This article provides a comprehensive analysis of the market’s expansion, highlighting key trends, emerging career opportunities for attorneys, and notable regional variations across the United States. From boutique firms to BigLaw, trusts and estates practices are evolving to meet complex client needs—making it a promising and stable path for legal professionals seeking long-term career security and specialized expertise.

Table of Contents

- Executive Summary

- I. Introduction: The Unprecedented Boom in Trusts and Estates Law

- II. Market Drivers and Fundamental Forces

- III. Regional Variations and Geographic Trends

- IV. Types of Trusts and Estates Work and Practice Areas

- V. Career Progression and Compensation Analysis

- VI. Leading Firms and Best Practices by Region

- VII. Fee Structures and Client Cost Considerations

- VIII. Business Generation and Client Development

- IX. Trusts and Estates Litigation Trends

- X. Probate Practice and Administration

- XI. Future Outlook and Market Projections

- XII. Career Opportunities and Job Market Analysis

- Conclusion

- References and Sources

Executive Summary

The trusts and estates legal practice area is experiencing unprecedented growth and demand, driven by the largest intergenerational wealth transfer in human history. With over $124 trillion expected to change hands over the next two decades, primarily from Baby Boomers and Generation X to younger generations, the demand for sophisticated estate planning services has reached extraordinary levels.

This comprehensive report examines the multifaceted boom in trusts and estates law, analyzing market drivers, regional variations, career opportunities, and compensation trends. Key findings include:

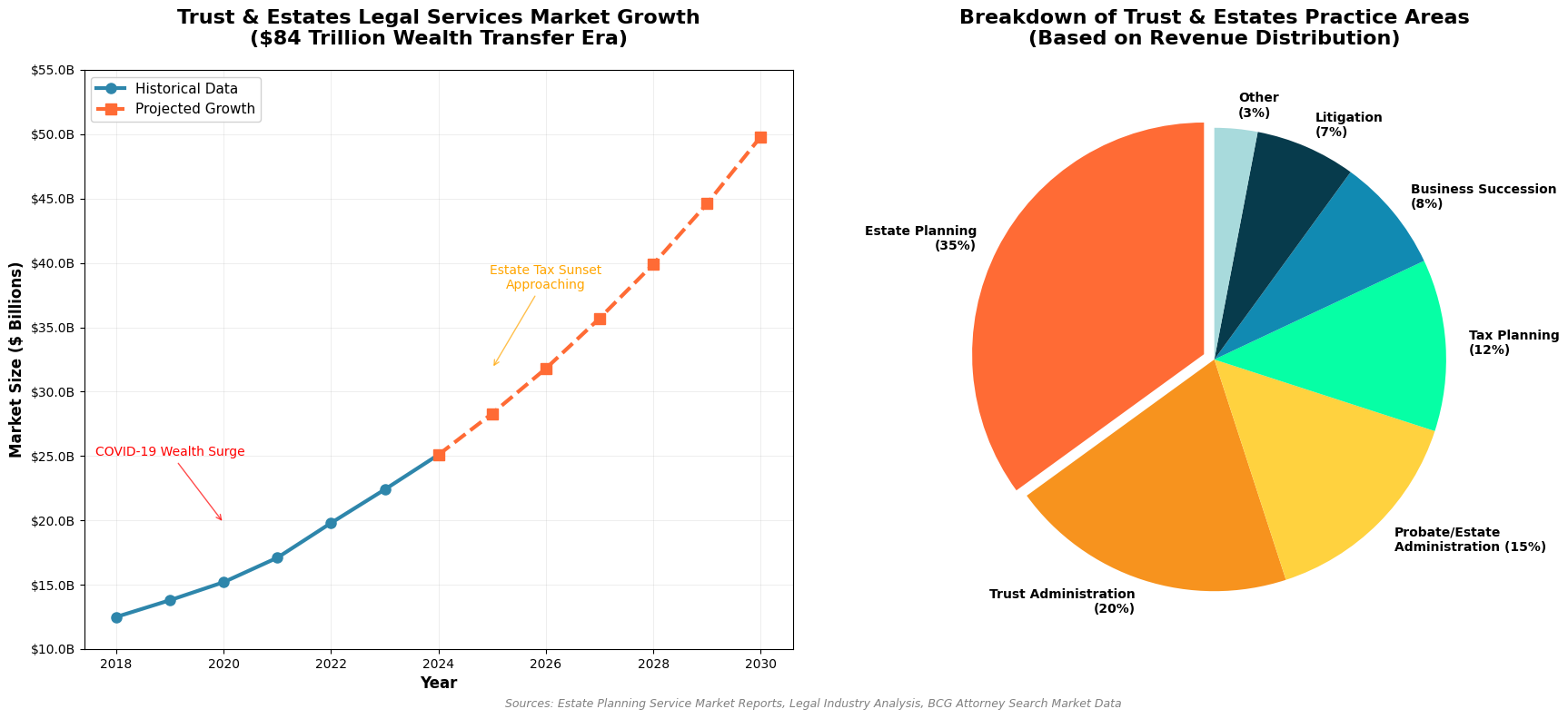

- The trusts and estates legal services market is projected to grow from $25.1 billion in 2024 to $49.8 billion by 2030, representing a compound annual growth rate of 9.2%

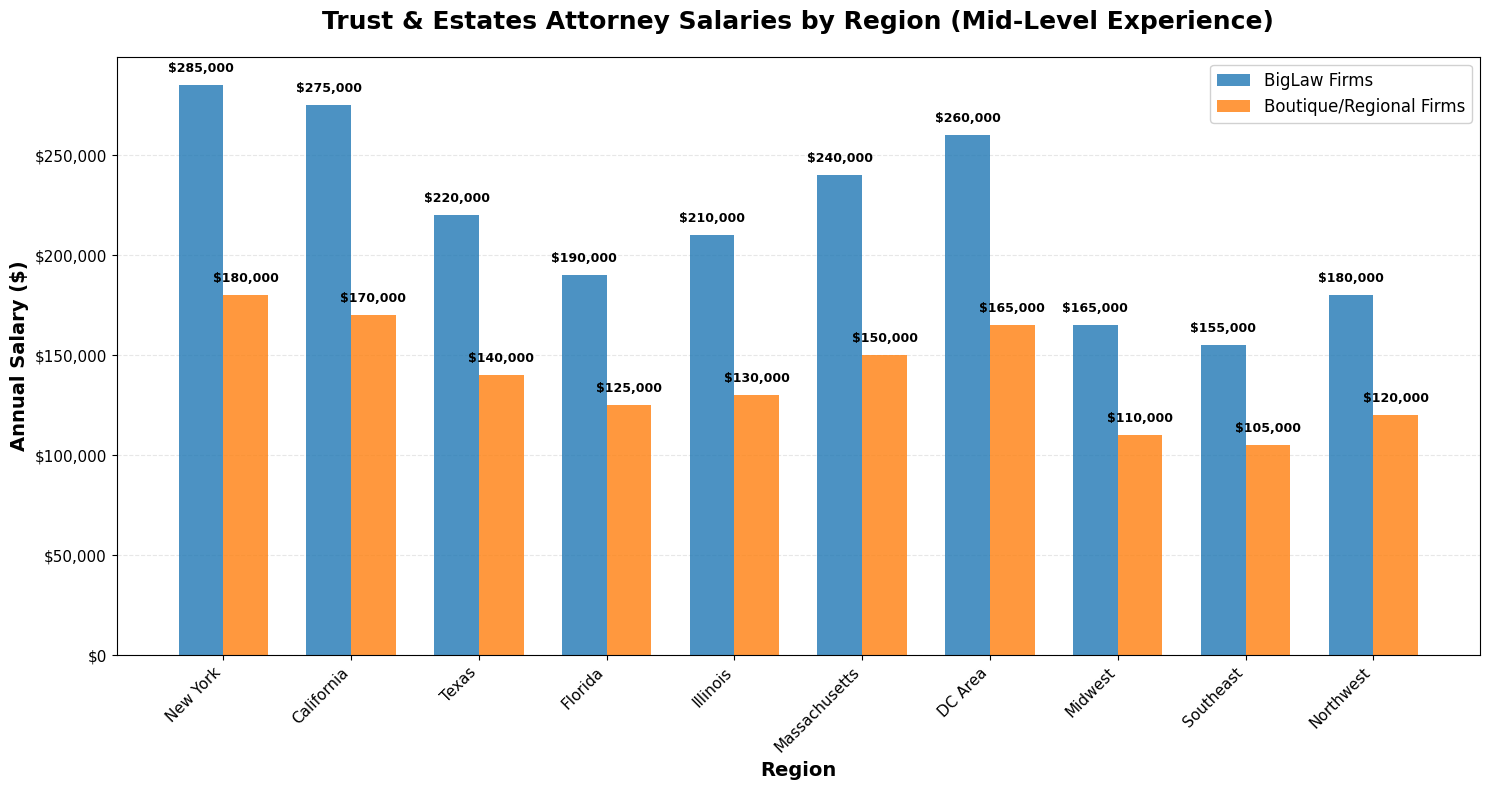

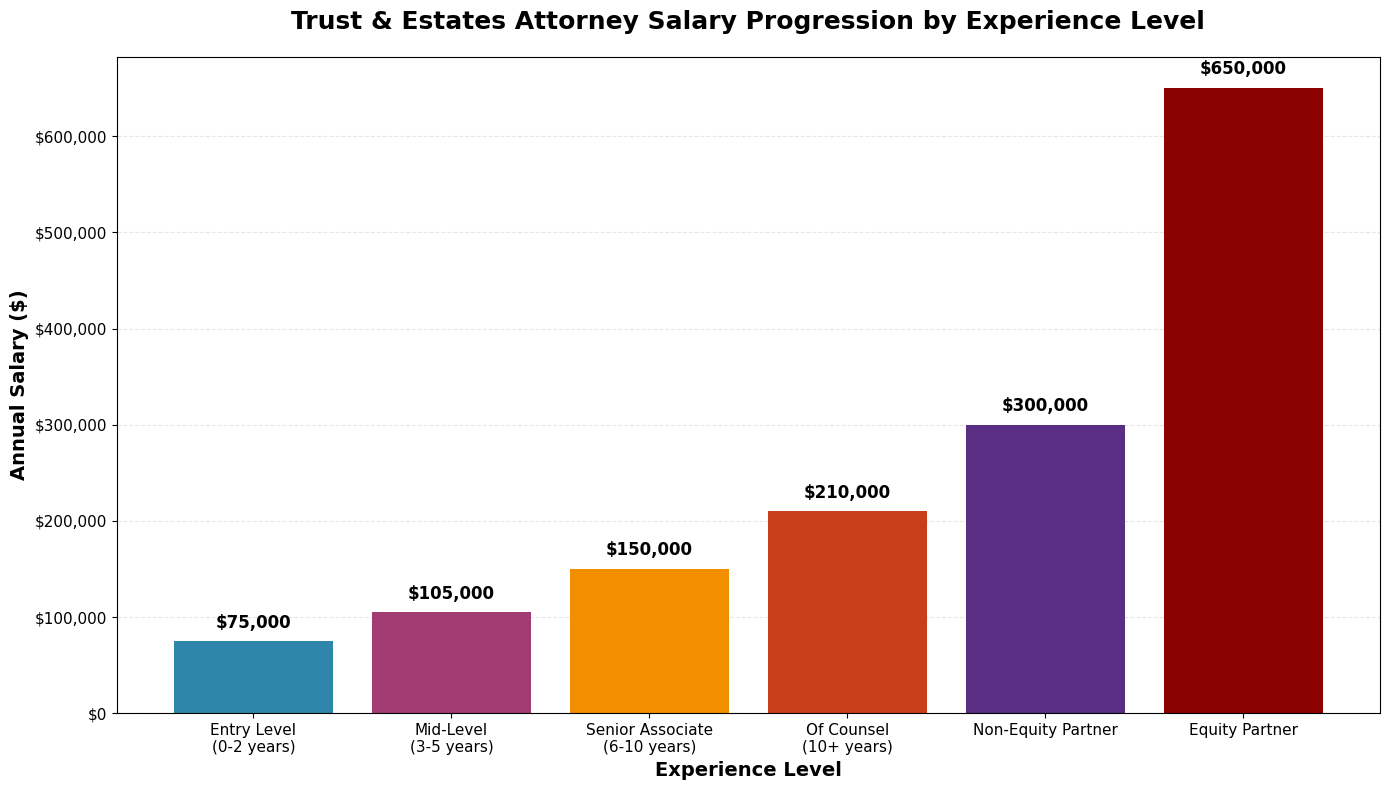

- Salary progression in the field ranges from $75,000 for entry-level positions to over $650,000 for equity partners, with significant regional variations

- A critical talent shortage exists, with job openings far exceeding the supply of qualified attorneys

- The impending sunset of estate tax exemptions in 2026 has created urgent planning needs for high-net-worth clients

- Regional growth is particularly strong in tax-advantaged states like Florida and Texas

This report provides attorneys, law firms, and legal professionals with essential insights for understanding and capitalizing on the extraordinary opportunities within the trusts and estates practice area.

See Related Articles:

- The Ultimate Career Guide for Trusts & Estates Attorneys: Strategies for Success, Job Search, and Long-Term Growth

- The Growing Demand for Trusts and Estates Attorneys: A Lucrative and Essential Practice Area

- Top Boutique Trusts and Estates Law Firms in the San Francisco Bay Area (Fewer Than 25 Attorneys)

I. Introduction: The Unprecedented Boom in Trusts and Estates Law

The legal profession is witnessing an extraordinary phenomenon in the trusts and estates practice area that represents one of the most significant market opportunities in modern legal history. While many practice areas experience cyclical demand based on economic conditions, regulatory changes, or market fluctuations, trusts and estates law is currently benefiting from a convergence of demographic, economic, and regulatory factors that have created what industry experts are calling an unprecedented boom.

This surge in demand is fundamentally different from typical legal market cycles. It is driven by inexorable demographic realities that cannot be reversed or delayed, creating sustained demand that is expected to continue for decades. The implications for legal professionals, law firms, and the broader legal services market are profound and far-reaching.

- For context on how trusts and estates compares to other fields, explore the ultimate guide to attorney practice areas, which maps out in-demand specialties and salary benchmarks.

At the heart of this boom lies the "Great Wealth Transfer" – a demographic and economic event of historic proportions. Baby Boomers, who currently control approximately 70% of U.S. wealth, are beginning to transfer their assets to younger generations at an accelerating pace. This generation, born between 1946 and 1964, has accumulated wealth during a period of unprecedented economic growth, technological advancement, and asset appreciation that spans nearly six decades.

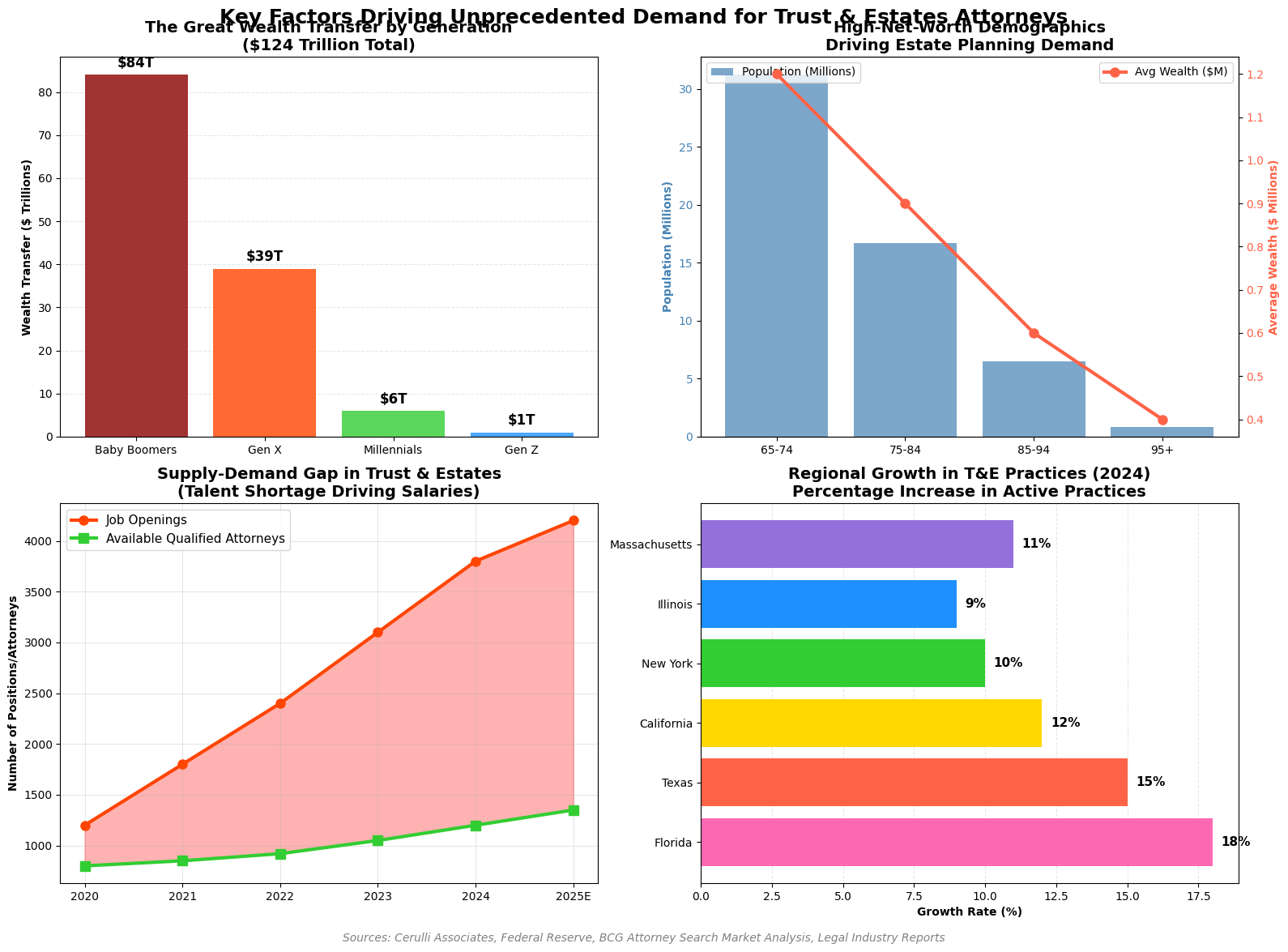

The numbers are staggering. According to multiple industry analyses, approximately $84 trillion in assets will be transferred from Baby Boomers alone over the next 20 years, with an additional $39 trillion coming from Generation X. This $124 trillion total represents the largest intergenerational wealth transfer in human history, dwarfing any previous generational transition by orders of magnitude.

However, the trusts and estates boom extends beyond simple wealth transfer mechanics. The complexity of modern wealth, the sophistication of planning techniques, the international nature of many high-net-worth families, and the evolving tax landscape have created demand for highly specialized legal services that few attorneys are equipped to provide. This has resulted in a supply-demand imbalance that has dramatically increased both compensation levels and career opportunities within the field.

The COVID-19 pandemic served as an additional catalyst, accelerating wealth creation among high-net-worth individuals while simultaneously highlighting mortality and the importance of comprehensive estate planning. Market valuations, real estate appreciation, and the digital transformation of various industries created new categories of ultra-high-net-worth individuals who require sophisticated planning services.

Perhaps most significantly for legal professionals, the trusts and estates field has historically been underrepresented in large law firms and legal education. While corporate law and litigation have dominated BigLaw hiring and law school curricula, trusts and estates was often viewed as a specialized niche practice. This historical underinvestment in talent development has created the current shortage of experienced practitioners, leading to intense competition for qualified attorneys and significant salary premiums.

Figure 1: Key Factors Driving Unprecedented Demand for Trusts & Estates Attorneys

The regulatory environment has added urgency to the market dynamics. The Tax Cuts and Jobs Act of 2017 doubled the federal estate and gift tax exemption to historically high levels, but these increases are scheduled to sunset on December 31, 2025. This creates a narrow window for high-net-worth individuals to take advantage of current exemption levels, driving immediate demand for sophisticated planning strategies.

Industry observers report that trusts and estates practices are experiencing demand levels that exceed capacity by significant margins. Major law firms are struggling to staff matters, boutique practices are turning away clients, and lateral hiring in the field has become intensely competitive. This environment has created extraordinary opportunities for attorneys at all experience levels who possess trusts and estates expertise.

II. Market Drivers and Fundamental Forces

The Great Wealth Transfer: Demographic Imperatives

The primary driver of the trusts and estates boom is the Great Wealth Transfer, a demographic phenomenon that represents the natural progression of the wealthiest generation in American history entering their legacy planning years. Baby Boomers, now aged 60 to 78, control an estimated 70% of total U.S. wealth, representing approximately $84 trillion in assets that will be transferred over the next two decades.

This wealth concentration is historically unprecedented. The post-World War II economic expansion, the development of employer-sponsored retirement plans, the growth of homeownership, and multiple decades of stock market appreciation have created wealth accumulation patterns that dwarf previous generations. The average Baby Boomer household has net worth exceeding $1.2 million, compared to $600,000 for Generation X and $400,000 for Millennials.

- These demographic shifts are fueling a growing demand for trusts and estates attorneys, highlighting the increasing value firms and clients place on this expertise.

The transfer process is already underway and accelerating. While some wealth transfer occurs through inheritance upon death, increasingly sophisticated families are implementing lifetime gifting strategies, family business succession plans, and complex trusts structures designed to minimize tax consequences while maintaining family control over assets. These strategies require extensive legal guidance and ongoing administration, creating sustained demand for trusts and estates services.

- For an even closer look at why the profession is thriving, see The Growing Demand for Trusts and Estates Attorneys: A Lucrative and Essential Practice Area.

Generation X, born between 1965 and 1980, represents the second wave of the wealth transfer phenomenon. This generation is expected to transfer an additional $39 trillion, much of it inherited from Baby Boomer parents and subsequently re-planned for transfer to Millennial and Generation Z children. This creates a multi-generational planning dynamic that requires sophisticated legal structures and ongoing professional management.

COVID-Era Wealth Creation and Market Dynamics

The COVID-19 pandemic served as an unexpected accelerant for wealth creation and estate planning activity. Market volatility in early 2020 was followed by unprecedented monetary policy responses that fueled asset price appreciation across multiple categories. Stock markets reached historic highs, real estate values surged, and digital assets emerged as a new wealth category requiring specialized planning attention.

High-net-worth individuals experienced disproportionate wealth gains during this period. Technology entrepreneurs, real estate investors, and business owners who adapted successfully to pandemic conditions often saw dramatic increases in asset values. Private equity valuations soared, public company stock prices reached new peaks, and residential real estate markets experienced appreciation rates not seen in decades.

Simultaneously, the pandemic highlighted mortality and family security concerns for many wealthy families. The initial uncertainty about the virus's impact, combined with widespread economic disruption, prompted many individuals to reconsider their estate planning strategies. Estate planning attorneys reported unprecedented demand for basic planning documents, while sophisticated families accelerated complex planning initiatives.

The low interest rate environment that persisted through much of the pandemic period created exceptional opportunities for certain estate planning techniques. Grantor retained annuity trusts (GRATs), charitable lead annuity trusts (CLATs), and installment sales to intentionally defective grantor trusts (IDGTs) became particularly attractive in low-rate environments, driving sophisticated planning activity among ultra-high-net-worth families.

Estate Tax Exemption Sunset and Regulatory Urgency

One of the most significant near-term drivers of trusts and estates activity is the scheduled sunset of the increased federal estate and gift tax exemptions on December 31, 2025. The Tax Cuts and Jobs Act of 2017 doubled the basic exclusion amount from approximately $5.5 million to $11 million per individual (indexed for inflation), effectively eliminating federal estate tax exposure for all but the wealthiest 0.1% of Americans.

Under current law, these enhanced exemptions will automatically revert to pre-2018 levels (adjusted for inflation) beginning January 1, 2026. This means the exemption will drop from approximately $13.6 million per individual in 2024 to an estimated $7 million per individual in 2026, representing a reduction of nearly 50%.

This creates extraordinary urgency for high-net-worth families to implement gifting strategies before the window closes. Individuals who can make lifetime gifts using the current higher exemption amounts can permanently remove future appreciation from their taxable estates, even if the exemption amounts decrease in subsequent years. The IRS has confirmed that gifts made under the higher exemption amounts will not be subject to "clawback" if exemptions are subsequently reduced.

The planning techniques being employed to take advantage of current exemption levels are among the most sophisticated in the estate planning repertoire. These include large outright gifts, sales to grantor trusts, charitable lead trusts, and various partnership and discount strategies designed to maximize the value of gifts within exemption limits. Each of these techniques requires specialized legal expertise and often involves complex valuations, ongoing administration, and coordination with tax and financial advisors.

Talent Scarcity and Market Dynamics

Unlike many legal practice areas that have experienced oversupply issues in recent years, trusts and estates law faces a critical shortage of qualified practitioners. This scarcity stems from several structural factors that have limited the pipeline of experienced attorneys entering the field.

Historically, trusts and estates law has been underrepresented in large law firm recruiting and training programs. While corporate law and litigation practices have dominated BigLaw associate programs, trusts and estates was often viewed as a specialized niche that required limited staffing. Many major firms operated small trusts and estates groups that focused primarily on serving existing corporate clients' personal needs rather than developing standalone private client practices.

Law school curricula have similarly underemphasized trusts and estates education. While courses in estates and trusts are typically required, advanced coursework in estate planning, tax, and fiduciary law is often limited. Few law schools offer comprehensive programs that prepare students for sophisticated trusts and estates practice, and clinical programs in the area are rare.

The result of these historical factors is a limited pool of experienced trusts and estates attorneys relative to current demand levels. Industry surveys suggest that job openings in the field significantly exceed the number of qualified candidates, with some markets experiencing ratios of three or more open positions for every available attorney.

This supply-demand imbalance has created exceptional opportunities for attorneys with trusts and estates expertise. Lateral hiring has become intensely competitive, with firms offering significant salary premiums, enhanced partnership tracks, and attractive benefits packages to recruit experienced practitioners. The market dynamics have also created opportunities for junior attorneys willing to specialize in the field, as firms are investing heavily in training and development programs to build their trusts and estates capabilities.

Figure 2: Trust & Estates Legal Services Market Growth & Practice Areas Distribution

Institutional and Firm Expansion Initiatives

Recognizing the market opportunity, law firms across all categories are expanding their trusts and estates capabilities. AmLaw 100 firms that historically maintained small private client groups are investing heavily in lateral recruitment and practice development. Regional firms are building national trusts and estates practices to compete for high-net-worth clients. Boutique practices are expanding their geographic reach and service offerings to capture market demand.

This institutional expansion has created additional demand for experienced attorneys and intensified competition for talent. Firms are not only competing for clients but also for the attorneys capable of serving those clients. The result has been significant salary inflation, expanded benefits packages, and enhanced career progression opportunities throughout the trusts and estates field.

The expansion is not limited to traditional law firms. Accounting firms, wealth management companies, family offices, and trust companies are all building trusts and estates legal capabilities, either through direct hiring or strategic partnerships. This multi-institutional competition for talent has further tightened the attorney supply market and created diverse career opportunities for qualified practitioners.

III. Regional Variations and Geographic Trends

Traditional Wealth Centers: New York, California, and the Northeast

New York remains the epicenter of sophisticated trusts and estates practice in the United States, reflecting its role as the nation's financial capital and home to the highest concentration of ultra-high-net-worth individuals. The city's trusts and estates legal market is characterized by the presence of elite boutique firms, major BigLaw practices, and sophisticated family offices that demand the highest levels of technical expertise.

Manhattan-based trusts and estates attorneys typically command the highest compensation levels in the country, with senior associates earning $250,000 to $350,000 annually and partners often exceeding $500,000 to $1 million or more. The complexity of clients and matters in the New York market drives these premium compensation levels, as attorneys regularly handle multi-billion-dollar family wealth transfers, international planning structures, and cutting-edge tax strategies.

The New York trusts and estates bar is distinguished by its technical sophistication and collegial culture. Many of the field's leading practitioners, academics, and thought leaders are based in the metropolitan area, creating an environment of intellectual excellence and professional development. The New York State Bar Association's Trusts and Estates Law Section is among the most active and influential professional organizations in the field.

- If you're focusing on California, reviewing the best trusts and estates firms in California can help gauge where hiring and compensation are most competitive.

California, particularly the San Francisco Bay Area and Los Angeles, represents the second major concentration of trusts and estates activity. The state's technology wealth, entertainment industry fortunes, and international business connections create unique planning challenges that require specialized expertise. California's community property laws, high state income tax rates, and complex trust regulations add layers of complexity that distinguish the market from other regions.

Silicon Valley wealth creation has been a particular driver of California trusts and estates activity. Technology entrepreneurs and executives often accumulate wealth through equity compensation that requires sophisticated planning to manage tax consequences and liquidity constraints. The rapid wealth creation cycles in the technology industry create urgent planning needs that drive demand for immediate, high-level legal services.

Los Angeles trusts and estates practice is heavily influenced by entertainment industry wealth, which presents unique challenges related to intellectual property rights, residual income streams, and international earnings. Many entertainment industry families also have complex personal circumstances that require sensitive handling and specialized expertise.

- For attorneys eyeing the L.A. market specifically, our page on the best trusts and estates firms in Los Angeles offers a curated view of top local players

The broader Northeast corridor, including Connecticut, New Jersey, and the Washington D.C. metropolitan area, represents another major concentration of trusts and estates activity. Connecticut, in particular, has a long history of family wealth and sophisticated planning, with many multi-generational families maintaining significant trust structures and family offices in the state.

Emerging Growth Markets: Florida, Texas, and the Sunbelt

Florida has emerged as one of the fastest-growing trusts and estates markets in the country, driven by favorable tax policies, attractive trust laws, and significant in-migration of wealthy individuals and families. The state's absence of personal income tax, robust asset protection laws, and sophisticated trust statutes have made it a preferred destination for wealth transfer and family office establishment.

Miami has developed into a major international wealth center, particularly for Latin American families seeking U.S.-based planning services. The city's trusts and estates practices have expanded rapidly to serve both domestic clients relocating from high-tax states and international families establishing U.S. presence. The market is characterized by sophisticated international planning, complex family dynamics, and significant cross-border wealth management needs.

Palm Beach and Naples have become centers for ultra-high-net-worth families, with several boutique trusts and estates firms establishing presences to serve this concentrated wealth population. The seasonal nature of many client relationships in these markets has created opportunities for firms to develop national practices while maintaining Florida bases of operation.

Texas represents another major growth market, driven by oil and gas wealth, technology expansion, and business-friendly policies. Houston, Dallas, and Austin have all experienced significant growth in trusts and estates practice, with both local and national firms expanding their presence to serve the state's growing high-net-worth population.

The absence of state income tax in Texas, combined with favorable business laws and relatively low costs of living, has attracted significant wealth migration from higher-tax states. This trend has created demand for sophisticated planning services as individuals and families establish Texas residency and restructure their wealth management strategies.

Figure 3: Trust & Estates Attorney Salaries by Region (Mid-Level Experience)

Mountain West and Secondary Markets

The Mountain West region, including Colorado, Utah, Nevada, and Wyoming, has experienced significant growth in trusts and estates activity driven by favorable state laws, attractive lifestyle factors, and strategic tax planning opportunities. Several states in the region have modernized their trust statutes to attract wealth management business, creating specialized trust company industries and associated legal practices.

Nevada has positioned itself as a major trust jurisdiction through elimination of state income tax, modernization of trust laws, and establishment of a specialized trust company regulatory framework. Las Vegas and Reno have developed sophisticated trusts and estates practices that serve both local clients and families establishing Nevada trusts for tax and asset protection purposes.

Wyoming has similarly modernized its trust laws and eliminated state income tax, attracting significant trust business and associated legal activity. The state's dynasty trust statutes, privacy protections, and favorable directed trust laws have made it a preferred jurisdiction for sophisticated family wealth structures.

Colorado has experienced growth driven by lifestyle migration and favorable business conditions, while Utah's growing technology sector has created new wealth that requires sophisticated planning services. Both states have developed strong regional trusts and estates practices that serve local high-net-worth populations.

International and Cross-Border Considerations

The globalization of wealth has created significant demand for cross-border trusts and estates planning services throughout the United States. Major metropolitan areas with significant international populations have developed specialized practices focused on serving non-U.S. persons with U.S. connections and U.S. persons with international wealth.

These cross-border practices require expertise in international tax law, treaty interpretation, foreign trust regulations, and multi-jurisdictional estate planning. The complexity of these matters typically commands premium fees and requires attorneys with specialized training and experience.

Cities with significant international business presence, including New York, Los Angeles, Miami, San Francisco, and Chicago, have developed the most sophisticated cross-border trusts and estates practices. These markets serve as entry points for international families seeking U.S. planning services and as bases for U.S. families with international wealth.

IV. Types of Trusts and Estates Work and Practice Areas

Estate Planning and Wealth Transfer

Estate planning represents the largest segment of trusts and estates practice, accounting for approximately 35% of practice revenue according to industry surveys. This core practice area encompasses the development of comprehensive strategies to transfer wealth efficiently while minimizing tax consequences and achieving family objectives.

Modern estate planning has evolved far beyond simple will drafting to encompass sophisticated techniques designed to address complex family and tax situations. High-net-worth clients typically require comprehensive planning that includes multiple trust structures, business succession planning, charitable giving strategies, and international considerations.

The most common estate planning techniques currently in demand include grantor retained annuity trusts (GRATs), which allow individuals to transfer future appreciation of assets to beneficiaries with minimal gift tax consequences. These trusts have become particularly popular in the current environment due to low interest rates and the availability of high exemption amounts before the 2026 sunset.

Sales to intentionally defective grantor trusts (IDGTs) represent another sophisticated technique experiencing high demand. These transactions allow individuals to freeze the value of assets in their estates while transferring future appreciation to family members. The grantor trust status provides income tax benefits during the trust term, while the installment sale structure provides ongoing income to the seller.

Charitable planning has become an increasingly important component of comprehensive estate planning, driven by both tax benefits and philanthropic objectives. Charitable remainder trusts, charitable lead trusts, and private foundation planning all require specialized expertise and ongoing administration that creates sustained client relationships.

International estate planning has grown significantly as more families have cross-border wealth and residency considerations. These matters require expertise in treaty law, foreign tax systems, and complex reporting requirements that few attorneys possess. The premium compensation available for international expertise has driven specialization in this area.

Trust Administration and Ongoing Management

Trust administration represents approximately 25% of trusts and estates practice revenue and provides the stable, recurring income that many practices depend upon. Unlike estate planning, which is typically project-based, trust administration creates ongoing client relationships that can span decades and multiple generations.

The administrative responsibilities associated with modern trust structures have grown increasingly complex as trust terms become more sophisticated and regulatory requirements expand. Trustees must navigate income tax compliance, distribution decisions, investment oversight, and beneficiary communications while managing potential conflicts and fiduciary liability issues.

Many trusts created in the current environment include sophisticated distribution standards, administrative powers, and beneficiary protections that require ongoing legal guidance. Dynasty trusts designed to continue in perpetuity create particularly complex administrative challenges that require specialized expertise throughout their terms.

The growth in directed trust structures, where investment and distribution responsibilities are separated among multiple parties, has created new categories of administrative work. These arrangements require careful coordination among trustees, investment advisors, and distribution committees, often with ongoing legal oversight.

Corporate trustee relationships have become increasingly important as family wealth grows and trust structures become more complex. Attorneys often serve as intermediaries between families and institutional trustees, helping to navigate service issues, fee negotiations, and performance concerns.

Probate and Estate Administration

Probate and estate administration represents approximately 20% of trusts and estates practice revenue, though this percentage has declined as more wealth is held in trust structures that avoid probate. However, the absolute dollar volume of probate work has increased as estate values have grown and the administration process has become more complex.

Modern estate administration often involves sophisticated asset valuation, tax compliance, and beneficiary relations that require specialized expertise. Estates that include closely held business interests, international assets, or complex financial instruments present particular challenges that command premium fees.

The administration of estates for high-net-worth decedents typically involves coordination with multiple professional advisors, including accountants, appraisers, investment advisors, and insurance professionals. Attorneys often serve as the quarterback for these complex administrations, managing the overall process while ensuring compliance with legal requirements.

Post-mortem tax planning has become an increasingly important component of estate administration, as administrators seek to minimize tax consequences through various elections and planning techniques. These strategies require sophisticated tax expertise and careful coordination with estate planning objectives.

Business Succession Planning

Business succession planning represents a specialized area within trusts and estates practice that addresses the unique challenges faced by business-owning families. These matters typically involve coordination between corporate law, tax law, and estate planning to develop comprehensive succession strategies.

The current environment has created particular urgency for business succession planning as Baby Boomer business owners seek to transition control to the next generation while taking advantage of current tax benefits. The combination of high estate tax exemptions and sophisticated valuation planning techniques has created exceptional opportunities for tax-efficient succession.

Employee stock ownership plans (ESOPs) have gained popularity as a succession strategy that provides liquidity to selling shareholders while maintaining business continuity and employee ownership. These transactions require specialized expertise in ERISA law, tax law, and corporate finance that few attorneys possess.

Family limited partnerships and limited liability companies have become standard tools for business succession planning, allowing for gradual ownership transfers while maintaining family control. These structures require careful planning and ongoing compliance to maintain their tax benefits and avoid challenge by the IRS.

Management succession planning has become increasingly complex as businesses grow and family involvement becomes more distributed across generations. Many business families require formal governance structures, employment policies, and conflict resolution mechanisms to manage multi-generational involvement.

Tax Planning and Compliance

Tax planning represents approximately 15% of trusts and estates practice revenue but is integral to virtually all sophisticated planning strategies. The complexity of current tax law, combined with the high stakes involved in planning for ultra-high-net-worth families, has created demand for attorneys with deep tax expertise.

Gift and estate tax planning requires understanding of complex valuation rules, timing strategies, and planning techniques that can significantly impact tax consequences. The current environment, with high exemptions scheduled to sunset in 2026, has created particular urgency for sophisticated tax planning.

Generation-skipping transfer tax (GST) planning has become critically important as families seek to maximize the benefits of their GST exemptions. These strategies often involve complex trust structures and careful allocation decisions that require specialized expertise.

Income tax planning for trusts and estates presents unique challenges related to distribution timing, beneficiary tax situations, and the interaction between federal and state tax systems. The complexity of these issues often requires ongoing consultation throughout trust administration.

International tax compliance has grown significantly as more families have cross-border wealth and residency considerations. The reporting requirements for foreign trusts, controlled foreign corporations, and passive foreign investment companies create complex compliance obligations that require specialized expertise.

Litigation and Dispute Resolution

Trusts and estates litigation represents approximately 5% of practice revenue but has grown significantly in recent years as wealth levels increase and family dynamics become more complex. The high stakes involved in estate and trust disputes often justify significant legal expenditures and attract specialized litigation counsel.

Will contests have become more common as estate values increase and family structures become more complex. These matters often involve sophisticated questions of capacity, undue influence, and document validity that require specialized expertise in both trusts and estates law and litigation practice.

Trust disputes have grown as trust structures become more complex and beneficiary populations become more distributed. Common issues include trustee removal, distribution disputes, and challenges to trust terms that require careful analysis of trust law and fiduciary duties.

Fiduciary litigation has expanded to include disputes with professional trustees, investment advisors, and other professionals who serve high-net-worth families. These matters often involve sophisticated questions of professional liability and damages that require specialized expertise.

Family business disputes represent a growing area of trusts and estates litigation as business-owning families face succession challenges. These matters often combine corporate law issues with trusts and estates considerations, requiring attorneys with expertise in both areas.

Key Practice Areas by Revenue Percentage

- Estate Planning: 35%

- Trust Administration: 25%

- Probate/Estate Administration: 20%

- Tax Planning: 15%

- Litigation: 5%

V. Career Progression and Compensation Analysis

Entry-Level Opportunities and Starting Salaries

Entry-level positions in trusts and estates law offer attractive starting salaries that reflect the field's current market dynamics and growth prospects. Recent law school graduates entering the trusts and estates field can expect starting salaries ranging from $65,000 to $225,000, depending on the type of firm, geographic location, and individual qualifications.

At elite BigLaw firms in major markets, first-year associates specializing in trusts and estates earn the standard Cravath scale salary of $225,000, plus bonuses that can add $15,000 to $50,000 in additional compensation. These positions are highly competitive and typically require excellent academic credentials, relevant internship experience, and demonstrated interest in the field.

Boutique trusts and estates firms, which represent a significant portion of the market, typically offer starting salaries ranging from $120,000 to $180,000 in major markets, with somewhat lower starting points in secondary markets. However, these positions often provide more immediate client contact, faster responsibility advancement, and clearer paths to partnership than large firm alternatives.

Regional firms have become increasingly competitive in their compensation packages as they seek to attract top talent to build their trusts and estates capabilities. Starting salaries at strong regional firms now commonly exceed $100,000 even in secondary markets, with many firms offering performance bonuses and accelerated advancement opportunities.

- To take your career to the next level, be sure to review the ultimate career guide for trusts & estates attorneys, offering detailed strategies on job search, specialization, and long-term growth.

The current talent shortage has created exceptional opportunities for new attorneys willing to specialize in trusts and estates law. Many firms are offering enhanced training programs, mentorship opportunities, and clear advancement paths to attract and retain junior talent. Some firms have developed formal trusts and estates fellowships or extended training programs designed to build expertise while providing competitive compensation.

Figure 4: Trust & Estates Attorney Salary Progression by Experience Level

Mid-Level Career Development and Compensation

Mid-level trusts and estates attorneys, typically those with three to eight years of experience, represent the most sought-after segment of the lateral market. These attorneys have developed sufficient expertise to handle sophisticated matters independently while still being early enough in their careers to adapt to new firm cultures and client relationships.

Compensation for mid-level trusts and estates attorneys varies significantly based on experience level, firm type, and geographic location. Third-year associates at major firms typically earn $275,000 to $300,000 in base salary, while senior associates with six to eight years of experience can earn $350,000 to $400,000 or more in top-tier practices.

For insight into how these regional differences affect partner compensation across all practice areas, review Partner Compensation by Geography: New York, California & Regional Market Analysis.

The lateral market for mid-level trusts and estates attorneys has become exceptionally competitive, with firms offering significant salary premiums, guaranteed bonuses, and enhanced benefits packages to attract experienced practitioners. It is not uncommon for lateral candidates to receive multiple competing offers with salary increases of 20% to 40% over their current compensation.

Many mid-level attorneys are finding opportunities to accelerate their career progression by moving between different types of practices. Corporate law or tax attorneys with relevant experience are increasingly making lateral moves into trusts and estates practices, often with significant salary increases and faster advancement tracks.

The business development expectations for mid-level trusts and estates attorneys vary significantly among firms but are generally less intensive than in other practice areas. The relationship-driven nature of the practice often allows attorneys to build client relationships gradually while developing technical expertise.

Senior Associate and Of Counsel Positions

Senior associates and of counsel positions in trusts and estates practice offer attractive alternatives to traditional partnership tracks while providing high compensation and significant autonomy. These positions have become increasingly common as law firms seek to retain experienced attorneys who may not wish to pursue equity partnership or may prefer more flexible arrangements.

Senior associates with eight to twelve years of experience typically earn $400,000 to $500,000 in major markets, with performance bonuses that can add substantial additional compensation. These positions often include significant client management responsibilities and may involve supervision of junior attorneys.

Of counsel positions in trusts and estates practice are particularly attractive for attorneys seeking work-life balance while maintaining high compensation levels. These positions typically offer base salaries ranging from $300,000 to $450,000, with less intensive business development expectations and more flexible scheduling arrangements.

Many trusts and estates practices have created senior attorney positions that bridge the gap between senior associate and partner levels. These positions often include profit-sharing arrangements, client origination credit, and leadership responsibilities without the full business development requirements of equity partnership.

The growing demand for experienced trusts and estates attorneys has created opportunities for senior practitioners to negotiate highly customized arrangements that meet their individual career objectives while providing firms with the expertise they need to serve clients effectively.

Partnership Opportunities and Equity Compensation

Partnership opportunities in trusts and estates practice have expanded significantly as firms recognize the importance of the practice area and the difficulty of recruiting experienced lateral partners. The pathway to partnership in trusts and estates is often more relationship-focused and less dependent on pure billable hour generation than in other practice areas.

Non-equity partnership positions typically offer guaranteed compensation ranging from $400,000 to $600,000, depending on firm size and market location. These positions often include profit-sharing arrangements that can add substantial additional compensation based on firm and individual performance.

Equity partnership in trusts and estates practice can be exceptionally lucrative, particularly for attorneys who develop significant client relationships and practice expertise. Equity partners at top-tier firms regularly earn $1 million to $3 million or more annually, with the highest earners often exceeding $5 million through a combination of client origination, matter management, and firm leadership.

The business development requirements for trusts and estates partnership are often more manageable than in other practice areas due to the relationship-driven nature of the client base. Many trusts and estates partners build their practices through referral relationships with other professionals, client development activities, and thought leadership rather than intensive business development efforts.

Boutique firm partnership opportunities often provide higher percentage ownership and more direct control over firm direction, though with somewhat lower absolute compensation levels than major firm partnerships. Many successful trusts and estates attorneys have built highly profitable boutique practices that provide both financial success and professional satisfaction.

Alternative Career Paths and Specialization Opportunities

The trusts and estates field offers numerous alternative career paths that can provide attractive compensation and professional satisfaction. Family offices, corporate trust departments, government positions, and academic opportunities all provide viable alternatives to traditional law firm practice.

Family office positions have become increasingly attractive as ultra-high-net-worth families establish dedicated professional management for their wealth. General counsel positions at family offices typically offer compensation ranging from $300,000 to $800,000, often with significant additional benefits including equity participation, deferred compensation, and attractive work-life balance.

Corporate trust companies and wealth management firms actively recruit experienced trusts and estates attorneys for senior positions in business development, relationship management, and legal compliance. These positions often provide more predictable compensation and career progression than traditional law firm practice.

Government service in trusts and estates offers opportunities to influence policy development while gaining valuable experience that enhances private sector career prospects. The IRS, Treasury Department, and various state tax agencies all employ trusts and estates specialists, though compensation levels are typically lower than private practice alternatives.

Academic opportunities in trusts and estates have expanded as law schools recognize the importance of the practice area and the market demand for qualified graduates. Many successful practitioners combine teaching responsibilities with consulting practices to create rewarding and lucrative career combinations.

VI. Leading Firms and Best Practices by Region

National Leaders and Elite Practices

The trusts and estates field is distinguished by a relatively small number of nationally recognized elite practices that set the standard for technical excellence and serve the most sophisticated clients. These firms combine deep expertise, exceptional client service, and thought leadership to maintain their positions at the pinnacle of the profession.

McDermott Will & Emery stands as the preeminent national trusts and estates practice, earning Band 1 recognition from Chambers High Net Worth and serving as counsel to many of America's wealthiest families. The firm's trusts and estates group spans multiple offices including Chicago, New York, Washington D.C., and California, providing comprehensive coverage for national and international clients.

McDermott's trusts and estates practice is renowned for its technical sophistication and innovative planning strategies. The firm regularly handles multi-billion-dollar wealth transfers, complex international planning matters, and cutting-edge tax strategies that establish precedents for the broader field. The practice's attorneys are frequent speakers, authors, and thought leaders who help shape the development of trusts and estates law.

The firm's client base includes many Forbes 400 families, technology entrepreneurs, entertainment industry leaders, and international business families who require the highest levels of expertise and service. McDermott's ability to coordinate complex matters across multiple jurisdictions and practice areas makes it particularly valuable for sophisticated clients with diverse needs.

Among other Band 2 national leaders, Holland & Knight has built a distinguished reputation through its comprehensive private wealth services and strong regional presence, particularly in Florida. The firm's trusts and estates practice combines traditional planning excellence with innovative service delivery and has been particularly successful in serving families transitioning to tax-advantaged jurisdictions.

Katten Muchin Rosenman has established itself as a leader in trusts and estates practice through its strong Chicago foundation and expanding national presence. The firm is particularly known for its business succession planning capabilities and its integration of trusts and estates planning with corporate and tax services.

Loeb & Loeb has built its reputation on serving entertainment industry clients and high-net-worth families, particularly in California. The firm's trusts and estates practice is distinguished by its understanding of intellectual property wealth and complex entertainment industry planning needs.

Milbank LLP rounds out the Band 2 national leaders with its sophisticated New York-based practice that serves many of the world's wealthiest families. The firm is particularly known for its international planning capabilities and its coordination of trusts and estates planning with complex corporate and finance matters.

- Even in stable trusts and estates practices, consider best practices around firm alignment—see why law firm loyalty is a one-way street and what you can do to safeguard your career trajectory.

Regional Powerhouses and Specialized Practices

Beyond the national leaders, numerous regional firms have built exceptional trusts and estates practices that serve as the preferred counsel for wealthy families in their respective markets. These firms often provide more personalized service and local expertise while maintaining the technical sophistication required for complex planning matters.

In the Northeast, several firms have established themselves as regional leaders through decades of service to established wealth families. Day Pitney LLP, ranked Band 3 nationally by Chambers, has built particular strength in cross-border planning and serves many international families with U.S. connections. The firm's trusts and estates practice benefits from its strong Connecticut presence and its understanding of traditional wealth families.

Paul, Weiss, Rifkind, Wharton & Garrison has leveraged its New York corporate strength to build a sophisticated trusts and estates practice that serves many of its corporate clients' personal planning needs. The firm's integration of corporate and trusts and estates services makes it particularly valuable for business-owning families and executives.

Proskauer Rose has built its trusts and estates reputation through strong New York, Florida, and California practices that serve sophisticated client bases in each market. The firm's ability to coordinate multi-jurisdictional planning and its deep understanding of entertainment and sports industry wealth have distinguished its practice.

In Florida, the rapid growth of the trusts and estates market has created opportunities for both national and regional firms to establish strong practices. Holland & Knight's Florida presence has been particularly successful, while several boutique firms have built thriving practices serving the state's growing high-net-worth population.

Texas has seen significant expansion by both national and regional firms seeking to serve the state's growing wealth base. The absence of state income tax and the state's business-friendly environment have attracted significant wealth migration, creating opportunities for firms with strong trusts and estates capabilities.

- In evaluating firm options, our list of the best trusts and estates law firms offers an excellent starting point for identifying top-ranked practices nationally.

Boutique Excellence and Specialized Expertise

The trusts and estates field has long been characterized by exceptional boutique firms that provide highly specialized services to sophisticated client bases. These firms often attract attorneys from major practices who seek more direct client relationships and the ability to focus exclusively on trusts and estates matters.

Many of the most successful boutique trusts and estates firms are built around small groups of senior attorneys who have developed significant client relationships and technical expertise. These firms often provide more personalized service and faster decision-making than larger institutions while maintaining the technical sophistication required for complex matters.

The current market environment has been particularly favorable for boutique trusts and estates firms, as the demand for specialized expertise has increased while the supply of qualified attorneys has remained limited. Many boutique firms are experiencing unprecedented growth and are actively recruiting experienced attorneys from larger firms.

Boutique firms often specialize in particular aspects of trusts and estates practice, such as international planning, charitable planning, or business succession. This specialization allows them to develop exceptional expertise in their chosen areas while serving clients with specific needs that may not be well-served by generalist practices.

The economics of boutique trusts and estates practice can be particularly attractive, as the high value of clients and matters often supports premium pricing while the smaller overhead structure allows for higher profit margins. Many successful boutique practitioners earn compensation levels that exceed those available at larger firms while enjoying greater autonomy and work-life balance.

Corporate Trusts and Institutional Practices

Corporate trust companies and institutional wealth managers have become increasingly important participants in the trusts and estates market, both as service providers and as employers of trusts and estates attorneys. These institutions often provide trust administration, investment management, and family office services that complement the legal services provided by law firms.

The largest corporate trustees, including Northern Trust, JP Morgan Private Bank, Bank of America Private Wealth Management, and Wells Fargo Private Bank, all maintain significant legal staffs that include experienced trusts and estates attorneys. These positions often provide attractive compensation and career progression opportunities while offering more predictable work environments than traditional law firm practice.

The relationship between law firms and corporate trustees has evolved significantly as both sectors have recognized the benefits of collaboration. Many law firms maintain strategic relationships with particular trust companies, while trust companies often refer complex legal matters to preferred law firm counsel.

Family offices have emerged as another significant employer of trusts and estates legal talent. Single-family offices serving ultra-high-net-worth families often employ general counsel with trusts and estates expertise, while multi-family offices may maintain larger legal staffs to serve their diverse client bases.

The growth of directed trust services has created new opportunities for collaboration between attorneys and corporate trustees. In directed trust arrangements, the trustee's responsibilities are limited to specific administrative functions while other professionals, often including attorneys, serve as investment advisors or distribution committees.

International and Cross-Border Practices

The globalization of wealth has created significant opportunities for firms with international trusts and estates capabilities. These practices require deep understanding of cross-border tax issues, treaty law, and foreign legal systems, making them among the most specialized and highly compensated areas within trusts and estates practice.

Withers, a UK-based firm with significant U.S. presence, has built one of the world's leading international private client practices. The firm's ability to coordinate planning across multiple jurisdictions and its deep understanding of international tax issues make it particularly valuable for globally mobile families and international business leaders.

Several U.S. firms have built strong international capabilities through strategic expansion and lateral hiring. These firms often maintain offices in key international centers while developing expertise in the tax and legal systems of countries where their clients have significant wealth or business interests.

The complexity of international trusts and estates planning often justifies premium pricing, making these practices particularly profitable for firms with the necessary expertise. The limited number of attorneys with international capabilities also reduces competitive pressure and supports higher compensation levels for qualified practitioners.

Cross-border planning often involves coordination with foreign counsel, tax advisors, and other professionals, requiring attorneys with strong project management skills and cultural sensitivity. The ability to navigate complex international relationships is often as important as technical legal expertise in building successful international practices.

VII. Fee Structures and Client Cost Considerations

Hourly Rate Structures and Market Pricing

Trusts and estates legal services are typically priced using hourly billing arrangements that reflect the complexity of matters, the expertise required, and regional market conditions. The range of hourly rates in the trusts and estates field spans from approximately $200 per hour for junior associates at smaller firms to over $1,500 per hour for senior partners at elite practices handling the most sophisticated matters.

In major markets such as New York, Los Angeles, and San Francisco, experienced trusts and estates partners at top-tier firms typically command hourly rates ranging from $800 to $1,200, with the most senior and specialized practitioners often exceeding these levels. The premium pricing reflects both the technical complexity of the work and the high value of the underlying assets and transactions.

Senior associates at major firms in primary markets typically bill at rates ranging from $500 to $800 per hour, while mid-level associates generally bill at $400 to $600 per hour. These rates have increased significantly in recent years as firms have adjusted pricing to reflect market demand and the specialized nature of trusts and estates expertise.

Regional markets typically see lower absolute rate levels while maintaining similar relative relationships between experience levels. In secondary markets, partner rates may range from $400 to $700 per hour, with associate rates proportionally scaled. However, the rate differentials between primary and secondary markets have narrowed as sophisticated clients have become willing to pay premium rates for specialized expertise regardless of location.

Boutique trusts and estates firms often command premium rates despite their smaller size, as clients recognize the value of specialized expertise and personalized service. Many boutique practitioners charge rates that meet or exceed those of major firm attorneys with similar experience levels, particularly when handling sophisticated planning matters.

The current market environment has generally supported rate increases across the trusts and estates field, as demand has outpaced supply and clients have demonstrated willingness to pay premium rates for quality services. Many firms have implemented regular rate increases of 5% to 10% annually, with some specialties seeing even higher increases.

Alternative Fee Arrangements and Value-Based Pricing

While hourly billing remains the dominant pricing model in trusts and estates practice, alternative fee arrangements have gained acceptance for certain types of matters. These alternatives often provide more predictable costs for clients while allowing attorneys to capture additional value for their expertise and efficiency.

Flat fee arrangements are commonly used for standardized estate planning services, such as basic will and trust preparation, power of attorney drafting, and routine administrative matters. These arrangements typically range from $2,500 to $15,000 for comprehensive planning packages, depending on complexity and geographic location.

For more sophisticated planning matters, many firms use hybrid arrangements that combine flat fees for specific deliverables with hourly billing for additional services or complications that arise during implementation. This approach provides cost predictability for basic services while maintaining flexibility for complex matters.

Value-based fee arrangements have gained traction for certain types of high-value planning matters, where the economic benefit to clients significantly exceeds traditional hourly billing amounts. These arrangements often involve fees calculated as a percentage of tax savings or wealth transfer benefits achieved through sophisticated planning strategies.

Retainer arrangements are common for ongoing trust administration and family office services, where clients require regular legal support but cannot predict the specific timing or nature of services needed. These arrangements typically involve monthly or quarterly payments that provide access to legal services as needed.

Success fees and contingent arrangements are occasionally used for complex matters where the outcome is uncertain, such as tax disputes or sophisticated planning strategies with significant execution risks. However, these arrangements require careful structuring to comply with professional responsibility requirements and client protection standards.

Cost Factors and Budget Considerations

The cost of trusts and estates legal services varies significantly based on numerous factors that clients should understand when budgeting for planning and administration needs. The complexity of family situations, the value of assets involved, and the sophistication of planning strategies all influence the level of legal services required and associated costs.

Simple estate planning for middle-class families typically costs between $2,500 and $7,500 for comprehensive planning that includes wills, trusts, powers of attorney, and healthcare directives. These matters generally require 15 to 30 hours of attorney time and can often be handled efficiently by experienced practitioners.

High-net-worth estate planning typically costs significantly more due to the complexity of tax planning, sophisticated trust structures, and coordination with other professional advisors. Comprehensive planning for families with estates exceeding $10 million often costs $25,000 to $100,000 or more, depending on the strategies employed and the level of customization required.

Ultra-high-net-worth families with estates exceeding $100 million may invest hundreds of thousands or millions of dollars in sophisticated planning strategies that can save tens or hundreds of millions in tax costs. These matters often involve teams of attorneys, accountants, appraisers, and other specialists working over extended periods to implement complex strategies.

Ongoing trust administration costs typically range from $25,000 to $100,000 annually for sophisticated trusts, depending on the complexity of trust terms, the nature of assets held, and the level of legal oversight required. These costs often represent a small percentage of trust assets while providing significant value through professional management and compliance.

International planning matters typically command premium pricing due to the specialized expertise required and the complexity of cross-border tax and legal issues. These matters often cost 25% to 50% more than comparable domestic planning due to the additional research, coordination, and compliance requirements involved.

Value Proposition and Return on Investment

Despite the significant costs associated with sophisticated trusts and estates planning, the economic benefits typically far exceed the professional fees involved. For high-net-worth families, effective planning can save millions or tens of millions of dollars in taxes while providing significant non-tax benefits related to asset protection, succession planning, and family governance.

Estate tax savings alone can justify substantial planning costs for families with taxable estates. With federal estate tax rates reaching 40% and some state estate taxes adding additional burdens, effective planning that reduces estate tax exposure by even modest percentages can generate savings that dwarf professional fees.

Generation-skipping transfer tax planning can provide even more dramatic benefits, as effective GST planning can eliminate transfer taxes for multiple generations. For families with substantial wealth, GST tax savings can reach hundreds of millions of dollars over time, making even expensive planning strategies economically attractive.

Income tax benefits associated with sophisticated planning strategies often provide ongoing value that compounds over time. Grantor trust strategies, charitable planning, and business succession planning can all generate significant income tax savings that continue throughout the life of the planning structures.

Non-tax benefits of sophisticated planning often provide value that exceeds pure economic measures. Asset protection benefits, family governance structures, and succession planning clarity can preserve family wealth and relationships in ways that cannot be easily quantified but provide immense value to client families.

The cost of not planning or planning inadequately often far exceeds the cost of sophisticated professional services. Families that fail to implement appropriate planning strategies may face avoidable tax burdens, family disputes, and wealth transfer inefficiencies that could have been prevented through professional guidance.

VIII. Business Generation and Client Development

Referral Networks and Professional Relationships

Trusts and estates practice differs significantly from other legal specialties in its heavy reliance on referral relationships and professional networks for business development. The personal and confidential nature of estate planning creates a client base that values trusted advisor relationships and professional recommendations above traditional marketing approaches.

Certified Public Accountants represent the single most important referral source for trusts and estates attorneys, as tax professionals often identify planning opportunities and client needs during routine tax preparation and planning services. Building strong relationships with sophisticated CPAs who serve high-net-worth clients is essential for developing a successful trusts and estates practice.

Wealth management professionals, including financial advisors, private bankers, and investment managers, represent another critical referral source. These professionals often have ongoing relationships with clients and are well-positioned to identify estate planning needs and coordinate comprehensive planning strategies. Many successful trusts and estates attorneys have developed formal referral relationships with wealth management firms and maintain regular communication about mutual clients.

Insurance professionals specializing in life insurance and disability insurance often encounter clients with sophisticated estate planning needs. Life insurance is frequently used to provide liquidity for estate taxes or to facilitate wealth transfer strategies, creating natural opportunities for collaboration between insurance professionals and trusts and estates attorneys.

Other attorneys represent an important referral source, particularly corporate attorneys, real estate attorneys, and family law attorneys who encounter clients with estate planning needs in the course of their practices. Building relationships with attorneys in complementary practices can provide steady referral streams and opportunities for collaborative client service.

Corporate trustees and family office professionals often refer legal work to trusted counsel while maintaining their client relationships. These referral sources are particularly valuable because they typically involve ongoing relationships rather than one-time transactions.

Client Development Strategies and Networking

Effective client development in trusts and estates practice requires a long-term approach that focuses on building trusts and demonstrating expertise rather than immediate transaction generation. The personal nature of estate planning means that clients typically work with attorneys they know and trust, making relationship building essential for practice development.

Professional education and thought leadership represent important components of trusts and estates business development. Speaking at professional conferences, writing articles for trade publications, and teaching continuing education courses help establish expertise and credibility while building professional networks.

Industry organization participation is crucial for trusts and estates practitioners, as many referrals and client relationships develop through professional association activities. Organizations such as the American College of Trusts and Estate Counsel (ACTEC), local bar association trusts and estates sections, and specialized groups like the Estate Planning Council provide valuable networking opportunities.

Client seminars and educational programs are effective tools for demonstrating expertise while providing valuable services to existing clients and referral sources. Many successful practitioners regularly host seminars on current tax law changes, planning strategies, and industry trends that attract both clients and referral sources.

Social and community involvement often plays an important role in trusts and estates business development, as many high-net-worth clients are active in charitable organizations, cultural institutions, and community leadership roles. Participation in these activities provides opportunities to build relationships with potential clients in non-business settings.

Digital marketing and social media have become increasingly important tools for trusts and estates business development, though they require careful consideration of client confidentiality and professional responsibility requirements. Many successful practitioners maintain professional websites, publish regular newsletters, and use social media platforms to share expertise and build professional networks.

- Alongside trusts and estates, commercial litigation has emerged as a major growth area, especially during times of economic uncertainty.

Specialization and Niche Development

The complexity and breadth of modern trusts and estates practice create opportunities for attorneys to develop specialized expertise in particular areas that can differentiate their practices and command premium fees. Specialization can help attorneys build reputations as go-to experts while reducing competition and supporting higher pricing.

International and cross-border planning represents one of the most lucrative specialization opportunities, as few attorneys possess the knowledge and experience required to handle sophisticated multi-jurisdictional matters. Attorneys with international expertise often command premium rates and serve clients throughout the country who cannot find local counsel with adequate expertise.

Charitable planning specialization has grown in importance as more high-net-worth families incorporate philanthropic objectives into their wealth transfer strategies. Attorneys with deep expertise in private foundations, charitable remainder trusts, and donor advised funds can build practices serving both individual families and charitable organizations.

Business succession planning offers opportunities for attorneys to combine trusts and estates expertise with corporate and tax law knowledge to serve business-owning families. This specialization often involves higher-value matters and longer-term client relationships than traditional estate planning.

Family office services have become an important specialization as ultra-high-net-worth families establish dedicated professional management for their wealth. Attorneys who understand family office operations and governance can provide valuable services while building relationships with some of the wealthiest families in the country.

Industry-specific expertise can provide differentiation and referral opportunities in markets with concentrated wealth in particular sectors. Attorneys who develop expertise serving technology entrepreneurs, entertainment industry professionals, or energy industry executives can build specialized practices with premium pricing and strong referral networks.

Technology and Innovation in Business Development

Technology is playing an increasingly important role in trusts and estates business development, both as a tool for building professional relationships and as a means of delivering services more efficiently. Attorneys who effectively leverage technology can build competitive advantages while serving clients more effectively.

Customer relationship management (CRM) systems have become essential tools for managing complex professional networks and client relationships. These systems help attorneys track referral sources, manage client communications, and identify business development opportunities while maintaining the detailed records necessary for professional compliance.

Digital communication tools, including video conferencing, secure document sharing, and electronic signature platforms, have expanded the geographic reach of trusts and estates practices while improving service efficiency. Many attorneys can now serve clients throughout the country without the travel requirements that previously limited practice geography.

Content management and digital publishing tools enable attorneys to share expertise and build thought leadership through regular blog posts, newsletters, and social media content. These tools help attorneys stay connected with their professional networks while demonstrating ongoing expertise and market awareness.

Data analytics and market intelligence tools help attorneys identify potential clients, track market trends, and optimize their business development activities. These tools can provide insights into wealth migration patterns, industry developments, and competitive dynamics that inform strategic planning.

Practice management technology helps attorneys deliver services more efficiently while maintaining the high-quality client service that is essential for referral generation. Technology that improves service delivery often translates directly into client satisfaction and referral generation.

IX. Trusts and Estates Litigation Trends

The Growing Landscape of Wealth Disputes

Trusts and estates litigation has experienced significant growth in recent years, driven by increasing wealth levels, more complex family structures, and the sophisticated planning strategies that have become common among high-net-worth families. The stakes involved in these disputes have grown dramatically, making litigation an increasingly important component of trusts and estates practice.

The rise in trusts and estates litigation correlates directly with the growth in family wealth and the complexity of modern planning structures. As estate values have increased and planning techniques have become more sophisticated, the potential for disputes has grown correspondingly. Multi-generational trusts, complex business succession plans, and international wealth structures all create opportunities for disagreement and legal challenge.

Family dynamics have become more complex as wealth spans multiple generations and traditional family structures evolve. Blended families, multiple marriages, and geographic dispersion of family members all contribute to communication challenges and potential conflicts that may ultimately require legal resolution.

The professional liability exposure associated with trusts and estates work has also increased, as attorneys, accountants, and trustees face potential claims related to planning strategies, administrative decisions, and fiduciary breaches. These professional liability matters often involve significant financial stakes and require specialized litigation expertise.

The current wealth transfer environment has created particular opportunities for litigation, as families implement complex planning strategies under time pressure to take advantage of current tax benefits before their potential expiration. The rushed implementation of sophisticated strategies may increase the likelihood of disputes or challenges in subsequent years.

Will Contests and Capacity Challenges

Will contests represent one of the most traditional forms of trusts and estates litigation, but they have evolved significantly in complexity and sophistication as estate values have increased and family situations have become more complex. Modern will contests often involve sophisticated expert testimony, detailed investigation of family circumstances, and complex legal theories that require specialized expertise.

Capacity challenges have become more common as individuals live longer and may execute estate planning documents during periods of diminished mental capacity. These cases often involve detailed medical testimony, expert analysis of cognitive function, and careful examination of the circumstances surrounding document execution.

Undue influence claims have grown in sophistication and frequency, particularly in cases involving elderly individuals with significant wealth and complex family relationships. These cases often require extensive discovery regarding family dynamics, caregiver relationships, and the circumstances of estate plan modification.

The increasing use of video recordings, detailed contemporaneous documentation, and sophisticated capacity assessments during estate planning meetings reflects the legal community's awareness of potential future challenges. These preventive measures often prove crucial in defending against will contests and capacity challenges.

The economic stakes involved in will contests have increased dramatically as estate values have grown. Contests involving estates worth tens or hundreds of millions of dollars can justify substantial litigation expenditures and often attract specialized litigation counsel with deep experience in high-stakes wealth disputes.

Trust Disputes and Fiduciary Litigation

Trust disputes have become increasingly common and complex as trust structures have evolved to address sophisticated planning objectives and family circumstances. The growth in dynasty trusts, directed trusts, and specialized planning vehicles has created new categories of potential disputes that require specialized legal expertise.

Beneficiary disputes with trustees have grown in frequency and complexity, often involving disagreements about distribution decisions, investment strategies, and administrative practices. These disputes can be particularly challenging when they involve discretionary distribution standards or complex family circumstances.

Trustee removal actions have become more common as beneficiaries seek to replace institutional or individual trustees who they believe are not serving their interests effectively. These cases often involve detailed analysis of fiduciary duties, performance standards, and the specific terms of trust instruments.

Trust modification and termination litigation has increased as families seek to adapt trust structures to changed circumstances, new tax laws, or evolving family needs. These matters often require judicial approval and may involve complex negotiations among multiple beneficiary classes with competing interests.