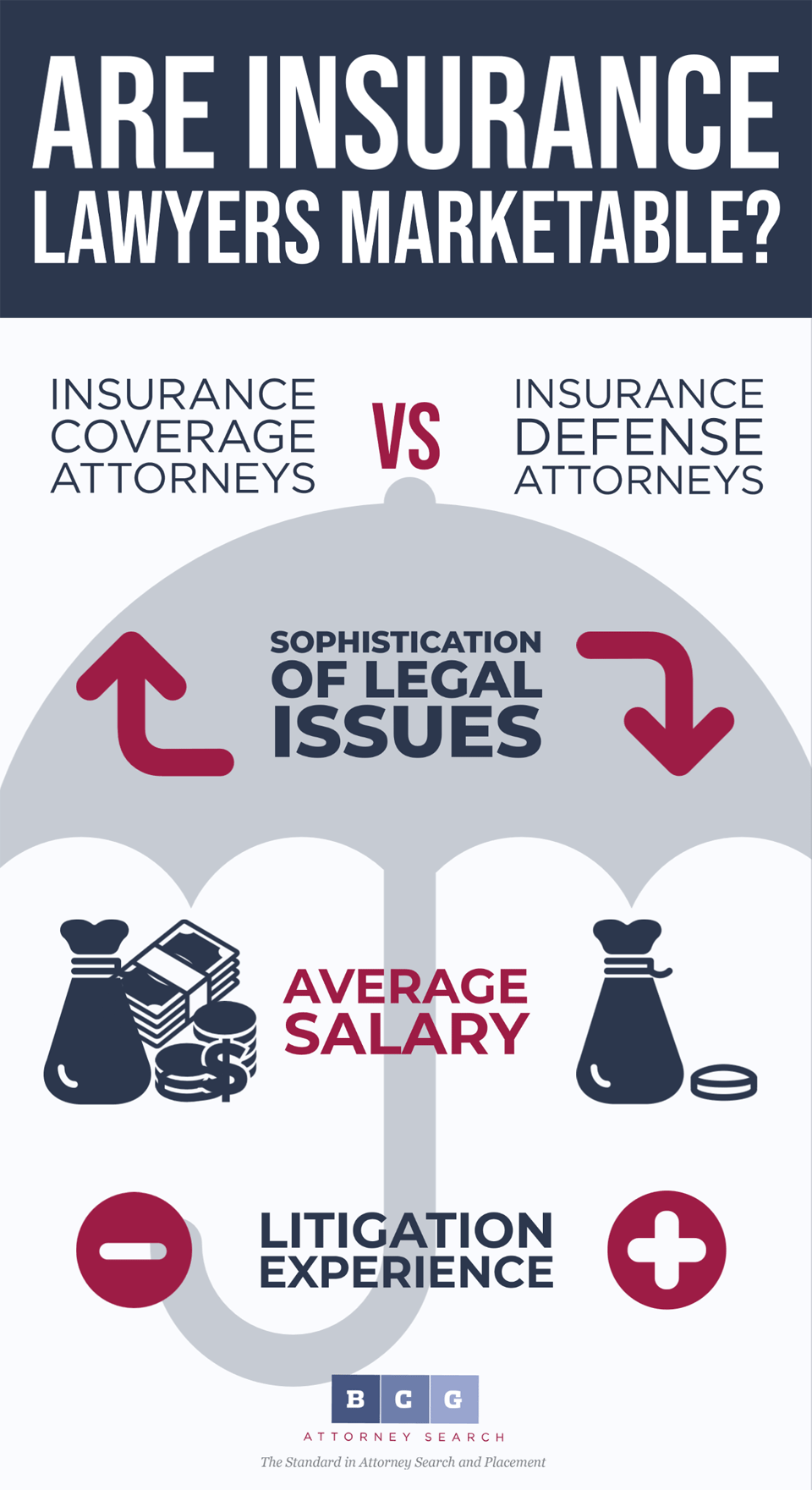

We are frequently contacted by attorneys whose practices focus on insurance law. The relative marketability of these attorneys depends on the specific nature of their practice. Insurance coverage attorneys are highly marketable, and can take up challenging new positions with top law firms with relative ease. On the other hand, those who practice insurance defense find it more difficult to make an upwardly-mobile move, notwithstanding their often excellent litigation skills.

As a general rule, insurance coverage cases involve more sophisticated legal issues and are more likely to result in binding case law that will directly affect future claims.

The phrase "insurance defense" refers to situations where an insurer hires counsel to defend its insured against an action brought by a third party -- typically, an action alleging that the insured has caused the third party to suffer bodily injury or property damage. The parties to the action typically are the insured and the third-party claimant. The legal issues revolve around whether the insured defendant is liable to the third party, and if so, for how much.

![]()

In contrast, the parties to insurance coverage actions generally are the insurer and the insured. The insured is seeking to recover under a policy of insurance, and the central legal question is whether the insured's policy covers the loss or liability. Insurance coverage actions also may involve complex issues, including disputes between insurers-relating to matters such as primary/excess coverage, time-on-the-risk, or reinsurance. Such actions also may involve first-party claims for coverage (e.g., for a loss suffered by the insured, rather than by a third party, such as fire or earthquake damage to the insured's home, or theft of the insured's personal property) that are never at issue in insurance defense.

Automobile insurance provides a fairly straightforward example of the difference between insurance defense and insurance coverage. Imagine that an insured driver is involved in an automobile accident with another driver. As a result, both cars are damaged, and the other driver is injured. The other driver sues the insured for the injuries and damages allegedly suffered. The insured therefore seeks coverage for the other driver's injuries and property damage, and asks the insurer to defend him in the lawsuit brought by the other driver.

If there are no coverage issues, the defendant's insurer will appoint counsel to defend the insured in the action, and will attempt to resolve the claim for bodily injury and property damage, by settlement or otherwise. The legal issues will be fairly straightforward -- how did the accident occur, what was the proximate cause of any resulting injuries and damage, and what is the monetary value of the injuries and damage suffered. If the insured is found liable, or agrees to a settlement within policy limits, the insurer will pay the tab.

But if there are coverage issues, the insurer may refuse to cover the damages suffered by the insured and the third party, and may refuse to defend the insured in the lawsuit brought by the other driver. In that event, coverage litigation may ensue -- instigated by either the insured or the insurer -- in which the operative question will be whether the insured's policy covers-or potentially covers-the loss or liability resulting from the automobile accident, thereby entitling the insured to a defense and/or indemnity. The legal issues involved in such a suit will not focus on whether the insured is liable to the other driver. Rather, they will focus on matters such as whether the policy was in effect at the time of the accident, whether the driver of the vehicle was in fact insured under the policy, or whether the insured's liability arises from an excluded risk (such as situations where the insured intentionally caused the accident).

Thus, insurance defense cases tend to focus on the facts of a particular incident or occurrence. Insurance coverage cases tend to focus on the language of the policy and the case law construing the policy language. Such cases can have a much more dramatic impact on the insurer's bottom line, because they can establish precedent that will apply to future claims.

Insurance defense law firms are less likely to use legal recruiters than firms that handle insurance coverage work.

While insurance defense cases sometimes involve high-dollar claims, the practice generally tends to be high volume/low value. Because insurance defense work tends to be high volume, insurance carriers often assign a lot of cases to a particular firm, but pay a fairly low hourly rate. Insurance coverage cases, on the other hand, can be quite large scale, with multimillion dollar claims that take years to litigate (for example, claims for coverage of liability for environmental contamination that allegedly took place over decades, thereby implicating numerous policies). Carriers generally are willing to pay a much higher hourly rate for these types of cases, because as a general rule, the work is more sophisticated, and, as mentioned above, more likely to result in binding case law that will apply to future claims.

Firms that handle insurance defense work tend to pay their attorneys salaries that are below market. They are often unwilling to recruit lateral attorneys through recruiting firms, which can entail a substantial fee, preferring to hire candidates directly. On the other hand, many of the top law firms in the country handle insurance coverage work. Some handle such matters on behalf of insurers and some handle them on behalf of well-heeled corporate policyholders. In either event, such firms are able to command very respectable hourly rates for their work, and generate a healthy revenue stream in the practice area. Many such firms are our clients.

Insurance defense attorneys can maximize their marketability to top law firms by focusing on insurance coverage work to the greatest extent possible, and honing their litigation skills.

Many law firms that focus primarily on insurance defense work also do a fair amount of insurance coverage work. Attorneys who work at such firms can maximize their marketability to top law firms by handling as much insurance coverage work as they can get their hands on. Attorneys who have done so (including this author) have been able to leverage themselves into better-paying positions at more prestigious law firms, where they have handled more sophisticated and satisfying work. We have had success marketing such attorneys to top law firms by focusing on the strong, hands-on litigation experience that they have gained through their insurance defense work, and the exposure to sophisticated legal issues that they have gained through their insurance coverage work.

Such attorneys should approach a potential lateral move with considerable thought. Some individuals in hiring positions have a bias against insurance defense attorneys, perceiving them to be less careful in their work and to have less sophisticated experience than other candidates. To address any such bias, a candidate should ensure that his or her application is as well-presented and informative as possible. The application should highlight any insurance coverage experience-including a description of the specific nature of that experience (e.g., first-party or third-party, types of coverage/claims, etc.) as well as the extent of the candidate's hands-on litigation experience. Many insurance defense attorneys have substantially more experience than their counterparts at more prestigious firms in handling depositions, oral arguments, arbitrations, and trial. This experience can be very attractive to firms when presented as part of a strong package.

A final thought to keep in mind is that conflicts can be a major concern in insurance coverage work. While some firms represent both insurers and policyholders, most focus on representing one side or the other. A firm that represents only policyholders may be unwilling to consider hiring an attorney who has represented insurers, simply as a matter of firm policy, or due to actual or perceived conflicts of interest. Your job search should be tailored accordingly.

Any of our BCG recruiters would be happy to discuss your insurance practice with you to determine how you can take your practice to the highest level.

Click here to contact Harrison