Why Salary Isn't Everything: Long-Term Career Success in Smaller Legal Markets

A comprehensive analysis of how smaller legal markets offer superior career opportunities, work-life balance, financial advantages, and long-term success compared to major market BigLaw positions.

Introduction

For many attorneys, the pursuit of BigLaw salaries and prestigious firm names overshadows other critical factors that shape a fulfilling career. Yet, in smaller legal markets across the United States, attorneys often find advantages that extend far beyond compensation—such as stronger client relationships, faster career advancement, greater stability, and improved work-life balance.

This report explores why salary alone should not dictate career decisions and highlights the long-term benefits of practicing law in secondary and regional markets. By comparing lifestyle, opportunity, and sustainability with high-paying but demanding large market roles, we provide a clear perspective on what truly drives lasting success in the legal profession.

Whether you are considering a lateral move, planning a relocation, or evaluating your long-term goals, this guide offers valuable insights into why smaller markets may present some of the best opportunities for attorneys today.

The Salary Trap: Why Lawyers Over-Prioritize Compensation

Every year, thousands of talented attorneys make career decisions based primarily on salary figures—often to their long-term detriment. This myopic focus on immediate compensation creates a trap that can derail promising legal careers and limit professional fulfillment for decades to come.

The legal profession's emphasis on prestigious BigLaw salaries has created a fundamentally distorted perception of career success. When first-year associates earn $225,000+ at AmLaw 100 firms, it becomes all too easy to assume that higher pay automatically equals better opportunities, superior training, and enhanced career prospects. However, this assumption ignores critical factors that ultimately determine not just career satisfaction, but long-term professional success, financial security, and personal well-being.

The reality is that smaller legal markets—cities like Austin, Nashville, Denver, Charlotte, Salt Lake City, and dozens of others—offer compelling advantages that often surpass what major metropolitan markets can provide. These advantages extend far beyond simple cost-of-living calculations to encompass career advancement opportunities, client relationship development, professional autonomy, community integration, and long-term wealth building potential.

This comprehensive analysis examines why attorneys who prioritize smaller markets often achieve greater career satisfaction, build more sustainable practices, and ultimately create more fulfilling professional lives than their BigLaw counterparts who chase the highest salaries in the most expensive markets.

The Financial Reality: Why Smaller Markets Often Mean More Money

The most immediate and quantifiable advantage of smaller legal markets lies in their superior financial dynamics. While BigLaw salaries grab headlines, the true measure of financial success should be effective income after accounting for cost of living, taxation, work-life balance, and long-term wealth accumulation potential.

Cost-Adjusted Income: The Real Numbers

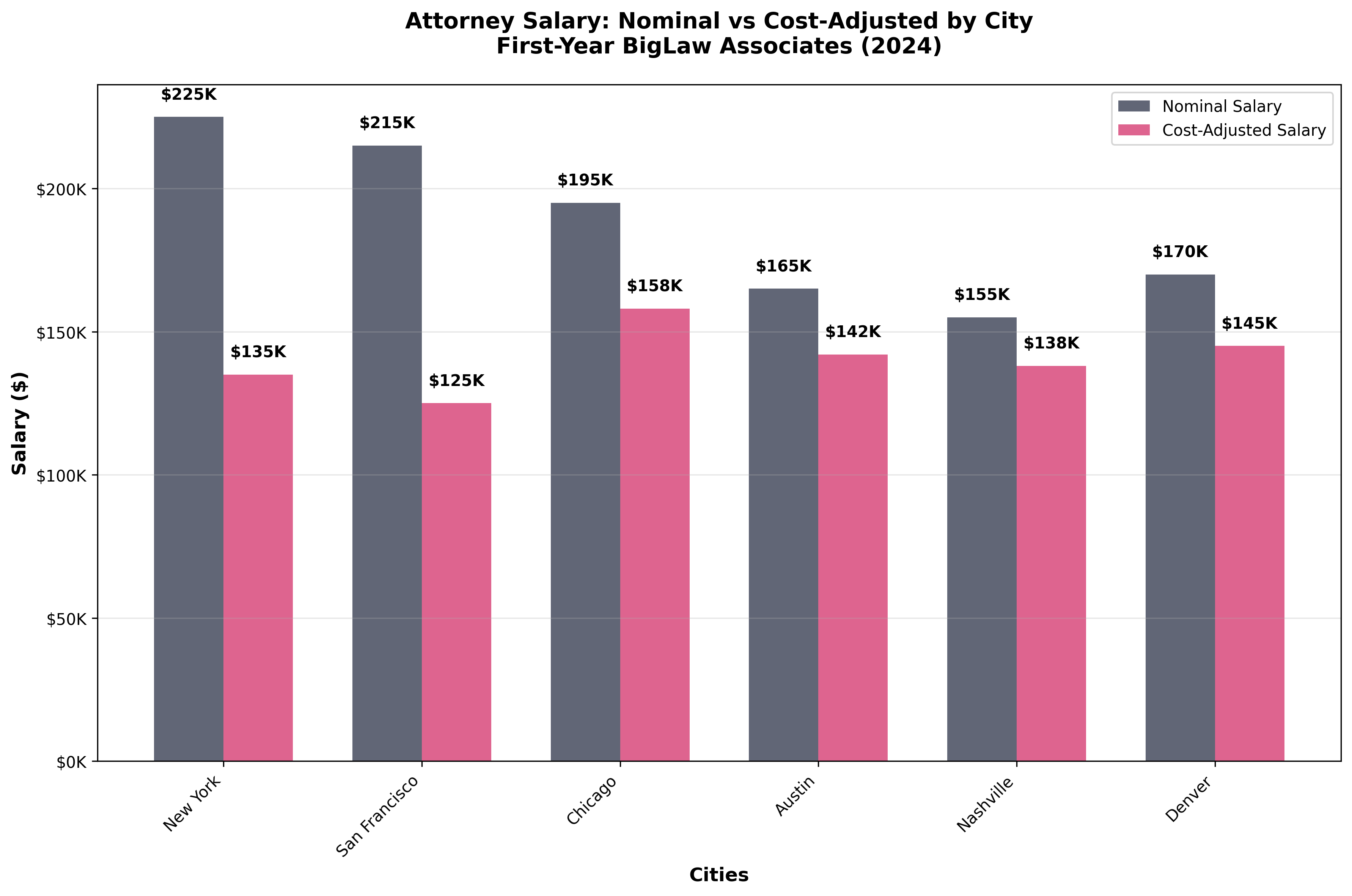

When attorneys earning $225,000 in New York City are compared to their counterparts earning $160,000 in Austin or Nashville, the raw salary differential appears substantial. However, this comparison becomes meaningless when adjusted for the dramatic differences in living costs, taxation, and quality of life expenses.

Salary Comparison: Major vs. Secondary Markets

The data reveals a striking reality: after adjusting for cost of living, attorneys in secondary markets often enjoy superior purchasing power. A $160,000 salary in Austin provides approximately $142,000 in adjusted buying power, while a $225,000 salary in Manhattan provides only $135,000 in equivalent purchasing power. This $7,000 difference represents just the beginning of the financial advantages smaller markets provide.

The Hidden Costs of BigLaw Practice

Beyond basic cost of living, BigLaw practice in major markets imposes numerous hidden financial burdens that dramatically erode take-home pay and long-term wealth accumulation:

Hidden BigLaw Costs (Annual)

- Extended commuting costs and time value: $12,000 - $18,000

- Business attire and dry cleaning: $4,000 - $6,000

- Frequent business meals and entertainment: $6,000 - $12,000

- Higher insurance and healthcare costs: $3,000 - $5,000

- Premium services (cleaning, delivery, etc.): $8,000 - $15,000

- Total Additional Annual Costs: $33,000 - $56,000

Effective Hourly Compensation: The Most Important Metric

Perhaps the most revealing financial comparison between markets involves calculating effective hourly compensation—total compensation divided by total hours worked. This metric strips away the illusion of high BigLaw salaries and reveals the true value proposition of different career paths.

Effective Hourly Rates Across Legal Markets

The analysis reveals that regional firm attorneys often achieve superior effective hourly rates compared to their BigLaw counterparts. An Austin associate earning $160,000 while working 1,900 hours annually achieves an effective rate of $105 per hour, while a Manhattan BigLaw associate earning $225,000 but working 2,400 hours achieves only $94 per hour.

This differential becomes even more pronounced when considering the hidden costs outlined above. The Austin attorney's superior effective hourly rate, combined with lower living costs and reduced ancillary expenses, creates a substantial financial advantage that compounds over time.

Home Ownership and Wealth Building

One of the most significant long-term financial advantages of smaller markets lies in dramatically reduced housing costs and the realistic possibility of home ownership early in one's career. While BigLaw associates in Manhattan, San Francisco, or Washington D.C. often spend 40-60% of their income on rent with little prospect of home ownership, their counterparts in smaller markets can purchase homes within their first few years of practice.

Manhattan BigLaw Associate

- Annual Salary: $225,000

- Monthly Rent (1BR): $4,500

- % of Income to Housing: 48%

- Home Ownership: Years 8-12

- Median Home Price: $2,100,000

Austin Regional Associate

- Annual Salary: $160,000

- Monthly Mortgage (3BR): $2,800

- % of Income to Housing: 26%

- Home Ownership: Years 2-4

- Median Home Price: $620,000

The Austin attorney builds equity from an early career stage while enjoying a larger living space, while the Manhattan attorney continues renting at costs that exceed the Austin attorney's mortgage payments. Over a 10-year period, this differential creates hundreds of thousands of dollars in net worth variation.

Accelerated Career Advancement: The Fast Track to Leadership

While BigLaw firms are notorious for their lengthy and uncertain partnership tracks, smaller legal markets offer dramatically accelerated pathways to leadership positions, equity participation, and professional autonomy. This acceleration stems from fundamental structural differences in how regional and mid-size firms operate compared to their BigLaw counterparts.

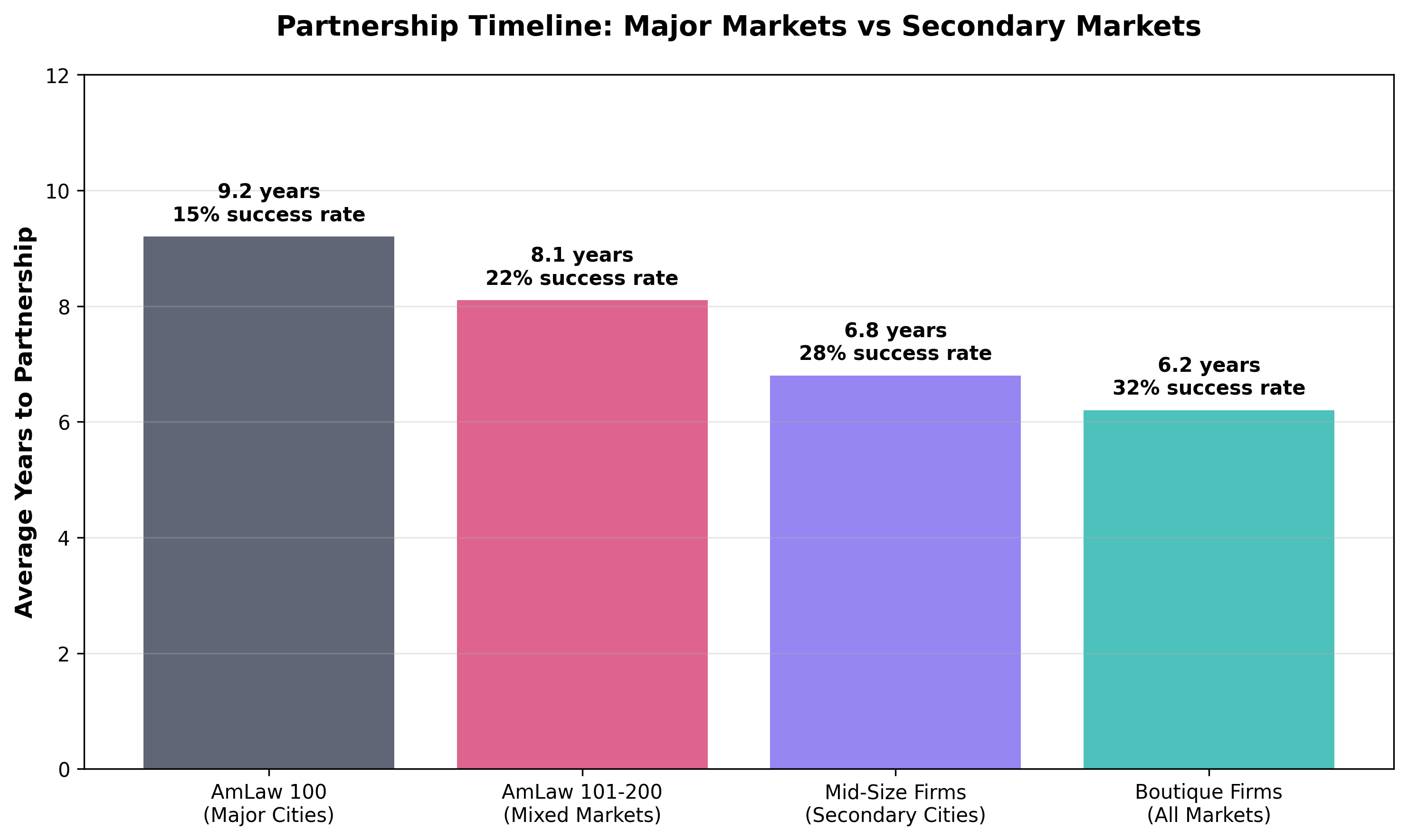

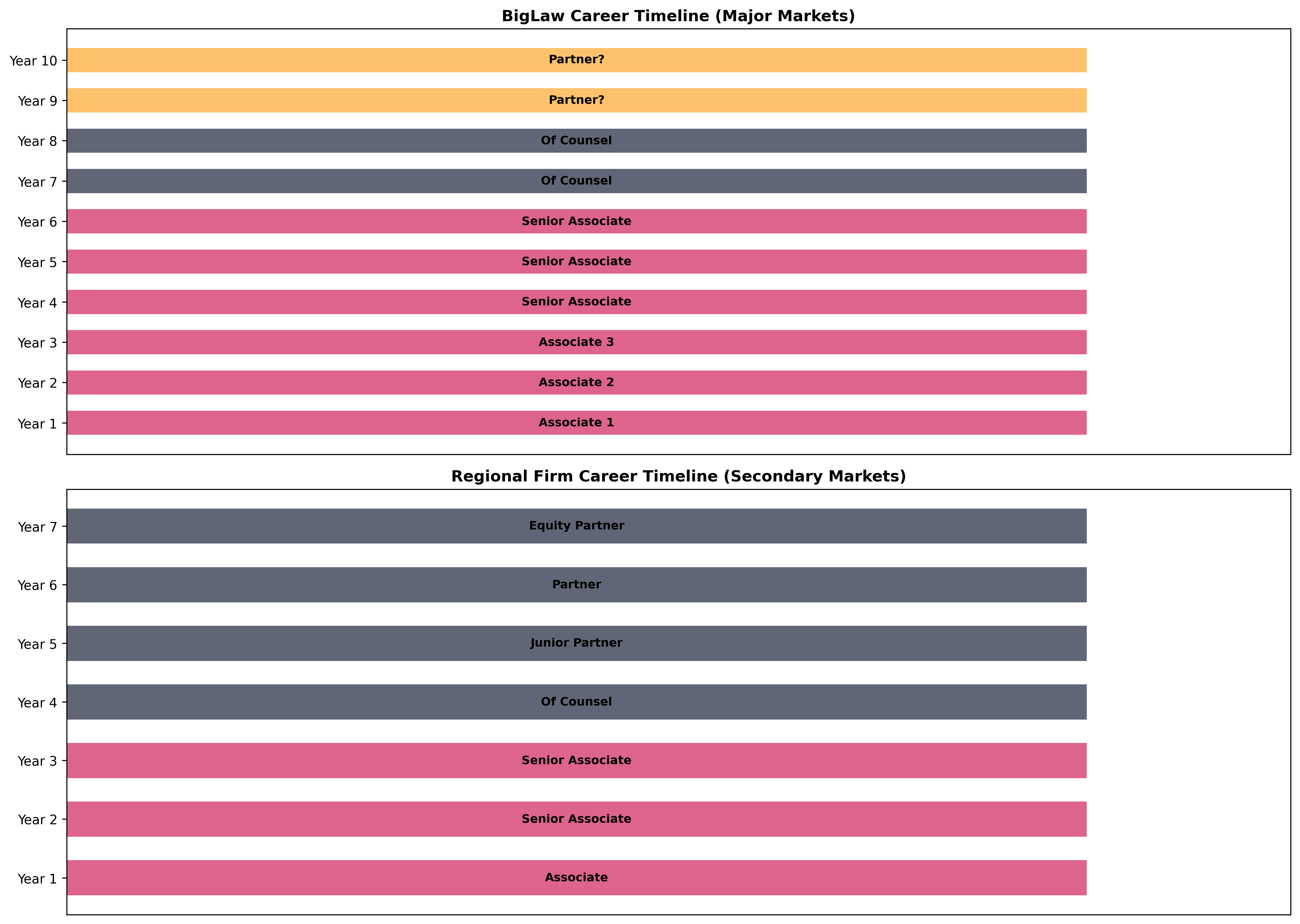

Partnership Timeline Realities

The data on partnership timelines reveals one of the most compelling arguments for smaller market practice. While AmLaw 100 firms average 9.2 years to partnership with only a 15% success rate, mid-size firms in secondary markets average 6.8 years with a 28% success rate. This isn't merely a statistical anomaly—it reflects fundamental differences in firm structure, client development opportunities, and growth strategies.

Partnership Timeline: Major vs. Secondary Markets

The reasons behind these dramatically different advancement trajectories are multifaceted and interconnected:

Why Smaller Markets Accelerate Advancement

Smaller Associate Classes

Regional firms typically hire 2-8 associates per year compared to 50+ in BigLaw, creating less internal competition and more individual attention.

Earlier Client Responsibility

Associates handle client relationships and case management from year one, developing business skills that BigLaw associates acquire much later.

Lower Business Development Thresholds

Partnership often requires $750K-$1.2M in annual originations compared to $2M+ in BigLaw.

Flatter Organizational Structure

Less hierarchical structures mean faster access to decision-making roles and profit-sharing opportunities.

Real Responsibility from Day One

Perhaps the most significant career advantage of smaller markets is the breadth and depth of responsibility that attorneys assume from the beginning of their careers. While BigLaw associates often spend their first several years on document review, due diligence, and research tasks, their counterparts in regional firms are taking depositions, arguing motions, meeting with clients, and managing cases independently.

This early responsibility creates a cascading series of professional advantages. Associates develop practical legal skills, client management capabilities, business development instincts, and industry knowledge at an accelerated pace. By their fourth or fifth year, they often possess the well-rounded skill set that BigLaw associates may not acquire until their seventh or eighth year—if at all.

Work-Life Integration: Sustainable Practice in Smaller Markets

The work-life balance advantages of smaller legal markets extend far beyond simple hour reductions. They encompass fundamental differences in practice culture, client expectations, community integration, and the ability to build a sustainable career that enhances rather than detracts from personal well-being and family life.

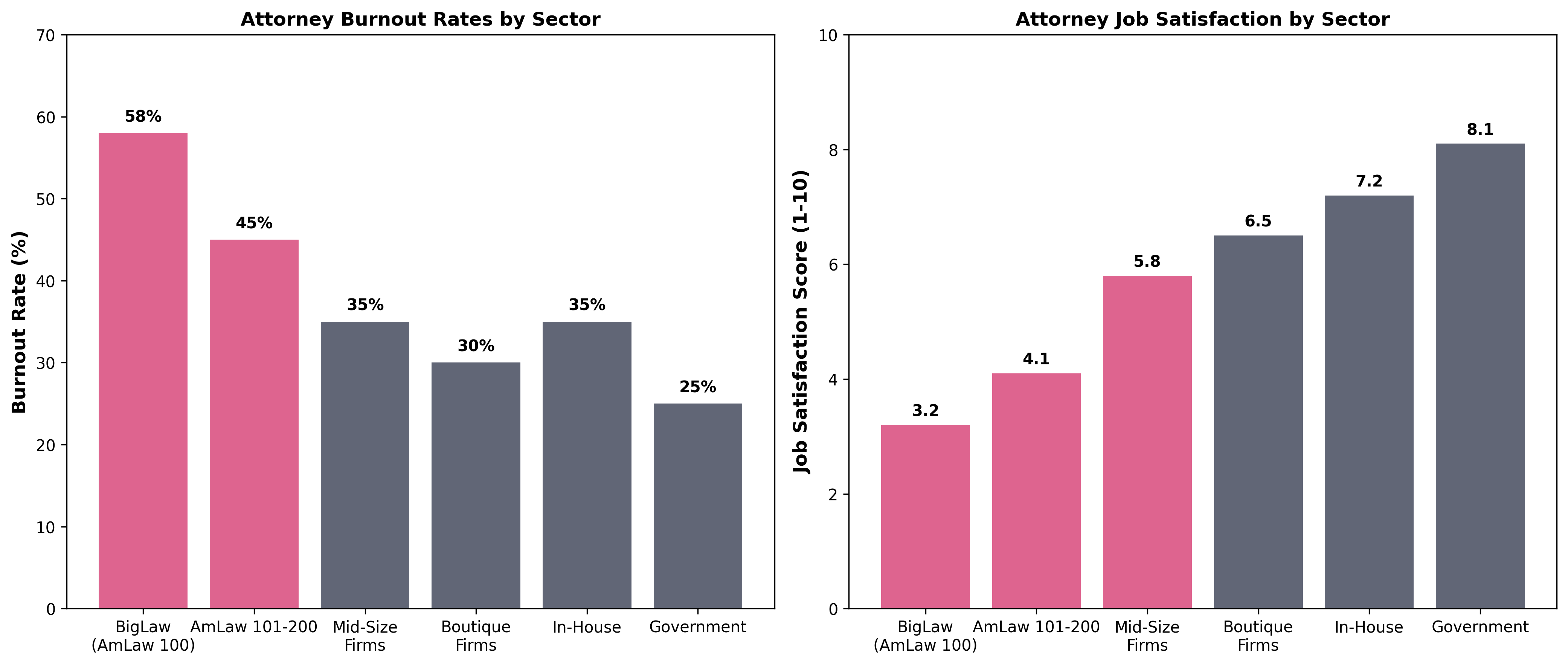

Burnout Rates and Job Satisfaction

The data on attorney burnout and job satisfaction reveals stark differences between practice environments. BigLaw firms consistently show burnout rates approaching 60%, while regional and mid-size firms maintain rates closer to 35%. More importantly, job satisfaction scores show inverse relationships with firm size and market competitiveness.

Attorney Burnout vs. Job Satisfaction by Practice Setting

These differences stem from several interconnected factors that make smaller market practice more sustainable over long-term careers:

Predictable Schedules

Regional firms typically operate with more predictable work schedules, allowing attorneys to plan personal activities and family commitments. While busy periods occur, they're often project-specific rather than constant states of emergency.

Shorter Commutes

Average commute times in secondary markets range from 15-25 minutes compared to 45-90 minutes in major metropolitan areas. This daily time savings translates to 200+ additional hours annually for personal activities.

Community Integration

Smaller markets enable deeper community involvement, from youth sports coaching to nonprofit board service, creating fulfilling activities outside legal practice while building valuable professional networks.

Reduced Stress Culture

Regional firm cultures often emphasize long-term client relationships and sustainable business practices rather than the aggressive, high-pressure environments typical of BigLaw practice.

Client Relationship Advantages: Building Lasting Professional Bonds

One of the most profound advantages of smaller legal markets lies in the nature and quality of attorney-client relationships. While BigLaw practice often reduces attorneys to interchangeable resources within large team structures, smaller markets enable attorneys to build deep, lasting relationships that form the foundation of sustainable legal careers and significant business development success.

Relationship Depth and Continuity

In smaller markets, attorneys often serve as trusted advisors to clients across multiple legal matters and business cycles. Rather than being brought in for specific transactions or disputes, they become integral parts of their clients' strategic decision-making processes. This relationship depth creates multiple advantages for both career development and professional satisfaction.

Client relationships in smaller markets typically span years or decades, compared to the project-specific engagements common in BigLaw practice. This continuity allows attorneys to develop sophisticated understanding of their clients' businesses, industries, and strategic objectives. They become not just legal service providers but strategic business advisors who understand their clients' operations at fundamental levels.

Professional Development

- Deep industry expertise development

- Strategic business acumen

- Advanced problem-solving skills

- Executive-level communication abilities

Business Benefits

- Predictable revenue streams

- Reduced business development costs

- Premium billing opportunities

- Referral network expansion

Client Development and Origination

Business development in smaller markets follows fundamentally different dynamics than in major metropolitan areas. With fewer attorneys competing for client relationships, and stronger community connections facilitating introductions, attorneys in smaller markets can build substantial books of business more quickly and efficiently.

The statistics are compelling: attorneys in secondary markets typically develop $750K to $1.2M books of business within 5-7 years, compared to the $2M+ thresholds often required for BigLaw partnership. More importantly, client origination in smaller markets often flows from community relationships, referral networks, and reputation rather than expensive business development activities.

Economic Stability and Market Resilience in Secondary Legal Markets

One of the most compelling but often overlooked advantages of smaller legal markets is their superior economic stability and resilience during market downturns. While BigLaw firms in major markets experience dramatic swings in demand, hiring, and layoffs based on economic cycles and industry-specific disruptions, smaller markets provide more consistent and sustainable practice environments.

Recession Resilience and Layoff Patterns

Historical analysis of legal industry layoffs during economic downturns reveals stark differences between major and secondary markets. During the 2008-2009 financial crisis and the 2020 COVID-19 pandemic, layoff rates in secondary markets were consistently 40-60% lower than in major metropolitan legal markets.

This resilience stems from several structural factors that make smaller market practices more economically stable:

Diversified Client Base

Smaller markets typically serve diverse local economies rather than concentrated industry sectors, reducing vulnerability to single-industry downturns.

Client Loyalty

Long-term client relationships create more stable revenue streams that persist through economic uncertainty.

Lower Overhead

Reduced office costs and operational expenses provide greater flexibility during revenue declines.

Growing Market Dynamics

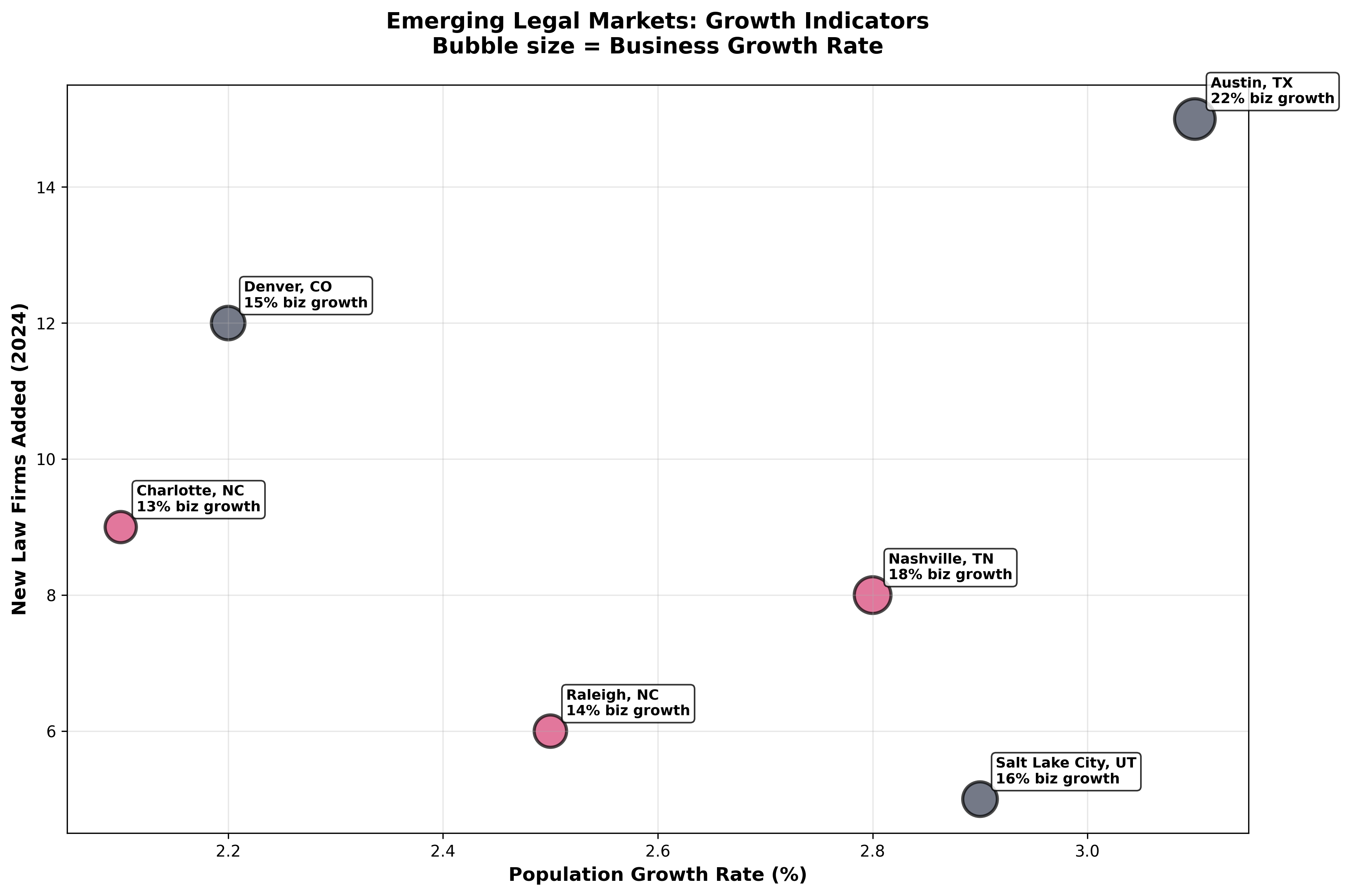

Many secondary legal markets are experiencing sustained growth that outpaces traditional major markets. This growth is driven by corporate relocations, population migration, cost arbitrage, and the development of regional business clusters that create expanding demand for legal services.

Emerging Legal Markets: Growth Indicators

Markets like Austin, Nashville, Denver, Raleigh, and Charlotte are experiencing business growth rates of 15-22% annually, far exceeding growth rates in traditional major markets. This growth creates expanding opportunities for legal services and sustainable career development.

Professional Development and Skill Building in Smaller Markets

The professional development advantages of smaller legal markets extend far beyond faster partnership tracks to encompass broader skill development, enhanced leadership opportunities, and accelerated expertise building that often surpasses what major market practice provides.

Broader Skill Development

Attorneys in smaller markets inherently develop broader skill sets than their BigLaw counterparts who may spend years within narrow specializations. This breadth stems from client needs, firm resource constraints, and market dynamics that require attorneys to handle diverse legal matters and develop multifaceted expertise.

BigLaw Skills (Years 1-5)

- Specialized legal research and writing

- Document review and due diligence

- Narrow subspecialty expertise

- Large team collaboration

- Process adherence and quality control

Regional Practice Skills (Years 1-5)

- Client relationship management

- Business development and origination

- Cross-practice area competency

- Independent case management

- Strategic business advisory

- Community networking and leadership

- Courtroom advocacy and negotiation

Career Trajectory Comparison: Two Paths, Different Outcomes

To illustrate the cumulative advantages of smaller market practice, consider the career trajectories of two hypothetical attorneys with similar credentials who choose different paths after law school graduation.

Career Progression: BigLaw vs. Regional Practice

BigLaw Path: Manhattan

Years 1-3: Document review, 2,400+ hours annually, $190K-$225K salary

Years 4-6: Senior associate, limited client contact, $280K-$350K salary

Years 7-9: Partnership track uncertainty, $375K-$400K, 85% won't make partner

Year 10+: Most transition to in-house or other careers due to partnership failure

Regional Path: Austin

Years 1-2: Client contact from day one, 1,900 hours annually, $140K-$160K salary

Years 3-4: Case management, business development training, $175K-$190K salary

Years 5-7: Junior partner track, $200K-$250K + profit sharing

Year 8+: Equity partner, $300K-$500K + equity, sustainable long-term career

Cumulative Advantages Analysis

By year 10, the attorney who chose the regional path typically enjoys superior work-life balance, comparable or better total compensation, equity participation, established client relationships, community integration, and sustainable career prospects. The BigLaw attorney, statistically speaking, has likely transitioned to a different career path after failing to achieve partnership.

More importantly, the regional attorney has built a foundation for continued career growth and wealth accumulation that can continue for decades, while many BigLaw alumni find themselves starting over in new career paths during their prime earning years.

Conclusion: Redefining Legal Career Success

The evidence overwhelmingly supports a fundamental reconsideration of how attorneys evaluate career opportunities and define professional success. While BigLaw salaries command attention and prestige, the comprehensive analysis of smaller legal markets reveals superior opportunities across virtually every dimension of career satisfaction and long-term success.

From financial advantages that extend beyond simple salary comparisons to encompass cost-adjusted income, home ownership opportunities, and long-term wealth building, smaller markets provide compelling economic benefits. The accelerated career advancement, enhanced work-life balance, deeper client relationships, and greater professional autonomy create cumulative advantages that compound over entire careers.

Perhaps most importantly, attorneys in smaller markets report significantly higher levels of professional satisfaction, personal fulfillment, and career sustainability. They build practices that enhance rather than detract from their personal lives, develop expertise that grows more valuable over time, and create foundations for long-term success that extend well beyond their peak earning years.

Key Takeaways for Legal Career Planning

Financial Reality: Cost-adjusted income in smaller markets often exceeds BigLaw compensation when considering effective hourly rates, living costs, and wealth-building opportunities.

Career Acceleration: Partnership tracks average 2-3 years faster with significantly higher success rates in regional and mid-size firms.

Professional Development: Broader skill development, earlier client responsibility, and enhanced leadership opportunities accelerate professional growth.

Sustainable Careers: Lower burnout rates, better work-life integration, and community connections create careers that can be sustained and enhanced for decades.

Market Positioning: Growing secondary markets offer expanding opportunities and reduced competition for establishing market leadership positions.

The legal profession is evolving rapidly, with technology, client expectations, and work-life balance priorities reshaping traditional career models. Attorneys who recognize and capitalize on the advantages of smaller legal markets position themselves ahead of these trends rather than clinging to increasingly outdated models of professional success.

For attorneys at any career stage—from law students planning their post-graduation strategies to senior associates considering lateral moves to partners evaluating practice transitions—smaller legal markets deserve serious consideration not as consolation prizes but as optimal career choices that offer superior paths to professional success, personal fulfillment, and long-term prosperity.

The question is not whether you can afford to consider smaller markets, but whether you can afford not to.