2026 Patent Attorney Market Research Brief

The U.S. Market for Patent Attorneys

(How to Get Hired Now)

Prepared with current web research and recruiter observations from a recent BCG conversation with an electrical-engineering patent prosecutor in Texas (remote, per-matter contract history, semiconductor/networking/software exposure). Charts included below.

Introduction

The 2025 Patent Attorney Market Research Brief provides an in-depth analysis of the evolving landscape for intellectual property (IP) lawyers and patent practitioners. With rapid advancements in technology, increasing demand for patent protection across industries, and shifting global regulations, the role of patent attorneys has never been more critical. This brief examines hiring trends, salary expectations, practice area growth, and market challenges impacting patent attorneys in 2025. Whether you are a law firm, corporate legal department, or attorney navigating your career path, this research offers actionable insights into the opportunities and risks shaping the profession.

Executive Summary

Patent prosecution remains one of the few U.S. legal practice areas where federal practice + remote viability + boutique dominance create real opportunity—even in a cautious market.

Market Indicators Are Mixed

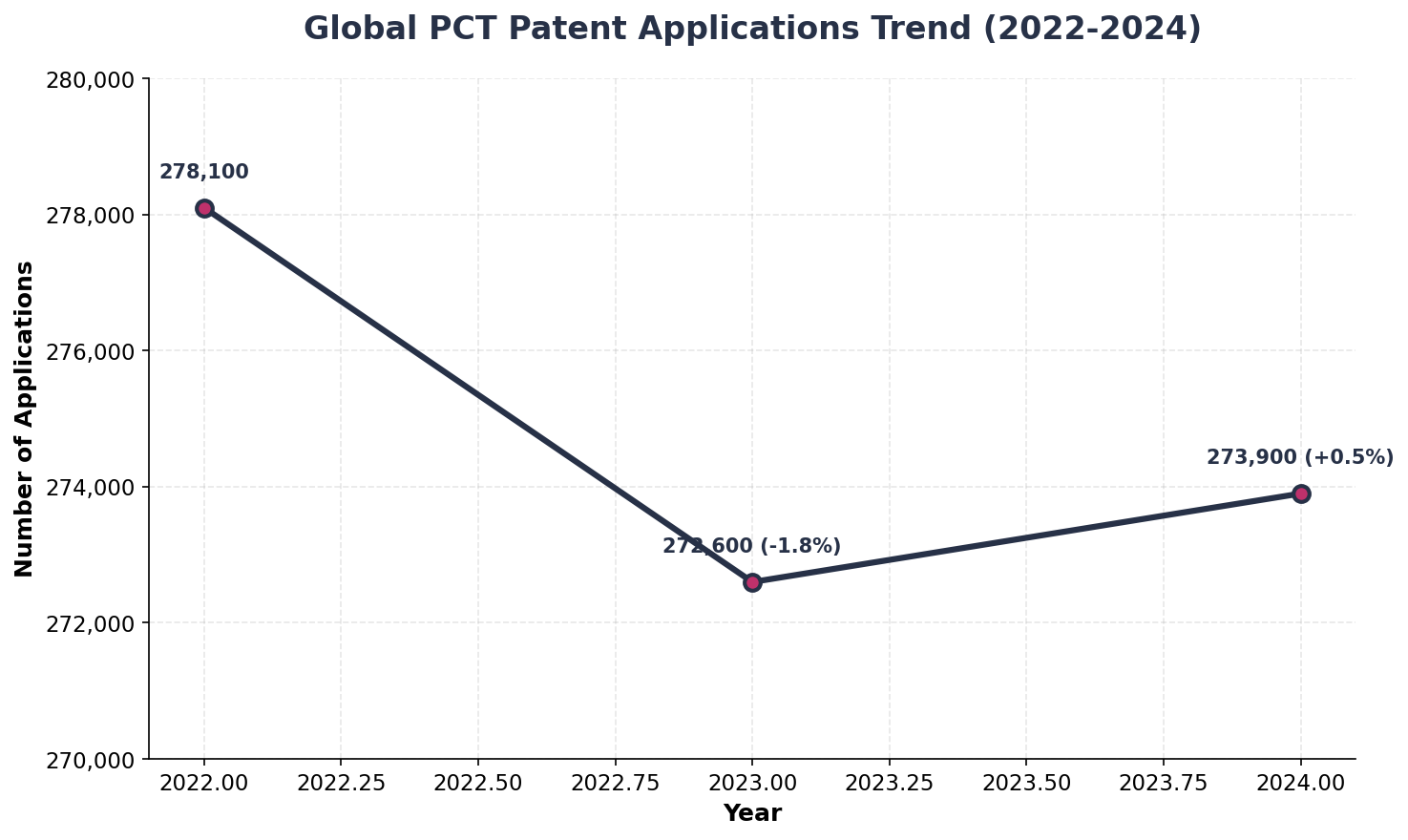

- PCT filings: Dipped 1.8% in 2023, then ticked up 0.5% in 2024

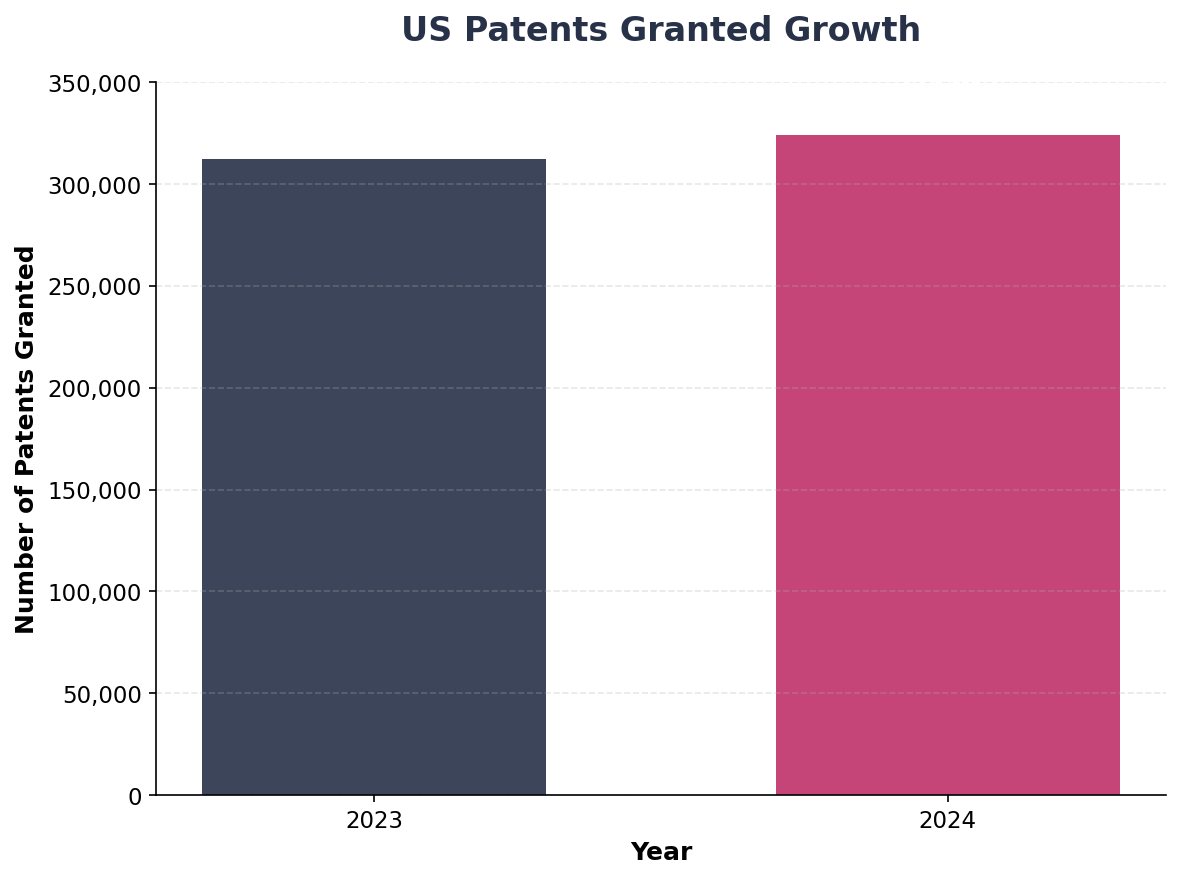

- USPTO grants: Rose ~4% in 2024 to 324,042

- Office pendency: Managing large unexamined inventory (~20 months first-action)

- Life sciences hiring: Tracks VC/biopharma funding cycles

- Semiconductor/AI/computing: Drive EE/CS demand

The BCG Playbook That's Working

- Go broad and early: Target boutiques in multiple states

- Prioritize clusters: EE/CS → Bay Area, Austin, Seattle; Life sciences → Boston, RTP

- Lead with junior value: Rate leverage, training appetite favor 2-6 year attorneys

- Exploit signals: Litigation wins often imply prosecution needs

Ready to Accelerate Your Patent Attorney Career?

BCG Attorney Search has placed thousands of patent attorneys in top-tier positions. Let our expertise work for you.

Market Signals (2024–2025)

Current data points and trends shaping the patent attorney job market

Global PCT Patent Applications Recovery

Key Insight: PCT applications fell 1.8% in 2023 (272,600), the first decline in 14 years, amid rate hikes and macro uncertainty; 2024 saw a modest rebound to ~273,900 applications.

U.S. Patent Grants Climbed in 2024

Key Insight: The IPO "Top 300" tallies show 312,486 patents granted in 2023 and 324,042 in 2024 (+4%). That's constructive for prosecution workloads feeding into grants with a lag.

USPTO Managing Large Inventory

The USPTO dashboard emphasizes pendency reduction campaigns and substantial unexamined inventory. A 2024 blog cited ~20 months first-action pendency in April 2024. Prosecution continues to be a multi-office-action discipline—and firms staff to sustain that cadence.

AI Is an Expanding Prosecution Area

WIPO's Generative AI Patent Landscape (2024) and EPO Patent Index 2024 show strong AI/computer-tech growth (+10.6% AI inventions); China leads GenAI filings. Expect steady U.S. EE/CS/AI drafting demand, with eligibility analysis still key.

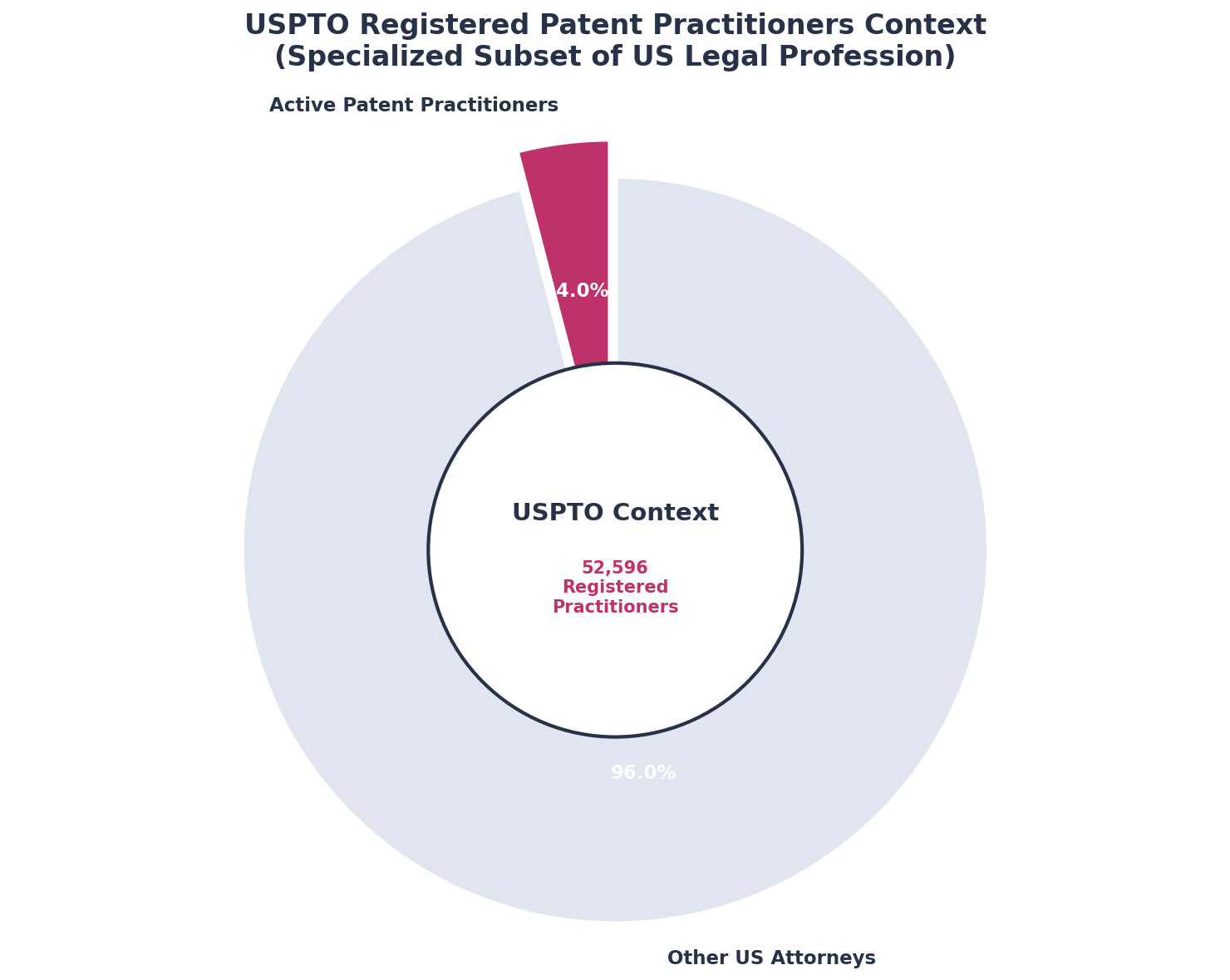

The Active Bar Is Large—and Mobile

USPTO's OED indicates ~52,596 active registered patent practitioners, reinforcing a competitive but nationally mobile talent pool (agents + attorneys).

Demand by Technical Background

Detailed analysis of practice areas and geographic opportunities

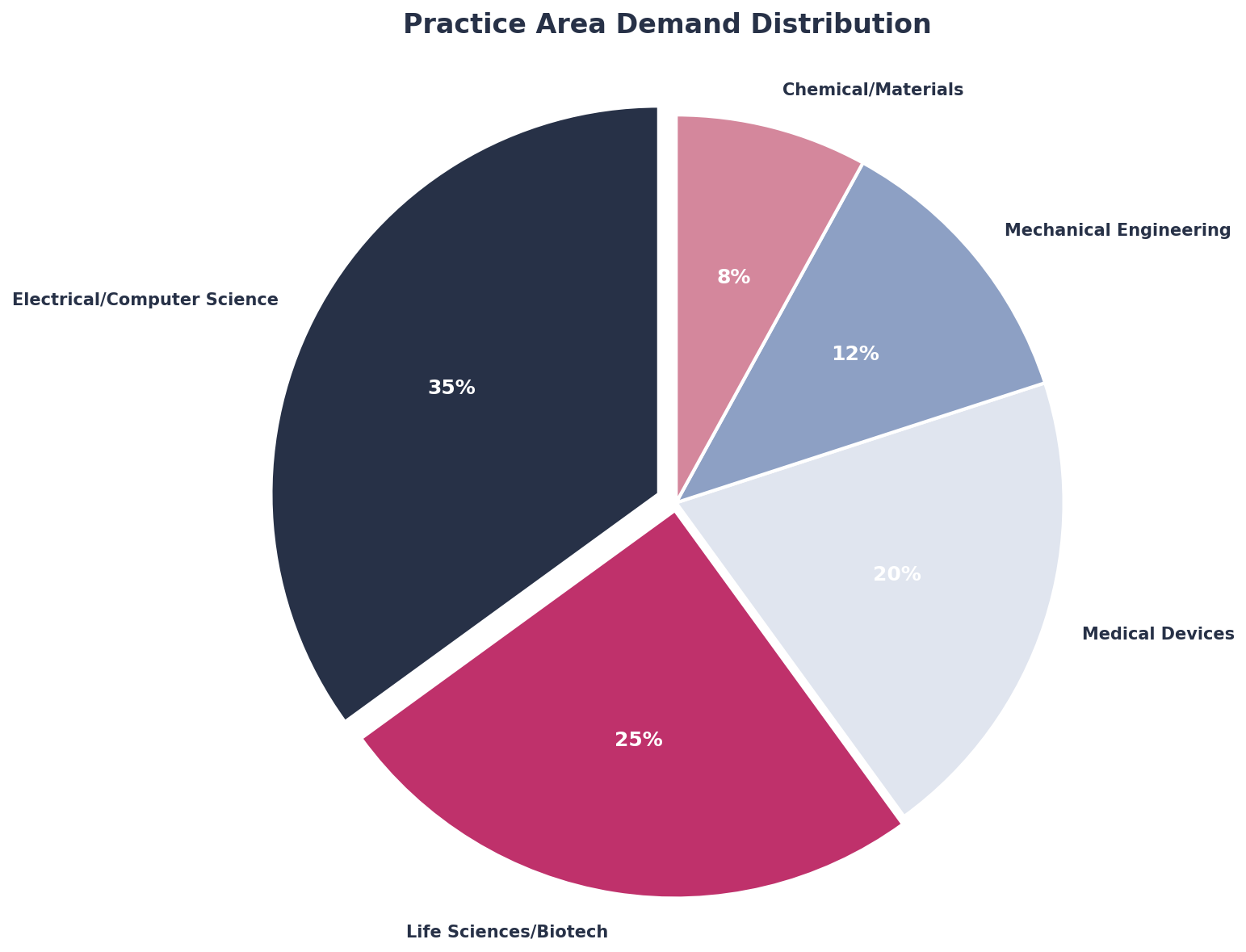

Practice Area Demand Distribution

EE/CS/Software/Semiconductors

Why demand holds:

Continuous innovation (chips, wireless, cloud/edge, AI/ML, autonomy) keeps drafting & OA response work flowing. 2024 EPO data points to computer technology/AI as a top growth field; U.S. grants rose in 2024.

Where:

- Bay Area (platforms/chips)

- Austin (semis/embedded)

- Phoenix (fabs)

- Seattle (cloud)

- DC/NoVA (federal/telecom)

- Remote roles at prosecution boutiques nationwide

Resume advantage: Specific sub-domains (semiconductor process, EDA, optics/imaging, networking) accelerate interviews at boutiques with matching client rosters.

Life Sciences (biotech/pharma/chemistry/med-devices)

PhD requirements:

PhD often preferred/required for biotech/pharma drafting and strategy roles at top life-sciences firms. Med-devices is more accessible to B.S./M.S. engineers with device experience.

Where:

- Boston/Cambridge

- SF Bay Area

- San Diego

- Research Triangle Park

- NJ/NY corridor

- Med-devices: LA/OC and Minneapolis–St. Paul

Hiring correlation: Tracks cluster health and funding cycles. Life sciences demand remains cluster-dependent.

Geographic Clusters & Application Strategy

Where to aim your applications for maximum success

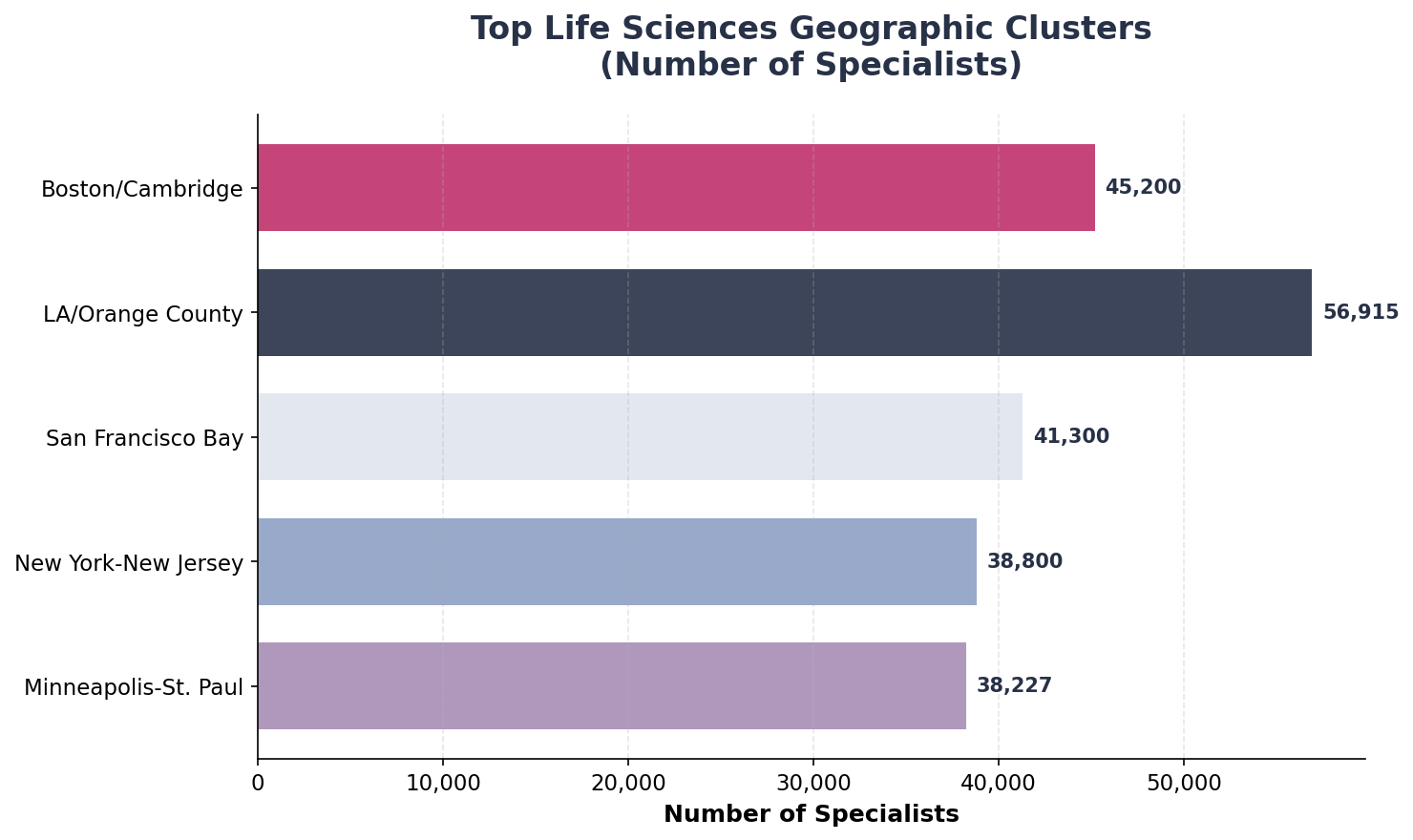

Top Life Sciences Geographic Clusters

CBRE 2025 Data: Boston/Cambridge retains the #1 R&D cluster, NY–NJ leads manufacturing, and LA/Orange County + Minneapolis–St. Paul anchor med-tech labor pools (~56,915 and ~38,227 specialists).

R&D Hubs (Best for Early-Stage/PhD Biotech)

- Boston/Cambridge: Remains #1; consistent IP workflows

- Bay Area: #2 position; strong platform presence

- San Diego: #3 R&D hub; growth-stage companies

Generate consistent IP workflows—drafting, responses, freedom-to-operate, due diligence.

Manufacturing/Pilot Plants

- NY–NJ: Leads U.S. life sciences manufacturing

- Process + scale-up: Method/device claims and supply-chain IP

Supporting method/device claims and supply-chain IP development.

Med-Device Hiring Hotspots

- LA/OC and Minneapolis–St. Paul: ~37% of U.S. med-tech labor pools

- Boutique firms: Frequently add drafters on flat-fee projects

As device makers scale SKUs, demand increases for specialized IP support.

National/Remote Prosecution

- Federal practice scope: USPTO enables remote work across state lines

- Registration requirements: Subject to USPTO registration and local UPL constraints

University and bar guidance consistently describe patent practice as federal in scope.

Compensation Analysis

AIPLA 2023 survey data and market context

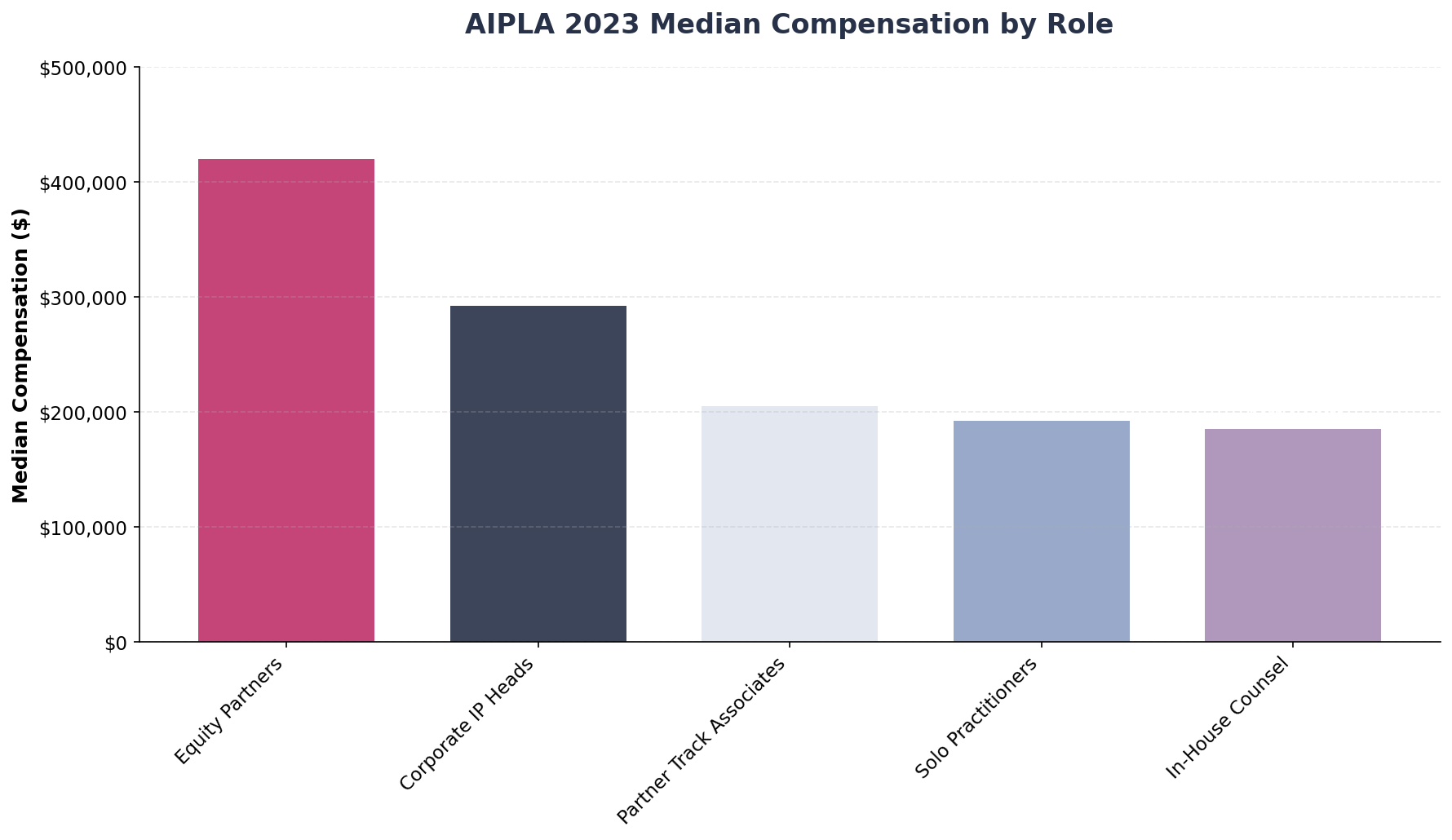

AIPLA 2023 Median Compensation by Role

Equity Partners

$420,000

Private firm, equity partners - highest median 2022 gross income

Corporate IP Heads

$292,250

Full-time corporate IP department heads

Partner-Track Associates

$205,000

Full-time partner-track attorneys median income

Solo Practitioners

$192,250

Full-time solo practitioners reported median

In-House Counsel

$185,000

Corporate IP attorneys and in-house counsel

Utility Drafting Costs

$8K-$15K

Per application, higher for complex AI/semis/biologics

USPTO Registered Patent Practitioners Context

Market Context: ~52,596 active registered patent practitioners out of ~1.3M total U.S. attorneys, showing patent law as a highly specialized field with national competition but also national opportunity due to federal practice scope.

Firm Types, Fees, and How Hiring Actually Happens

Understanding the market dynamics and billing structures

Where Most Drafting Sits

Small and midsize IP boutiques (and even solos) carry a large share of application drafting/response work. They staff up/down with remote drafters and pay flat fees for predictable units of work (draft, OA response, appeal briefing).

- Typical utility application: $8k–$15k

- Variation by complexity (AI/semis/biologics higher)

- Pattern reflected in AIPLA survey categories

Fee Pressure → Junior Leverage

Fixed fees and client budgets push firms toward 2–6 year candidates who can hit quality targets at sustainable rates. Seniors win with:

- Rainmaking ability

- Deep niche subject matter expertise

- Process leadership (quality programs, examiner analytics)

Signals a Firm May Hire Without a Posting

- Recent litigation wins or big grants: Upstream pipeline implications

- Press releases about lab expansions: CBRE/MassBio snapshots often imply downstream IP needs

- Active patent litigation or PTAB: Often means prosecution teams are busy too

Macro Context You Can Cite in Interviews

Current talking points that demonstrate market awareness

Global Patent Trends

- PCT: Down 1.8% in 2023, nudged up 0.5% in 2024 → resilient global pipeline

- WIPO data: 3.55M global applications in 2023, fourth consecutive year of growth

- China dominance: 1.64M applications worldwide, commanding GenAI lead

U.S. Market Strength

- USPTO grants: +4% in 2024 vs 2023 → healthy throughput feeding client wins

- Technology focus: AI/Computer tech rising (EPO +10.6% AI inventions)

- Pendency management: 20.2 months first-action, improvement trends

Market Opportunity

- National competition: OED active practitioners ~52,596

- National opportunity: Remote practice due to federal scope

- Life sciences resilience: 2.1M U.S. jobs (record high), despite funding constraints

Cluster Intelligence

- Boston-Cambridge: #1 R&D cluster, 12.9% of core life sciences roles

- Minneapolis-St. Paul: Leads med-tech (1.2% occupation concentration)

- Funding cycles: VC constraints affecting hiring but creating opportunities

Why Junior Attorneys Are Often More Marketable

Why Juniors Pop:

- Price–value fit under flat fees

- Trainability on client's claim-drafting style

- Easy to load to 1,800–2,000 billable hours on prosecution

How Seniors Win:

- Niche mastery (semiconductor flows, biologics CMC, imaging algorithms)

- Process leadership (OA response programs, PTAB strategy)

- Business development (corporate contacts, flat-fee packages)

The "Broad-Market" Playbook That Gets Interviews Now

BCG's proven 7-step strategy for patent attorney job search success

1Treat Postings as Signals

If a firm posts patent litigation or IP transactions, assume prosecution is alive there. Send a tight note with two tailored writing samples aligned to their client base (e.g., semiconductors or med-devices).

Pro Tip: Grant/filing trends support this assumption—litigation wins often indicate upstream prosecution activity.

2Target Boutiques by Cluster

EE/CS/AI/Semis:

- Bay Area

- Austin

- Seattle

- Phoenix

- DC/NoVA

Biotech/Pharma/Med-devices:

- Boston/Cambridge

- Bay Area

- San Diego

- RTP

- NJ/NY

- LA/OC, Minneapolis–St. Paul (med-devices)

Build a 50–200 firm list per cluster; pitch remote availability with flat-fee familiarity if applicable.

3Use Archived Jobs + Bar/Association Boards

Most roles never hit LinkedIn; they live on firm websites, bar associations, and specialty orgs. LawCrossing aggregates many of these otherwise hidden posts.

4Lead with Outcomes

Use bullets like: "Avg. 3 OA rounds to allowance across 12 cases in [tech]; first-action allowances in [x] matters; recovered 10 claims post-final via AFCP 2.0." (No confidential client data; anonymize.)

5Re-tool the Resume for Breadth

Group matters by technology buckets ("Networking/Switching," "Semiconductor Packaging," "Med-device thermal control," "Software systems"). If you can draft broadly—say so explicitly, and note any AI-adjacent exposure.

6Remote Etiquette

Make clear you're USPTO-registered; you understand federal practice; you can collaborate asynchronously with inventors and in-house counsel.

7For Life Sciences Without a PhD

Angle toward med-devices, chem/mech, diagnostics instrumentation, or manufacturing/process where PhD signals are less rigid. Cite device hubs (LA/OC, Minneapolis).

Risks & Evolving Issues

Key challenges to watch and frame strategically in interviews

Funding Sensitivity in Biotech

CBRE's 2025 life-sciences outlook calls out ongoing funding constraints and talent pipeline issues; hiring can be lumpy quarter-to-quarter. MassBio 2025 shows rare job decline in Massachusetts (117K jobs, funding down 17%).

Strategy: Target med-device and manufacturing roles, emphasize process/scale-up experience.

Eligibility/§101 for Software/AI

Applicants still navigate evolving case law and USPTO guidance; emphasize your ability to draft technical improvements and tie claims to practical applications.

Opportunity: High demand for attorneys who can navigate AI patentability challenges.

Global Competition

WIPO data shows China's surge (1.64M applications, GenAI leadership), pressuring global filing strategies and standards-related work.

Response: Develop expertise in international filing strategies and PCT prosecution.

Flat Fee Pressure

Stagnant flat fees creating race to the bottom, but also opportunities for efficient practitioners and those who can leverage technology (including AI tools) to increase quality and productivity.

Adaptation: Focus on efficiency, technology adoption, and niche specialization.

Where Opportunities Are Expanding

Emerging growth areas in patent practice

AI/Agents + Semiconductor Stack

EDA, packaging, HBM, lithography → steady corporate filing + standards work. EPO shows computer technology +3.3%, AI inventions +10.6%.

Med-Devices Evolution

Mechanical/electrical/biomech interfaces → LA/OC, Minneapolis hubs. Device makers scaling SKUs creating prosecution demand.

Manufacturing & Process

NY–NJ and RTP → method claims, scale-up, quality systems. Life sciences manufacturing expansion drives IP needs.

What Firm Sizes Do the Work?

Understanding the patent practice landscape by firm type

Boutiques (1–40 lawyers)

- Majority of day-to-day drafting

- Flat-fee heavy business model

- Remote-friendly culture

- Fastest to add bandwidth

- Staff up/down with remote drafters

IP Groups in AmLaw Firms

- More selective for posted roles

- Prefer juniors with elite credentials

- Value seniors who bring business

- Higher rates, more complex matters

Solo + Specialized Pods

- Niche platforms (med-device only, imaging only)

- Scale via contractors

- Great targets for direct outreach

- Flexible working arrangements

Ready to Advance Your Patent Attorney Career?

BCG Attorney Search has the market intelligence, industry connections, and proven track record to accelerate your career trajectory in patent law.

Submit Your Resume (Fast-Track)

Ready to be considered for active and stealth roles?

Submit Resume NowAlready Have a BCG Profile?

Update locations, practice tags, and upload writing samples to unlock broader outreach.

Update ProfileWhy BCG Attorney Search?

Appendix: BCG Recruiter Insights

Pattern-matched observations from recent candidate conversations

Remote Work Reality

Remote preference is common and workable in prosecution; many boutiques embrace this model if you can deliver consistent, on-spec drafts and timely OAs. Federal practice scope enables nationwide opportunities.

"Signals Over Postings"

Don't self-reject when you see patent litigation postings; contact the firm and pitch prosecution capacity. Litigation wins often indicate upstream prosecution pipeline activity.

Breadth Sells

If you can credibly draft in semiconductors, networking, cloud, and software (and explain where you draw the line on deep AI math), say so plainly—then back it with aligned writing samples.

Geographic Strategy

Texas remains a decent market, but consider Utah/Ohio/Carolinas/Midwest for lower-competition remote placements, plus the coastal clusters for volume opportunities.

Sources & Data References

Comprehensive source attribution for market intelligence

Global Patent Data

- WIPO PCT & global IP indicators (2023–2024): PCT filings fell 1.8% in 2023 (272,600), slight 2024 rebound; global patent apps hit 3.55M in 2023

- EPO Patent Index 2024: Computer technology +3.3%, AI inventions +10.6%, China GenAI leadership

- WIPO Publications: World Intellectual Property Indicators 2024, Generative AI Patent Landscape

U.S. Patent Statistics

- IPO Top 300 totals: 312,486 grants (2023) → 324,042 (2024), Samsung leads with 9,304 patents

- USPTO OED/practitioner count: ~52,596 active registered practitioners

- USPTO pendency/inventory: Patents Dashboard and public updates; 20.2 months first-action pendency

Geographic & Employment Data

- CBRE 2025 Life Sciences Talent Trends: Boston #1 R&D (12.9% national share), Minneapolis leads med-tech concentration (1.2%)

- MassBio snapshot: 117K Massachusetts life sciences jobs, rare decline amid funding constraints (-17%)

- Employment trends: 2.1M U.S. life sciences jobs (record high), 3.1% unemployment in sector

Compensation & Market Analysis

- AIPLA 2023 survey extracts: $420K equity partners, $292K corporate IP heads, $205K partner-track, $192K solo practitioners

- Billing frameworks: $8K–$15K utility application drafting (complexity variations)

- Market dynamics: Flat fee pressure, boutique dominance, remote work trends