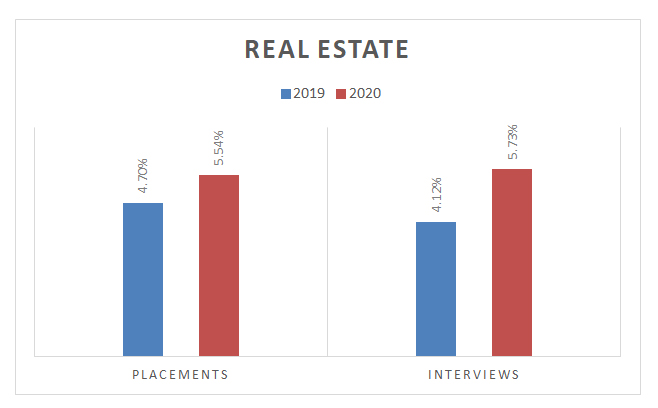

| Placements | Real Estate | 4.70% | 5.54% | 17.84% | 6 | 4 |

| Interviews | Real Estate | 4.12% | 5.73% | 39.09% | 5 | 4 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Tax | 3.36% | 2.17% | -35.22% | 7 | 11 |

| Interviews | Tax | 3.59% | 2.22% | -38.20% | 7 | 10 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Technology Transactions | 0.67% | 1.30% | 94.35% | 26 | 18 |

| Interviews | Technology Transactions | 0.74% | 1.01% | 36.90% | 20 | 19 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Telecommunications | 0.00% | 0.00% | 100.00% | 37 | 37 |

| Interviews | Telecommunications | 0.21% | 0.00% | -100.00% | 30 | 38 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

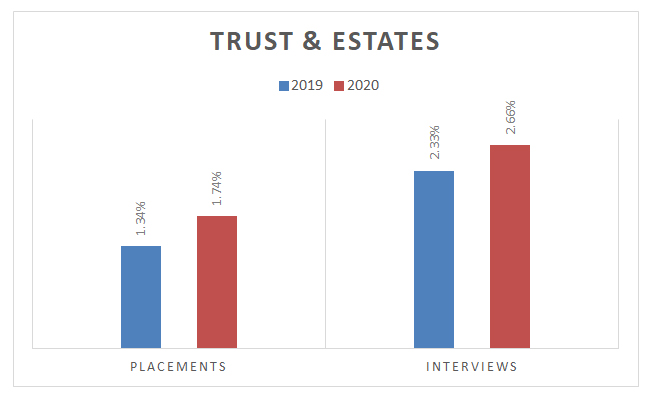

| Placements | Trust and Estates | 1.34% | 1.74% | 29.57% | 17 | 15 |

| Interviews | Trust and Estates | 2.33% | 2.66% | 14.56% | 11 | 9 |

| Status | Practice Area | 2019 | 2020 | Growth or Decline | Rank 2019 | Rank 2020 |

| Placements | Workers Compensation | 0.00% | 0.00% | 100.00% | 38 | 38 |

| Interviews | Workers Compensation | 0.00% | 0.50% | 100.00% | 34 | 31 |

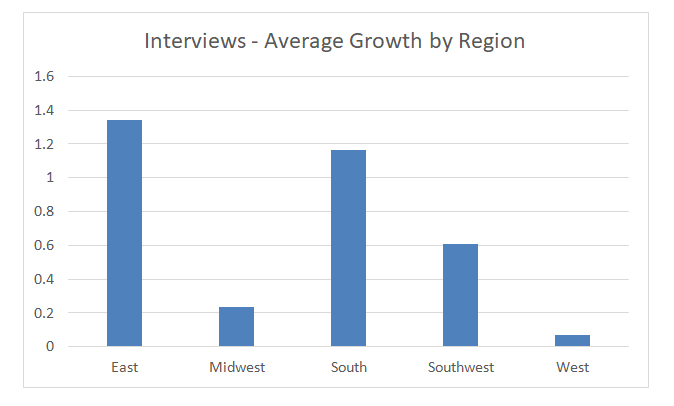

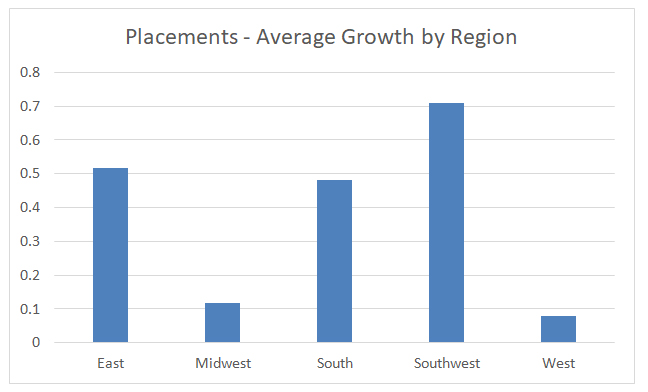

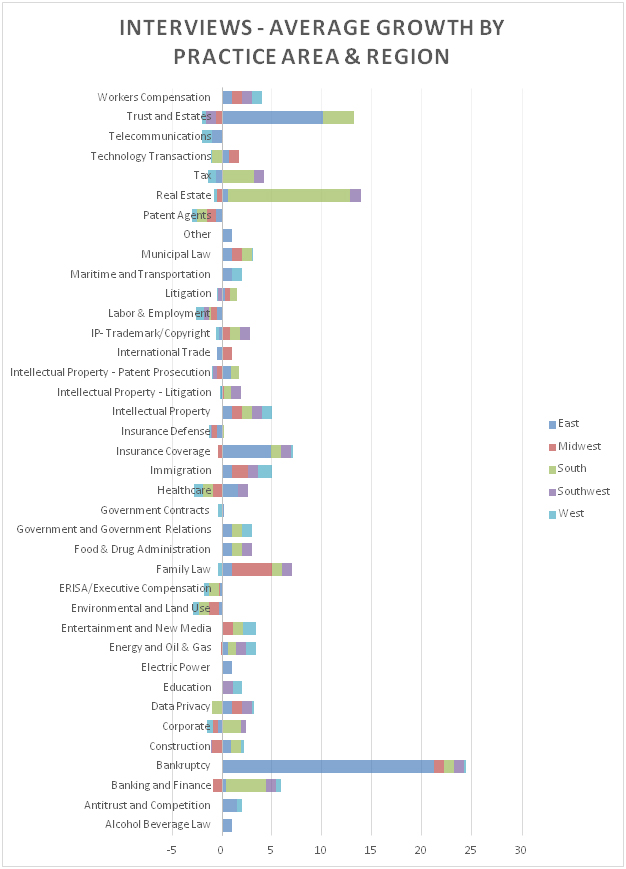

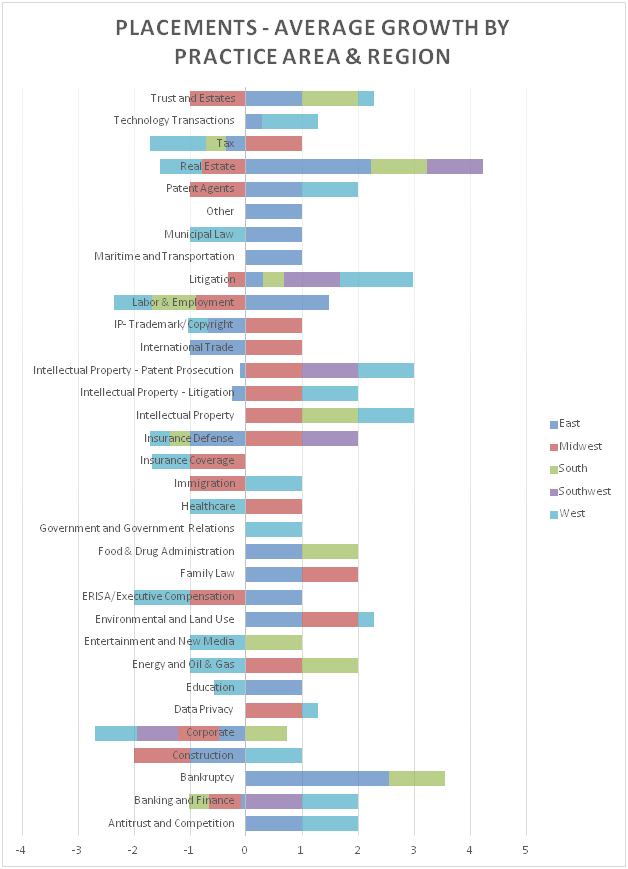

Regions Differences in Interviews and Placements Between 2020 and 2019

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Alcohol Beverage Law | 0.00% | 0.02% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | Antitrust and Competition | 0.00% | 0.43% | 100.00% |

| Placements | West | Antitrust and Competition | 0.00% | 0.58% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Antitrust and Competition | 0.21% | 0.53% | 149.10% |

| Interviews | West | Antitrust and Competition | 0.21% | 0.31% | 46.53% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | Banking and Finance | 3.36% | 3.04% | -9.3% |

| Placements | Midwest | Banking and Finance | 0.67% | 0.29% | -56.81% |

| Placements | South | Banking and Finance | 0.67% | 0.43% | -35.22% |

| Placements | Southwest | Banking and Finance | 0.00% | 0.17% | 100.00% |

| Placements | West | Banking and Finance | 0.00% | 0.43% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Banking and Finance | 1.59% | 2.18% | 37.74% |

| Interviews | Midwest | Banking and Finance | 0.85% | 0.06% | -92.67% |

| Interviews | South | Banking and Finance | 0.11% | 0.53% | 398.20% |

| Interviews | Southwest | Banking and Finance | 0.00% | 0.08% | 100.00% |

| Interviews | West | Banking and Finance | 0.32% | 0.50% | 58.25% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | Bankruptcy | 0.67% | 2.39% | 256.30% |

| Placements | South | Bankruptcy | 0.00% | 1.74% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Bankruptcy | 0.11% | 2.35% | 2127.26% |

| Interviews | Midwest | Bankruptcy | 0.00% | 0.15% | 100.00% |

| Interviews | South | Bankruptcy | 0.00% | 0.65% | 100.00% |

| Interviews | Southwest | Bankruptcy | 0.00% | 0.05% | 100.00% |

| Interviews | West | Bankruptcy | 0.63% | 0.74% | 17.22% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | Construction | 1.34% | 0.00% | -100.00% |

| Placements | Midwest | Construction | 0.67% | 0.00% | -100.00% |

| Placements | West | Construction | 0.00% | 0.43% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Construction | 0.32% | 0.59% | 85.61% |

| Interviews | Midwest | Construction | 0.53% | 0.00% | -100.00% |

| Interviews | South | Construction | 0.00% | 0.09% | 100.00% |

| Interviews | Southwest | Construction | 0.11% | 0.09% | -12.08% |

| Interviews | West | Construction | 0.21% | 0.28% | 31.88% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | Corporate | 7.38% | 3.91% | -47.00% |

| Placements | Midwest | Corporate | 2.68% | 0.72% | -73.01% |

| Placements | South | Corporate | 0.67% | 1.16% | 72.75% |

| Placements | Southwest | Corporate | 0.67% | 0.17% | -74.09% |

| Placements | West | Corporate | 3.36% | 0.87% | -74.09% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Corporate | 7.40% | 4.26% | -42.43% |

| Interviews | Midwest | Corporate | 2.33% | 1.21% | -47.78% |

| Interviews | South | Corporate | 0.42% | 1.24% | 193.06% |

| Interviews | Southwest | Corporate | 0.21% | 0.32% | 49.46% |

| Interviews | West | Corporate | 3.49% | 1.37% | -60.75% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | Midwest | Data Privacy | 0.00% | 0.14% | 100.00% |

| Placements | West | Data Privacy | 1.34% | 1.74% | 29.57% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Data Privacy | 0.00% | 0.50% | 100.00% |

| Interviews | Midwest | Data Privacy | 0.00% | 0.16% | 100.00% |

| Interviews | South | Data Privacy | 0.11% | 0.00% | -100.00% |

| Interviews | Southwest | Data Privacy | 0.00% | 0.03% | 100.00% |

| Interviews | West | Data Privacy | 0.63% | 0.74% | 17.22% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | Education | 0.00% | 0.29% | 100.00% |

| Placements | West | Education | 0.67% | 0.29% | -56.81% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Education | 0.42% | 0.45% | 6.97% |

| Interviews | Southwest | Education | 0.00% | 0.05% | 100.00% |

| Interviews | West | Education | 0.21% | 0.40% | 90.49% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Electric Power | 0.00% | 0.06% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | Midwest | Energy and Oil & Gas | 0.00% | 0.36% | 100.00% |

| Placements | South | Energy and Oil & Gas | 0.00% | 0.29% | 100.00% |

| Placements | West | Energy and Oil & Gas | 0.67% | 0.00% | -100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Energy and Oil & Gas | 0.21% | 0.34% | 61.18% |

| Interviews | Midwest | Energy and Oil & Gas | 0.21% | 0.19% | -12.08% |

| Interviews | South | Energy and Oil & Gas | 0.11% | 0.19% | 75.84% |

| Interviews | Southwest | Energy and Oil & Gas | 0.00% | 0.09% | 100.00% |

| Interviews | West | Energy and Oil & Gas | 0.00% | 0.09% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | South | Entertainment and New Media | 0.00% | 0.29% | 100.00% |

| Placements | West | Entertainment and New Media | 0.67% | 0.00% | +100.00& |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Entertainment and New Media | 0.11% | 0.11% | 5.50% |

| Interviews | Midwest | Entertainment and New Media | 0.00% | 0.04% | 100.00% |

| Interviews | South | Entertainment and New Media | 0.00% | 0.25% | 100.00% |

| Interviews | West | Entertainment and New Media | 0.32% | 0.74% | 134.45% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | Environmental and Land Use | 0.00% | 0.43% | 100.00% |

| Placements | Midwest | Environmental and Land Use | 0.00% | 0.22% | 100.00% |

| Placements | West | Environmental and Land Use | 0.67% | 0.87% | 29.57% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Environmental and Land Use | 0.74% | 0.50% | -32.18% |

| Interviews | Midwest | Environmental and Land Use | 0.32% | 0.00% | -100.00% |

| Interviews | South | Environmental and Land Use | 0.11% | 0.00% | -100.00% |

| Interviews | West | Environmental and Land Use | 1.37% | 0.63% | -54.46% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | ERISA/Executive Compensation | 0.00% | 0.72% | 100.00% |

| Placements | Midwest | ERISA/Executive Compensation | 0.67% | 0.00% | -100.00% |

| Placements | West | ERISA/Executive Compensation | 0.67% | 0.00% | -100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | ERISA/Executive Compensation | 0.42% | 0.34% | -19.41% |

| Interviews | Midwest | ERISA/Executive Compensation | 0.11% | 0.09% | -12.08% |

| Interviews | South | ERISA/Executive Compensation | 0.11% | 0.00% | -100.00% |

| Interviews | West | ERISA/Executive Compensation | 0.53% | 0.28% | -47.25% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | Family Law | 0.00% | 2.61% | 100.00% |

| Placements | Midwest | Family Law | 0.00% | 1.16% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Family Law | 0.00% | 0.82% | 100.00% |

| Interviews | Midwest | Family Law | 0.11% | 0.53% | 398.20% |

| Interviews | South | Family Law | 0.00% | 0.37% | 100.00% |

| Interviews | Southwest | Family Law | 0.00% | 0.03% | 100.00% |

| Interviews | West | Family Law | 0.11% | 0.06% | -41.39% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | Food & Drug Administration | 0.00% | 1.74% | 100.00% |

| Placements | South | Food & Drug Administration | 0.00% | 0.43% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Food & Drug Administration | 0.00% | 0.48% | 100.00% |

| Interviews | South | Food & Drug Administration | 0.00% | 0.28% | 100.00% |

| Interviews | Southwest | Food & Drug Administration | 0.00% | 0.09% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | West | Government and Government Relations | 0.00% | 0.14% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Government and Government Relations | 0.00% | 0.33% | 100.00% |

| Interviews | South | Government and Government Relations | 0.00% | 0.06% | 100.00% |

| Interviews | West | Government and Government Relations | 0.00% | 0.22% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Government Contracts | 0.11% | 0.12% | 17.22% |

| Interviews | West | Government Contracts | 0.11% | 0.06% | -41.39% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | Midwest | Healthcare | 0.00% | 0.29% | 100.00% |

| Placements | West | Healthcare | 1.34% | 0.00% | -100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Healthcare | 0.21% | 0.56% | 163.75% |

| Interviews | Midwest | Healthcare | 0.63% | 0.06% | -90.23% |

| Interviews | South | Healthcare | 0.32% | 0.00% | -100.00% |

| Interviews | Southwest | Healthcare | 0.00% | 0.09% | 100.00% |

| Interviews | West | Healthcare | 0.63% | 0.06% | -90.23% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | Midwest | Immigration | 0.67% | 0.00% | -100.00% |

| Placements | West | Immigration | 0.00% | 0.87% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Immigration | 0.00% | 0.12% | 100.00% |

| Interviews | Midwest | Immigration | 0.11% | 0.28% | 163.75% |

| Interviews | Southwest | Immigration | 0.00% | 0.03% | 100.00% |

| Interviews | West | Immigration | 0.11% | 0.25% | 134.45% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | Midwest | Insurance Coverage | 0.67% | 0.00% | -100.00% |

| Placements | West | Insurance Coverage | 1.34% | 0.43% | -67.61% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Insurance Coverage | 0.11% | 0.62% | 489.05% |

| Interviews | Midwest | Insurance Coverage | 0.32% | 0.20% | -36.50% |

| Interviews | South | Insurance Coverage | 0.00% | 0.04% | 100.00% |

| Interviews | Southwest | Insurance Coverage | 0.00% | 0.05% | 100.00% |

| Interviews | West | Insurance Coverage | 0.32% | 0.37% | 17.22% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | Insurance Defense | 4.70% | 0.00% | -100.00% |

| Placements | Midwest | Insurance Defense | 0.00% | 0.65% | 100.00% |

| Placements | South | Insurance Defense | 0.67% | 0.43% | -35.22% |

| Placements | Southwest | Insurance Defense | 0.00% | 0.17% | 100.00% |

| Placements | West | Insurance Defense | 1.34% | 0.87% | -35.22% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Insurance Defense | 1.90% | 0.87% | -54.25% |

| Interviews | Midwest | Insurance Defense | 0.85% | 0.48% | -43.22% |

| Interviews | South | Insurance Defense | 0.11% | 0.13% | 23.09% |

| Interviews | Southwest | Insurance Defense | 0.21% | 0.18% | -16.48% |

| Interviews | West | Insurance Defense | 0.63% | 0.51% | -19.41% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | Midwest | Intellectual Property | 0.00% | 0.29% | 100.00% |

| Placements | South | Intellectual Property | 0.00% | 0.43% | 100.00% |

| Placements | West | Intellectual Property | 0.00% | 0.14% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Intellectual Property | 0.00% | 0.48% | 100.00% |

| Interviews | Midwest | Intellectual Property | 0.00% | 0.31% | 100.00% |

| Interviews | South | Intellectual Property | 0.00% | 0.09% | 100.00% |

| Interviews | Southwest | Intellectual Property | 0.00% | 0.03% | 100.00% |

| Interviews | West | Intellectual Property | 0.00% | 0.09% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | Intellectual Property - Litigation | 2.01% | 1.52% | -24.42% |

| Placements | Midwest | Intellectual Property - Litigation | 0.00% | 0.43% | 100.00% |

| Placements | West | Intellectual Property - Litigation | 0.00% | 0.43% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Intellectual Property - Litigation | 1.27% | 1.25% | -1.09% |

| Interviews | Midwest | Intellectual Property - Litigation | 0.42% | 0.50% | 17.22% |

| Interviews | South | Intellectual Property - Litigation | 0.11% | 0.19% | 75.84% |

| Interviews | Southwest | Intellectual Property - Litigation | 0.00% | 0.09% | 100.00% |

| Interviews | West | Intellectual Property - Litigation | 1.06% | 0.87% | -17.94% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | Intellectual Property - Patent Prosecution | 2.68% | 2.39% | -10.92% |

| Placements | Midwest | Intellectual Property - Patent Prosecution | 0.00% | 0.72% | 100.00% |

| Placements | Southwest | Intellectual Property - Patent Prosecution | 0.00% | 0.87% | 100.00% |

| Placements | West | Intellectual Property - Patent Prosecution | 0.00% | 0.87% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Intellectual Property - Patent Prosecution | 2.11% | 4.09% | 93.42% |

| Interviews | Midwest | Intellectual Property - Patent Prosecution | 1.37% | 0.65% | -52.66% |

| Interviews | South | Intellectual Property - Patent Prosecution | 0.11% | 0.19% | 75.84% |

| Interviews | Southwest | Intellectual Property - Patent Prosecution | 0.42% | 0.28% | -34.06% |

| Interviews | West | Intellectual Property - Patent Prosecution | 0.63% | 0.56% | -12.08% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | International Trade | 0.67% | 0.00% | -100.00% |

| Placements | Midwest | International Trade | 0.00% | 0.87% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | International Trade | 0.21% | 0.11% | -48.71% |

| Interviews | Midwest | International Trade | 0.00% | 0.25% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | IP- Trademark/Copyright | 0.67% | 0.22% | -67.61% |

| Placements | Midwest | IP- Trademark/Copyright | 0.00% | 0.72% | 100.00% |

| Placements | West | IP- Trademark/Copyright | 0.67% | 0.43% | -35.22% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | IP- Trademark/Copyright | 1.27% | 0.87% | -31.62% |

| Interviews | Midwest | IP- Trademark/Copyright | 0.21% | 0.37% | 75.84% |

| Interviews | South | IP- Trademark/Copyright | 0.00% | 0.25% | 100.00% |

| Interviews | Southwest | IP- Trademark/Copyright | 0.00% | 0.15% | 100.00% |

| Interviews | West | IP- Trademark/Copyright | 0.32% | 0.22% | -31.62% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | Labor & Employment | 0.67% | 1.67% | 148.33% |

| Placements | Midwest | Labor & Employment | 1.34% | 0.14% | -89.20% |

| Placements | South | Labor & Employment | 5.37% | 1.16% | -78.41% |

| Placements | West | Labor & Employment | 10.07% | 3.33% | -66.89% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Labor & Employment | 2.43% | 1.10% | -54.64% |

| Interviews | Midwest | Labor & Employment | 1.27% | 0.50% | -60.93% |

| Interviews | South | Labor & Employment | 0.42% | 0.38% | -10.62% |

| Interviews | Southwest | Labor & Employment | 0.11% | 0.05% | -56.04% |

| Interviews | West | Labor & Employment | 8.35% | 1.96% | -76.56% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | Litigation | 10.07% | 13.19% | 31.00% |

| Placements | Midwest | Litigation | 6.71% | 4.57% | -31.98% |

| Placements | South | Litigation | 2.01% | 2.75% | 36.76% |

| Placements | Southwest | Litigation | 0.00% | 0.17% | 100.00% |

| Placements | West | Litigation | 6.71% | 15.51% | 131.06% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Litigation | 12.26% | 16.13% | 31.57% |

| Interviews | Midwest | Litigation | 4.55% | 6.49% | 42.78% |

| Interviews | South | Litigation | 1.59% | 2.76% | 74.27% |

| Interviews | Southwest | Litigation | 0.74% | 0.41% | -44.74% |

| Interviews | West | Litigation | 13.85% | 12.38% | -10.63% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | Maritime and Transportation | 0.00% | 0.43% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Maritime and Transportation | 0.00% | 0.09% | 100.00% |

| Interviews | West | Maritime and Transportation | 0.00% | 0.05% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | Municipal Law | 0.00% | 0.43% | 100.00% |

| Placements | West | Municipal Law | 1.34% | 0.00% | -100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Municipal Law | 0.00% | 0.13% | 100.00% |

| Interviews | Midwest | Municipal Law | 0.00% | 0.09% | 100.00% |

| Interviews | South | Municipal Law | 0.00% | 0.09% | 100.00% |

| Interviews | West | Municipal Law | 0.21% | 0.22% | 2.57% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | Other | 0.00% | 0.65% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Other | 0.00% | 0.28% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | Patent Agents | 0.00% | 1.74% | 100.00% |

| Placements | Midwest | Patent Agents | 0.67% | 0.00% | -100.00% |

| Placements | West | Patent Agents | 0.00% | 0.87% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Patent Agents | 0.53% | 0.19% | -64.83% |

| Interviews | Midwest | Patent Agents | 0.42% | 0.06% | -85.35% |

| Interviews | South | Patent Agents | 0.11% | 0.00% | -100.00% |

| Interviews | West | Patent Agents | 0.74% | 0.37% | -49.76% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | Real Estate | 0.67% | 2.17% | 223.91% |

| Placements | Midwest | Real Estate | 0.67% | 0.14% | -78.41% |

| Placements | South | Real Estate | 0.00% | 2.17% | 100.00% |

| Placements | Southwest | Real Estate | 0.00% | 0.17% | 100.00% |

| Placements | West | Real Estate | 3.36% | 0.87% | -74.09% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Real Estate | 1.69% | 2.75% | 62.47% |

| Interviews | Midwest | Real Estate | 0.63% | 0.32% | -50.18% |

| Interviews | South | Real Estate | 0.11% | 1.39% | 1218.77% |

| Interviews | Southwest | Real Estate | 0.11% | 0.22% | 111.00% |

| Interviews | West | Real Estate | 1.59% | 1.05% | -33.57% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | Tax | 2.01% | 1.30% | -35.22% |

| Placements | Midwest | Tax | 0.00% | 0.43% | 100.00% |

| Placements | South | Tax | 0.67% | 0.43% | -35.22% |

| Placements | West | Tax | 0.67% | 0.00% | -100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Tax | 1.80% | 0.70% | -61.21% |

| Interviews | Midwest | Tax | 0.63% | 0.68% | 7.46% |

| Interviews | South | Tax | 0.11% | 0.43% | 310.29% |

| Interviews | Southwest | Tax | 0.00% | 0.19% | 100.00% |

| Interviews | West | Tax | 1.06% | 0.22% | -78.90% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | Technology Transactions | 0.67% | 0.87% | 29.57% |

| Placements | West | Technology Transactions | 0.00% | 0.43% | 100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Technology Transactions | 0.42% | 0.73% | 72.17% |

| Interviews | Midwest | Technology Transactions | 0.00% | 0.10% | 100.00% |

| Interviews | South | Technology Transactions | 0.11% | 0.00% | -100.00% |

| Interviews | West | Technology Transactions | 0.21% | 0.19% | -12.08% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Telecommunications | 0.11% | 0.00% | -100.00% |

| Interviews | West | Telecommunications | 0.11% | 0.00% | -100.00% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Placements | East | Trust and Estates | 0.00% | 0.43% | 100.00% |

| Placements | Midwest | Trust and Estates | 0.67% | 0.00% | -100.00% |

| Placements | South | Trust and Estates | 0.00% | 0.43% | 100.00% |

| Placements | West | Trust and Estates | 0.67% | 0.87% | 29.57% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Trust and Estates | 0.11% | 1.18% | 1013.63% |

| Interviews | Midwest | Trust and Estates | 0.74% | 0.31% | -58.13% |

| Interviews | South | Trust and Estates | 0.11% | 0.43% | 310.29% |

| Interviews | Southwest | Trust and Estates | 0.11% | 0.00% | -100.00% |

| Interviews | West | Trust and Estates | 1.27% | 0.74% | -41.39% |

| Status | Region | Practice Area | 2019 | 2020 | % of Growth |

| Interviews | East | Workers Compensation | 0.00% | 0.03% | 100.00% |

| Interviews | Midwest | Workers Compensation | 0.00% | 0.23% | 100.00% |

| Interviews | Southwest | Workers Compensation | 0.00% | 0.19% | 100.00% |

| Interviews | West | Workers Compensation | 0.00% | 0.05% | 100.00% |

| Status | Practice Area | firm_location | Region | 2019 | 2020 |

| Interviews | Alcohol Beverage Law | District of Columbia | East | 0.00% | 0.02% |

| Interviews | Antitrust and Competition | California - Los Angeles - Westside | West | 0.00% | 0.09% |

| Interviews | Antitrust and Competition | California - Orange County | West | 0.00% | 0.03% |

| Interviews | Antitrust and Competition | California - San Diego | West | 0.21% | 0.00% |

| Interviews | Antitrust and Competition | California - San Francisco | West | 0.00% | 0.09% |

| Interviews | Antitrust and Competition | California - Silicon Valley/San Jose | West | 0.00% | 0.09% |

| Interviews | Antitrust and Competition | District of Columbia | East | 0.11% | 0.09% |

| Interviews | Antitrust and Competition | Massachusetts - Boston | East | 0.00% | 0.06% |

| Interviews | Antitrust and Competition | New York - New York City | East | 0.00% | 0.37% |

| Interviews | Antitrust and Competition | Rhode Island | East | 0.11% | 0.00% |

| Interviews | Banking and Finance | California - Los Angeles - Downtown | West | 0.00% | 0.09% |

| Interviews | Banking and Finance | California - Los Angeles - Westside | West | 0.00% | 0.13% |

| Interviews | Banking and Finance | California - San Francisco | West | 0.11% | 0.09% |

| Interviews | Banking and Finance | California - Silicon Valley/San Jose | West | 0.11% | 0.09% |

| Interviews | Banking and Finance | Colorado - Denver | Midwest | 0.21% | 0.00% |

| Interviews | Banking and Finance | District of Columbia | East | 0.00% | 0.19% |

| Interviews | Banking and Finance | Georgia - Atlanta | South | 0.00% | 0.06% |

| Interviews | Banking and Finance | Illinois - Chicago | Midwest | 0.32% | 0.00% |

| Interviews | Banking and Finance | Massachusetts - Boston | East | 0.00% | 0.28% |

| Interviews | Banking and Finance | Massachusetts - Other | East | 0.00% | 0.06% |

| Interviews | Banking and Finance | Minnesota - Minneapolis/St. Paul | Midwest | 0.11% | 0.00% |

| Interviews | Banking and Finance | Nebraska - Omaha | Midwest | 0.11% | 0.00% |

| Interviews | Banking and Finance | Nevada - Las Vegas | Southwest | 0.00% | 0.08% |

| Interviews | Banking and Finance | New Jersey - Northern | East | 0.00% | 0.14% |

| Interviews | Banking and Finance | New York - Long Island | East | 0.00% | 0.09% |

| Interviews | Banking and Finance | New York - New York City | East | 1.06% | 0.81% |

| Interviews | Banking and Finance | New York - White Plains/Westchester | East | 0.00% | 0.09% |

| Interviews | Banking and Finance | North Carolina - Charlotte | East | 0.11% | 0.37% |

| Interviews | Banking and Finance | Ohio - Cleveland | Midwest | 0.11% | 0.06% |

| Interviews | Banking and Finance | Pennsylvania - Philadelphia | East | 0.42% | 0.00% |

| Interviews | Banking and Finance | Texas - Austin | South | 0.00% | 0.28% |

| Interviews | Banking and Finance | Texas - Dallas-Ft.Worth | South | 0.00% | 0.09% |

| Interviews | Banking and Finance | Texas - Houston | South | 0.11% | 0.09% |

| Interviews | Banking and Finance | Virginia - Northern | East | 0.00% | 0.06% |

| Interviews | Banking and Finance | Virginia - Other | East | 0.00% | 0.09% |

| Interviews | Banking and Finance | Washington - Seattle | West | 0.11% | 0.09% |

| Interviews | Bankruptcy | California - Los Angeles | West | 0.00% | 0.19% |

| Interviews | Bankruptcy | California - Los Angeles - Downtown | West | 0.11% | 0.00% |

| Interviews | Bankruptcy | California - Los Angeles - Westside | West | 0.21% | 0.00% |

| Interviews | Bankruptcy | California - Orange County | West | 0.00% | 0.19% |

| Interviews | Bankruptcy | California - Sacramento | West | 0.00% | 0.19% |

| Interviews | Bankruptcy | California - San Diego | West | 0.11% | 0.00% |

| Interviews | Bankruptcy | California - San Francisco | West | 0.11% | 0.00% |

| Interviews | Bankruptcy | California - Silicon Valley/San Jose | West | 0.00% | 0.19% |

| Interviews | Bankruptcy | Colorado - Denver | Midwest | 0.00% | 0.06% |

| Interviews | Bankruptcy | Delaware - Wilmington | East | 0.00% | 0.09% |

| Interviews | Bankruptcy | District of Columbia | East | 0.11% | 0.00% |

| Interviews | Bankruptcy | Florida - Orlando | East | 0.00% | 0.06% |

| Interviews | Bankruptcy | Maryland - Baltimore | East | 0.00% | 0.23% |

| Interviews | Bankruptcy | Maryland - Other | East | 0.00% | 0.09% |

| Interviews | Bankruptcy | Michigan - Other | Midwest | 0.00% | 0.09% |

| Interviews | Bankruptcy | Nevada - Las Vegas | Southwest | 0.00% | 0.05% |

| Interviews | Bankruptcy | New Jersey - Northern | East | 0.00% | 0.23% |

| Interviews | Bankruptcy | New York - New York City | East | 0.00% | 1.18% |

| Interviews | Bankruptcy | North Carolina - Research Triangle | East | 0.00% | 0.28% |

| Interviews | Bankruptcy | Oregon - Portland | West | 0.11% | 0.00% |

| Interviews | Bankruptcy | Texas - Austin | South | 0.00% | 0.19% |

| Interviews | Bankruptcy | Texas - Dallas-Ft.Worth | South | 0.00% | 0.37% |

| Interviews | Bankruptcy | Texas - Houston | South | 0.00% | 0.09% |

| Interviews | Bankruptcy | Virginia - Northern | East | 0.00% | 0.19% |

| Interviews | Construction | Arizona - Phoenix | Southwest | 0.11% | 0.00% |

| Interviews | Construction | California - Los Angeles | West | 0.00% | 0.06% |

| Interviews | Construction | California - Los Angeles - Downtown | West | 0.11% | 0.06% |

| Interviews | Construction | California - Los Angeles - Westside | West | 0.11% | 0.00% |

| Interviews | Construction | California - Orange County | West | 0.00% | 0.09% |

| Interviews | Construction | California - San Francisco | West | 0.00% | 0.06% |

| Interviews | Construction | Colorado - Denver | Midwest | 0.32% | 0.00% |

| Interviews | Construction | Florida - Miami | East | 0.00% | 0.09% |

| Interviews | Construction | Florida - Orlando | East | 0.00% | 0.06% |

| Interviews | Construction | Maryland - Baltimore | East | 0.00% | 0.09% |

| Interviews | Construction | New Jersey - Northern | East | 0.00% | 0.09% |

| Interviews | Construction | New York - New York City | East | 0.32% | 0.09% |

| Interviews | Construction | Ohio - Cincinnati | Midwest | 0.11% | 0.00% |

| Interviews | Construction | Ohio - Cleveland | Midwest | 0.11% | 0.00% |

| Interviews | Construction | Pennsylvania - Other | East | 0.00% | 0.09% |

| Interviews | Construction | Tennessee - Nashville | South | 0.00% | 0.09% |

| Interviews | Construction | Utah | Southwest | 0.00% | 0.09% |

| Interviews | Construction | Virginia - Northern | East | 0.00% | 0.06% |

| Interviews | Corporate | Arizona - Phoenix | Southwest | 0.00% | 0.09% |

| Interviews | Corporate | California - Los Angeles | West | 0.32% | 0.06% |

| Interviews | Corporate | California - Los Angeles - Downtown | West | 0.00% | 0.09% |

| Interviews | Corporate | California - Los Angeles - Westside | West | 0.63% | 0.32% |

| Interviews | Corporate | California - Orange County | West | 0.11% | 0.00% |

| Interviews | Corporate | California - Other | West | 0.11% | 0.00% |

| Interviews | Corporate | California - Sacramento | West | 0.11% | 0.06% |

| Interviews | Corporate | California - San Diego | West | 0.11% | 0.19% |

| Interviews | Corporate | California - San Francisco | West | 1.06% | 0.19% |

| Interviews | Corporate | California - Silicon Valley/San Jose | West | 0.53% | 0.28% |

| Interviews | Corporate | Colorado - Denver | Midwest | 0.32% | 0.53% |

| Interviews | Corporate | Colorado - Other | Midwest | 0.11% | 0.00% |

| Interviews | Corporate | District of Columbia | East | 0.63% | 0.46% |

| Interviews | Corporate | Florida - Miami | East | 0.63% | 0.09% |

| Interviews | Corporate | Florida - Other | East | 0.11% | 0.00% |

| Interviews | Corporate | Florida - Tampa | East | 0.00% | 0.19% |

| Interviews | Corporate | Florida - West Palm Beach/Ft. Lauderdale | East | 0.42% | 0.00% |

| Interviews | Corporate | Georgia - Atlanta | South | 0.11% | 0.43% |

| Interviews | Corporate | Hawaii | Southwest | 0.00% | 0.19% |

| Interviews | Corporate | Illinois - Chicago | Midwest | 0.11% | 0.00% |

| Interviews | Corporate | Louisiana - New Orleans | South | 0.00% | 0.15% |

| Interviews | Corporate | Maryland - Baltimore | East | 0.21% | 0.00% |

| Interviews | Corporate | Maryland - Other | East | 0.11% | 0.19% |

| Interviews | Corporate | Massachusetts - Boston | East | 0.85% | 0.28% |

| Interviews | Corporate | Massachusetts - Other | East | 0.00% | 0.15% |

| Interviews | Corporate | Michigan - Detroit | Midwest | 0.11% | 0.06% |

| Interviews | Corporate | Michigan - Grand Rapids | Midwest | 0.00% | 0.06% |

| Interviews | Corporate | Minnesota - Minneapolis/St. Paul | Midwest | 1.16% | 0.19% |

| Interviews | Corporate | Missouri - St. Louis | Midwest | 0.11% | 0.13% |

| Interviews | Corporate | Nevada - Las Vegas | Southwest | 0.00% | 0.04% |

| Interviews | Corporate | New Jersey - Northern | East | 0.21% | 0.14% |

| Interviews | Corporate | New York - Albany | East | 0.00% | 0.25% |

| Interviews | Corporate | New York - Long Island | East | 0.00% | 0.19% |

| Interviews | Corporate | New York - New York City | East | 3.59% | 2.14% |

| Interviews | Corporate | New York - White Plains/Westchester | East | 0.00% | 0.09% |

| Interviews | Corporate | North Carolina - Charlotte | East | 0.32% | 0.00% |

| Interviews | Corporate | North Dakota | Midwest | 0.11% | 0.00% |

| Interviews | Corporate | Ohio - Cleveland | Midwest | 0.11% | 0.06% |

| Interviews | Corporate | Ohio - Other | Midwest | 0.11% | 0.00% |

| Interviews | Corporate | Ohio - Toledo | Midwest | 0.11% | 0.19% |

| Interviews | Corporate | Oregon - Portland | West | 0.21% | 0.00% |

| Interviews | Corporate | Pennsylvania - Pittsburgh | East | 0.11% | 0.00% |

| Interviews | Corporate | South Carolina - Other | South | 0.11% | 0.00% |

| Interviews | Corporate | Texas - Austin | South | 0.00% | 0.28% |

| Interviews | Corporate | Texas - Dallas-Ft.Worth | South | 0.21% | 0.28% |

| Interviews | Corporate | Texas - Houston | South | 0.00% | 0.09% |

| Interviews | Corporate | Utah | Southwest | 0.21% | 0.00% |

| Interviews | Corporate | Virginia - Northern | East | 0.21% | 0.00% |

| Interviews | Corporate | Virginia - Other | East | 0.00% | 0.09% |

| Interviews | Corporate | Washington | West | 0.11% | 0.00% |

| Interviews | Corporate | Washington - Seattle | West | 0.21% | 0.19% |

| Interviews | Data Privacy | California - Los Angeles - Westside | West | 0.21% | 0.00% |

| Interviews | Data Privacy | California - Orange County | West | 0.00% | 0.19% |

| Interviews | Data Privacy | California - San Francisco | West | 0.11% | 0.00% |

| Interviews | Data Privacy | California - Silicon Valley/San Jose | West | 0.11% | 0.28% |

| Interviews | Data Privacy | Colorado - Other | Midwest | 0.00% | 0.03% |

| Interviews | Data Privacy | Massachusetts - Boston | East | 0.00% | 0.12% |

| Interviews | Data Privacy | Missouri - St. Louis | Midwest | 0.00% | 0.04% |

| Interviews | Data Privacy | New Jersey - Northern | East | 0.00% | 0.09% |

| Interviews | Data Privacy | New York - New York City | East | 0.00% | 0.28% |

| Interviews | Data Privacy | Ohio - Cincinnati | Midwest | 0.00% | 0.09% |

| Interviews | Data Privacy | Tennessee - Nashville | South | 0.11% | 0.00% |

| Interviews | Data Privacy | Utah | Southwest | 0.00% | 0.03% |

| Interviews | Data Privacy | Washington - Seattle | West | 0.21% | 0.28% |

| Interviews | Education | Arizona - Phoenix | Southwest | 0.00% | 0.05% |

| Interviews | Education | California - Los Angeles - Westside | West | 0.00% | 0.09% |

| Interviews | Education | California - Other | West | 0.00% | 0.06% |

| Interviews | Education | California - San Francisco | West | 0.21% | 0.06% |

| Interviews | Education | California - Silicon Valley/San Jose | West | 0.00% | 0.19% |

| Interviews | Education | District of Columbia | East | 0.00% | 0.02% |

| Interviews | Education | Massachusetts - Boston | East | 0.11% | 0.19% |

| Interviews | Education | Massachusetts - Other | East | 0.11% | 0.00% |

| Interviews | Education | New Jersey - Northern | East | 0.00% | 0.19% |

| Interviews | Education | New York - Long Island | East | 0.00% | 0.06% |

| Interviews | Education | New York - New York City | East | 0.21% | 0.00% |

| Interviews | Electric Power | New York - New York City | East | 0.00% | 0.06% |

| Interviews | Energy and Oil & Gas | Arizona - Phoenix | Southwest | 0.00% | 0.09% |

| Interviews | Energy and Oil & Gas | California - San Francisco | West | 0.00% | 0.09% |

| Interviews | Energy and Oil & Gas | Colorado - Denver | Midwest | 0.11% | 0.06% |

| Interviews | Energy and Oil & Gas | Colorado - Other | Midwest | 0.00% | 0.03% |

| Interviews | Energy and Oil & Gas | Michigan - Grand Rapids | Midwest | 0.11% | 0.00% |

| Interviews | Energy and Oil & Gas | New York - Albany | East | 0.11% | 0.09% |

| Interviews | Energy and Oil & Gas | New York - New York City | East | 0.00% | 0.25% |

| Interviews | Energy and Oil & Gas | Ohio - Columbus | Midwest | 0.00% | 0.09% |

| Interviews | Energy and Oil & Gas | Texas - Dallas-Ft.Worth | South | 0.11% | 0.09% |

| Interviews | Energy and Oil & Gas | Texas - Houston | South | 0.00% | 0.09% |

| Interviews | Energy and Oil & Gas | West Virginia | East | 0.11% | 0.00% |

| Interviews | Entertainment and New Media | California - Los Angeles - Westside | West | 0.32% | 0.74% |

| Interviews | Entertainment and New Media | District of Columbia | East | 0.00% | 0.02% |

| Interviews | Entertainment and New Media | Georgia - Atlanta | South | 0.00% | 0.06% |

| Interviews | Entertainment and New Media | Louisiana - New Orleans | South | 0.00% | 0.06% |

| Interviews | Entertainment and New Media | Missouri - St. Louis | Midwest | 0.00% | 0.04% |

| Interviews | Entertainment and New Media | New York - New York City | East | 0.11% | 0.09% |

| Interviews | Entertainment and New Media | Texas - Dallas-Ft.Worth | South | 0.00% | 0.09% |

| Interviews | Entertainment and New Media | Texas - Houston | South | 0.00% | 0.04% |

| Interviews | Environmental and Land Use | California - Los Angeles - Downtown | West | 0.21% | 0.00% |

| Interviews | Environmental and Land Use | California - Los Angeles - Westside | West | 0.11% | 0.13% |

| Interviews | Environmental and Land Use | California - Oakland/East Bay | West | 0.11% | 0.00% |

| Interviews | Environmental and Land Use | California - Sacramento | West | 0.00% | 0.31% |

| Interviews | Environmental and Land Use | California - San Francisco | West | 0.53% | 0.00% |

| Interviews | Environmental and Land Use | California - Silicon Valley/San Jose | West | 0.00% | 0.19% |

| Interviews | Environmental and Land Use | District of Columbia | East | 0.11% | 0.00% |

| Interviews | Environmental and Land Use | Florida - Other | East | 0.00% | 0.04% |

| Interviews | Environmental and Land Use | Massachusetts - Boston | East | 0.21% | 0.19% |

| Interviews | Environmental and Land Use | Michigan - Grand Rapids | Midwest | 0.11% | 0.00% |

| Interviews | Environmental and Land Use | New Jersey - Northern | East | 0.11% | 0.00% |

| Interviews | Environmental and Land Use | New Jersey - Other | East | 0.21% | 0.00% |

| Interviews | Environmental and Land Use | New York - Albany | East | 0.00% | 0.09% |

| Interviews | Environmental and Land Use | New York - New York City | East | 0.00% | 0.09% |

| Interviews | Environmental and Land Use | New York - Rochester | East | 0.11% | 0.00% |

| Interviews | Environmental and Land Use | New York - Syracuse | East | 0.00% | 0.09% |

| Interviews | Environmental and Land Use | Ohio - Cleveland | Midwest | 0.11% | 0.00% |

| Interviews | Environmental and Land Use | Ohio - Other | Midwest | 0.11% | 0.00% |

| Interviews | Environmental and Land Use | Oregon - Portland | West | 0.11% | 0.00% |

| Interviews | Environmental and Land Use | Texas - Houston | South | 0.11% | 0.00% |

| Interviews | Environmental and Land Use | Washington - Seattle | West | 0.32% | 0.00% |

| Interviews | ERISA/Executive Compensation | California - Other | West | 0.11% | 0.00% |

| Interviews | ERISA/Executive Compensation | California - San Francisco | West | 0.21% | 0.09% |

| Interviews | ERISA/Executive Compensation | California - Silicon Valley/San Jose | West | 0.11% | 0.19% |

| Interviews | ERISA/Executive Compensation | Connecticut - Hartford | East | 0.11% | 0.00% |

| Interviews | ERISA/Executive Compensation | District of Columbia | East | 0.11% | 0.06% |

| Interviews | ERISA/Executive Compensation | Georgia - Atlanta | South | 0.11% | 0.00% |

| Interviews | ERISA/Executive Compensation | Kansas | Midwest | 0.00% | 0.09% |

| Interviews | ERISA/Executive Compensation | Maryland - Baltimore | East | 0.00% | 0.09% |

| Interviews | ERISA/Executive Compensation | Missouri - Kansas City | Midwest | 0.11% | 0.00% |

| Interviews | ERISA/Executive Compensation | New York - New York City | East | 0.21% | 0.19% |

| Interviews | ERISA/Executive Compensation | Washington - Seattle | West | 0.11% | 0.00% |

| Interviews | Family Law | California - Los Angeles | West | 0.11% | 0.06% |

| Interviews | Family Law | Colorado - Denver | Midwest | 0.00% | 0.34% |

| Interviews | Family Law | District of Columbia | East | 0.00% | 0.08% |

| Interviews | Family Law | Florida - West Palm Beach/Ft. Lauderdale | East | 0.00% | 0.19% |

| Interviews | Family Law | Maryland - Baltimore | East | 0.00% | 0.19% |

| Interviews | Family Law | New Jersey - Other | East | 0.00% | 0.19% |

| Interviews | Family Law | New York - Long Island | East | 0.00% | 0.09% |

| Interviews | Family Law | North Carolina - Other | East | 0.00% | 0.09% |

| Interviews | Family Law | Ohio - Columbus | Midwest | 0.11% | 0.00% |

| Interviews | Family Law | Tennessee - Nashville | South | 0.00% | 0.19% |

| Interviews | Family Law | Texas - Austin | South | 0.00% | 0.19% |

| Interviews | Family Law | Utah | Southwest | 0.00% | 0.03% |

| Interviews | Family Law | Wisconsin - Milwaukee | Midwest | 0.00% | 0.19% |

| Interviews | Food & Drug Administration | Arizona - Phoenix | Southwest | 0.00% | 0.09% |

| Interviews | Food & Drug Administration | District of Columbia | East | 0.00% | 0.48% |

| Interviews | Food & Drug Administration | Georgia - Atlanta | South | 0.00% | 0.09% |

| Interviews | Food & Drug Administration | Texas - Dallas-Ft.Worth | South | 0.00% | 0.19% |

| Interviews | Government and Government Relations | California - Los Angeles - Westside | West | 0.00% | 0.09% |

| Interviews | Government and Government Relations | California - Orange County | West | 0.00% | 0.03% |

| Interviews | Government and Government Relations | California - Other | West | 0.00% | 0.09% |

| Interviews | Government and Government Relations | District of Columbia | East | 0.00% | 0.24% |

| Interviews | Government and Government Relations | Florida - Other | East | 0.00% | 0.04% |

| Interviews | Government and Government Relations | Georgia - Atlanta | South | 0.00% | 0.06% |

| Interviews | Government and Government Relations | Massachusetts - Boston | East | 0.00% | 0.06% |

| Interviews | Government Contracts | California - Los Angeles | West | 0.11% | 0.00% |

| Interviews | Government Contracts | California - Sacramento | West | 0.00% | 0.06% |

| Interviews | Government Contracts | District of Columbia | East | 0.11% | 0.06% |

| Interviews | Government Contracts | Virginia - Northern | East | 0.00% | 0.06% |

| Interviews | Healthcare | Arizona - Phoenix | Southwest | 0.00% | 0.09% |

| Interviews | Healthcare | California - Los Angeles | West | 0.00% | 0.06% |

| Interviews | Healthcare | California - Los Angeles - Westside | West | 0.11% | 0.00% |

| Interviews | Healthcare | California - Orange County | West | 0.11% | 0.00% |

| Interviews | Healthcare | California - Other | West | 0.11% | 0.00% |

| Interviews | Healthcare | California - San Francisco | West | 0.32% | 0.00% |

| Interviews | Healthcare | District of Columbia | East | 0.11% | 0.19% |

| Interviews | Healthcare | Florida - Tampa | East | 0.11% | 0.00% |

| Interviews | Healthcare | Georgia - Atlanta | South | 0.11% | 0.00% |

| Interviews | Healthcare | Illinois - Chicago | Midwest | 0.53% | 0.00% |

| Interviews | Healthcare | Massachusetts - Boston | East | 0.00% | 0.09% |

| Interviews | Healthcare | Minnesota - Minneapolis/St. Paul | Midwest | 0.11% | 0.00% |

| Interviews | Healthcare | New York - New York City | East | 0.00% | 0.28% |

| Interviews | Healthcare | Ohio - Cleveland | Midwest | 0.00% | 0.06% |

| Interviews | Healthcare | Texas - Houston | South | 0.11% | 0.00% |

| Interviews | Healthcare | Texas - Other | South | 0.11% | 0.00% |

| Interviews | Immigration | California - Los Angeles | West | 0.00% | 0.06% |

| Interviews | Immigration | California - Orange County | West | 0.00% | 0.19% |

| Interviews | Immigration | California - Silicon Valley/San Jose | West | 0.11% | 0.00% |

| Interviews | Immigration | Michigan - Other | Midwest | 0.00% | 0.19% |

| Interviews | Immigration | Missouri - St. Louis | Midwest | 0.11% | 0.00% |

| Interviews | Immigration | New York - Long Island | East | 0.00% | 0.09% |

| Interviews | Immigration | New York - New York City | East | 0.00% | 0.03% |

| Interviews | Immigration | Ohio - Columbus | Midwest | 0.00% | 0.09% |

| Interviews | Immigration | Utah | Southwest | 0.00% | 0.03% |

| Interviews | Insurance Coverage | California - Los Angeles | West | 0.00% | 0.06% |

| Interviews | Insurance Coverage | California - Los Angeles - Westside | West | 0.11% | 0.09% |

| Interviews | Insurance Coverage | California - Orange County | West | 0.00% | 0.15% |

| Interviews | Insurance Coverage | Colorado - Denver | Midwest | 0.11% | 0.06% |

| Interviews | Insurance Coverage | District of Columbia | East | 0.00% | 0.02% |

| Interviews | Insurance Coverage | Florida - Miami | East | 0.00% | 0.19% |

| Interviews | Insurance Coverage | Florida - Tampa | East | 0.00% | 0.05% |

| Interviews | Insurance Coverage | Illinois - Chicago | Midwest | 0.21% | 0.14% |

| Interviews | Insurance Coverage | Massachusetts - Boston | East | 0.00% | 0.22% |

| Interviews | Insurance Coverage | Nevada - Las Vegas | Southwest | 0.00% | 0.05% |

| Interviews | Insurance Coverage | New York - New York City | East | 0.11% | 0.15% |

| Interviews | Insurance Coverage | Oregon - Portland | West | 0.00% | 0.06% |

| Interviews | Insurance Coverage | Texas - Houston | South | 0.00% | 0.04% |

| Interviews | Insurance Coverage | Washington - Seattle | West | 0.21% | 0.00% |

| Interviews | Insurance Defense | Arizona - Phoenix | Southwest | 0.21% | 0.05% |

| Interviews | Insurance Defense | California - Los Angeles | West | 0.42% | 0.15% |

| Interviews | Insurance Defense | California - Los Angeles - Westside | West | 0.11% | 0.00% |

| Interviews | Insurance Defense | California - Orange County | West | 0.00% | 0.06% |

| Interviews | Insurance Defense | California - San Francisco | West | 0.11% | 0.05% |

| Interviews | Insurance Defense | California - Silicon Valley/San Jose | West | 0.00% | 0.09% |

| Interviews | Insurance Defense | Colorado - Denver | Midwest | 0.11% | 0.22% |

| Interviews | Insurance Defense | Colorado - Other | Midwest | 0.00% | 0.03% |

| Interviews | Insurance Defense | District of Columbia | East | 0.11% | 0.02% |

| Interviews | Insurance Defense | Florida - Miami | East | 0.11% | 0.19% |

| Interviews | Insurance Defense | Florida - Tampa | East | 0.11% | 0.05% |

| Interviews | Insurance Defense | Florida - West Palm Beach/Ft. Lauderdale | East | 0.63% | 0.09% |

| Interviews | Insurance Defense | Illinois - Chicago | Midwest | 0.11% | 0.14% |

| Interviews | Insurance Defense | Maryland - Baltimore | East | 0.11% | 0.00% |

| Interviews | Insurance Defense | Michigan - Detroit | Midwest | 0.11% | 0.00% |

| Interviews | Insurance Defense | Michigan - Other | Midwest | 0.11% | 0.00% |

| Interviews | Insurance Defense | Missouri - St. Louis | Midwest | 0.11% | 0.00% |

| Interviews | Insurance Defense | Nevada - Las Vegas | Southwest | 0.00% | 0.13% |

| Interviews | Insurance Defense | New York - New York City | East | 0.74% | 0.25% |

| Interviews | Insurance Defense | New York - White Plains/Westchester | East | 0.00% | 0.09% |

| Interviews | Insurance Defense | Ohio - Cleveland | Midwest | 0.11% | 0.09% |

| Interviews | Insurance Defense | Oregon - Portland | West | 0.00% | 0.06% |

| Interviews | Insurance Defense | Pennsylvania - Philadelphia | East | 0.00% | 0.09% |

| Interviews | Insurance Defense | Pennsylvania - Pittsburgh | East | 0.00% | 0.09% |

| Interviews | Insurance Defense | Texas - Houston | South | 0.11% | 0.13% |

| Interviews | Insurance Defense | Virginia - Richmond | East | 0.11% | 0.00% |

| Interviews | Insurance Defense | Washington - Seattle | West | 0.00% | 0.09% |

| Interviews | Insurance Defense | Wisconsin - Milwaukee | Midwest | 0.21% | 0.00% |

| Interviews | Intellectual Property | California - Orange County | West | 0.00% | 0.09% |

| Interviews | Intellectual Property | Colorado - Denver | Midwest | 0.00% | 0.09% |

| Interviews | Intellectual Property | Georgia - Atlanta | South | 0.00% | 0.09% |

| Interviews | Intellectual Property | Illinois - Chicago | Midwest | 0.00% | 0.22% |

| Interviews | Intellectual Property | New Jersey - Northern | East | 0.00% | 0.06% |

| Interviews | Intellectual Property | Utah | Southwest | 0.00% | 0.03% |

| Interviews | Intellectual Property | Virginia - Northern | East | 0.00% | 0.42% |

| Interviews | Intellectual Property - Litigation | California - Los Angeles | West | 0.00% | 0.09% |

| Interviews | Intellectual Property - Litigation | California - Los Angeles - Downtown | West | 0.11% | 0.00% |

| Interviews | Intellectual Property - Litigation | California - Oakland/East Bay | West | 0.00% | 0.06% |

| Interviews | Intellectual Property - Litigation | California - Orange County | West | 0.00% | 0.09% |

| Interviews | Intellectual Property - Litigation | California - San Francisco | West | 0.53% | 0.37% |

| Interviews | Intellectual Property - Litigation | California - Silicon Valley/San Jose | West | 0.42% | 0.15% |

| Interviews | Intellectual Property - Litigation | Delaware - Wilmington | East | 0.00% | 0.19% |

| Interviews | Intellectual Property - Litigation | District of Columbia | East | 0.53% | 0.20% |

| Interviews | Intellectual Property - Litigation | Illinois - Chicago | Midwest | 0.42% | 0.25% |

| Interviews | Intellectual Property - Litigation | Massachusetts - Boston | East | 0.00% | 0.09% |

| Interviews | Intellectual Property - Litigation | Minnesota - Minneapolis/St. Paul | Midwest | 0.00% | 0.09% |

| Interviews | Intellectual Property - Litigation | New Jersey - Northern | East | 0.11% | 0.06% |

| Interviews | Intellectual Property - Litigation | New York - New York City | East | 0.42% | 0.25% |

| Interviews | Intellectual Property - Litigation | New York - White Plains/Westchester | East | 0.00% | 0.28% |

| Interviews | Intellectual Property - Litigation | Ohio - Cincinnati | Midwest | 0.00% | 0.06% |

| Interviews | Intellectual Property - Litigation | Pennsylvania - Philadelphia | East | 0.21% | 0.09% |

| Interviews | Intellectual Property - Litigation | Texas - Dallas-Ft.Worth | South | 0.11% | 0.19% |